Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

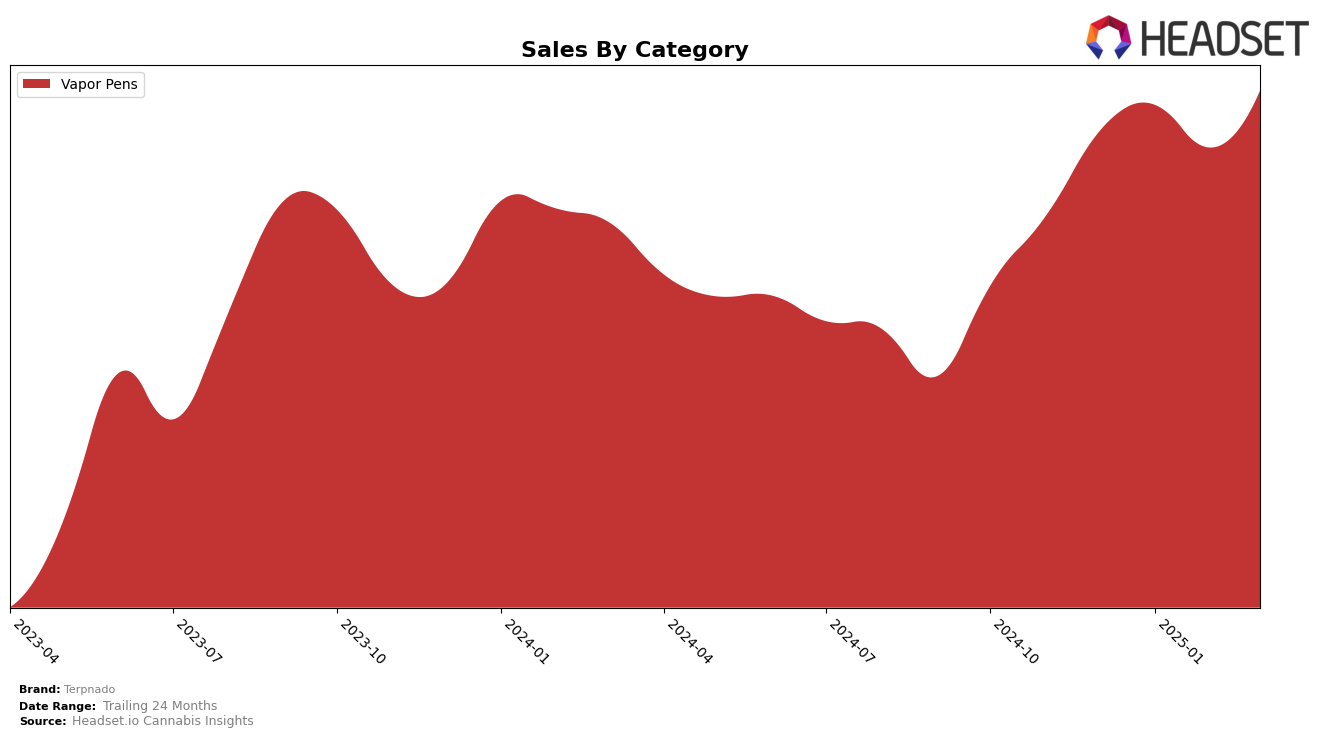

In the state of Washington, Terpnado has shown a consistent presence in the Vapor Pens category. Starting from a rank of 29 in December 2024, the brand improved its position to 25 by January 2025, a notable upward movement. Although there was a slight dip back to 28 in February, Terpnado quickly rebounded to the 25th position in March. This resilience in ranking suggests a stable demand for their products in Washington's competitive market. Despite the fluctuations, Terpnado's sales figures in March 2025 indicate a positive trajectory, surpassing their December numbers, which highlights their growing market share and consumer base.

It's important to note that Terpnado's presence in the top 30 rankings is limited to the Vapor Pens category in Washington, as no other categories or states listed them in the top 30. This absence can be seen as an area for potential growth or concern depending on the company's strategic goals. The consistent ranking within the Vapor Pens category, however, underscores a strong brand identity and product appeal within this niche. For stakeholders, understanding these dynamics could be crucial for making informed decisions about market expansion and category diversification.

Competitive Landscape

In the Washington vapor pens market, Terpnado has experienced fluctuating rankings over the past few months, reflecting a competitive landscape. Starting at rank 29 in December 2024, Terpnado improved to 25th in January 2025, but then slipped to 28th in February before recovering slightly to 25th in March. This fluctuation indicates a dynamic market where Terpnado is competing closely with brands like Freddy's Fuego and Hitz Cannabis. Notably, Hitz Cannabis showed a strong upward trend, moving from 30th in December to 23rd by March, potentially impacting Terpnado's market position. Meanwhile, Thrills experienced a decline from 20th to 26th, which could present an opportunity for Terpnado to capture more market share. Despite these challenges, Terpnado's sales have remained relatively stable, suggesting resilience and potential for growth if strategic adjustments are made to capitalize on competitors' weaknesses.

Notable Products

In March 2025, Blueberry Express Distillate Cartridge (1g) reclaimed its position as the top-selling product for Terpnado, with sales reaching 1904 units. Golden Peach Distillate Cartridge (1g) slipped to second place after leading in January and February. Alien Sour Apple Distillate Cartridge (1g) maintained a consistent third place, showing a slight increase in sales from the previous month. Strawberry Turbo Distillate Cartridge (1g) climbed back to fourth place, while Watermelon Crawl Distillate Cartridge (1g) rounded out the top five. Notably, Blueberry Express has shown resilience, improving its rank from third in February to first in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.