Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

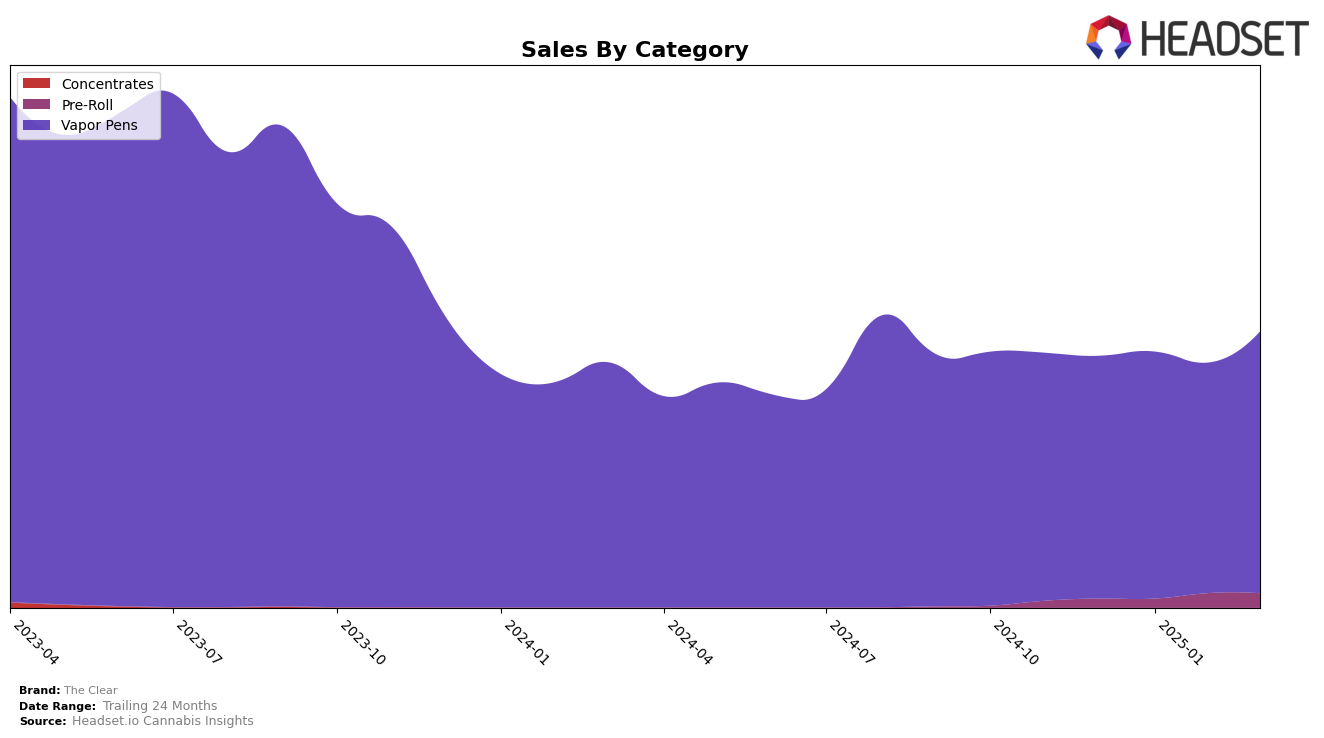

The Clear has demonstrated varied performance across different states and categories, with noteworthy movements in rankings and sales trends. In Colorado, The Clear's presence in the Pre-Roll category has not been strong, as it did not make it into the top 30 brands from December 2024 through March 2025. This highlights a potential area for growth or a need for strategic adjustments. In contrast, their Vapor Pens have shown a consistent improvement, moving from 18th place in December 2024 to a peak of 10th in February 2025, before settling at 13th in March 2025. This upward trend in Colorado suggests a solid foothold in the Vapor Pens category, which could be a stronghold for the brand in the state.

Looking at New Jersey, The Clear has maintained a robust position in the Vapor Pens category, beginning at 14th place in December 2024 and climbing to 11th by March 2025. This consistent presence in the top rankings indicates a strong market acceptance and potential for further growth. Meanwhile, in Massachusetts and Missouri, The Clear's rankings in the Vapor Pens category have been less stable, with rankings fluctuating but remaining outside the top 30 in Massachusetts. This could point to competitive challenges or market dynamics that differ from those in New Jersey. The varied performance across these states underscores the importance of localized strategies to capitalize on strong markets while addressing challenges in others.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, The Clear has experienced notable fluctuations in its market position over recent months. Starting from a rank of 14th in December 2024, The Clear saw a slight decline to 16th by February 2025, before rebounding to 11th in March 2025. This rebound is particularly significant as it suggests a positive shift in consumer preference or strategic adjustments by The Clear, resulting in a sales increase from $349,101 in February to $582,479 in March. In contrast, competitors like Timeless and Rythm maintained consistent ranks of 10th and 9th, respectively, throughout the same period, with Rythm achieving significantly higher sales figures, peaking at $1,384,505 in March. Meanwhile, &Shine and Jersey Smooth showed more stability in their rankings, with only minor shifts, indicating a relatively steady performance. The Clear's recent upward movement in rank suggests a potential for increased competitiveness in the New Jersey vapor pen market, highlighting the importance of strategic marketing and product positioning to capitalize on this momentum.

Notable Products

In March 2025, The Clear's top-performing product was the Elite - Golden Goat Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank from previous months with a notable sales figure of 3328 units. The Elite - Lemon Haze Distillate Cartridge (1g) rose to second place, climbing from its third position the previous month, with a significant increase in sales. The Elite - Blue Raz Distillate Cartridge (1g) also showed improvement, advancing from fifth place in January to third in March. A new entry, the Elite - Golden Goat Distillate Cartridge (2g), secured the fourth spot, indicating strong customer interest in larger quantities. Lastly, the Elite - Lime Sorbet Distillate Cartridge (1g) returned to the top five, retaining its fifth position from December, despite fluctuating rankings in the interim months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.