Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

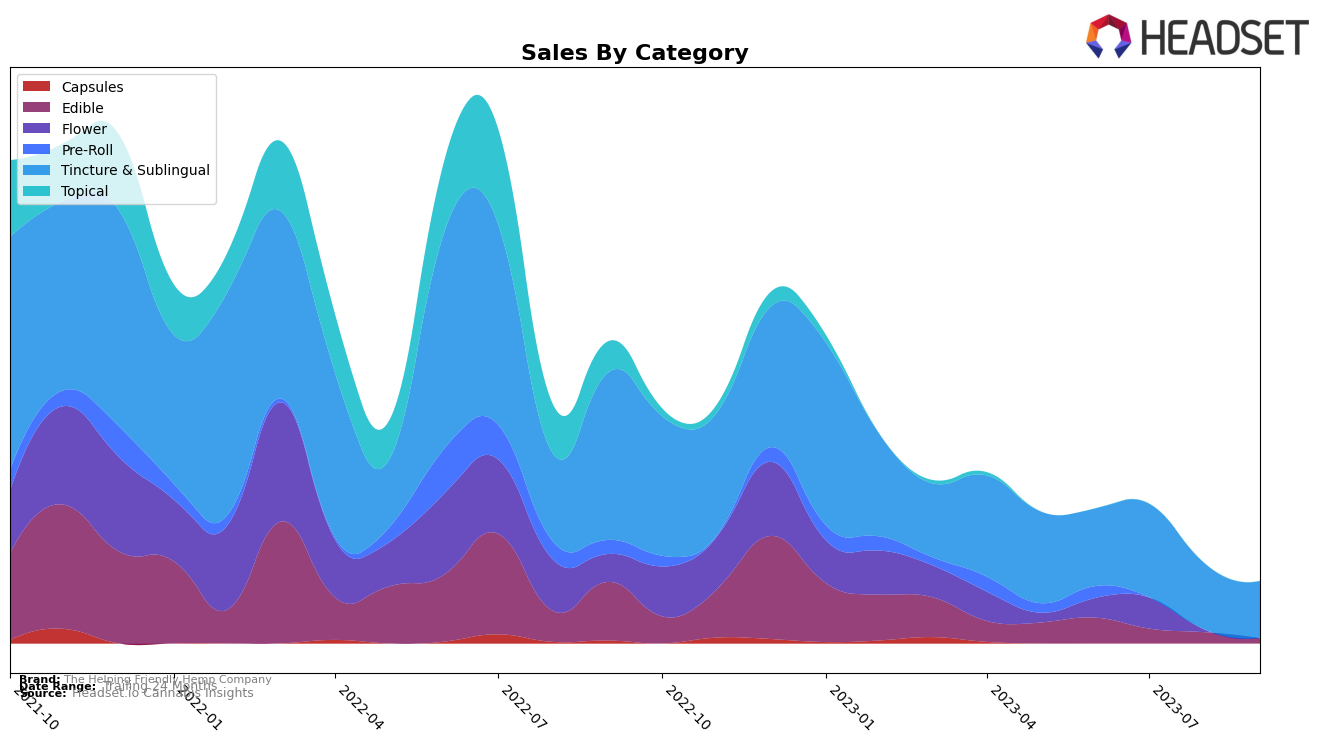

The Helping Friendly Hemp Company, a brand known for its quality hemp products, has shown a consistent performance in the 'Tincture & Sublingual' category in the state of Michigan. The brand has maintained its position within the top 20 brands over the months of June to September 2023. Interestingly, the brand climbed up the rankings from 19th in July 2023 to 16th in September 2023. While the specific sales figures cannot be shared, there was a noticeable fluctuation in sales over these months.

However, it's worth noting that the brand was not in the top 20 in some months. This could be seen as a challenge for the brand to improve its market position. But considering the competitive nature of the cannabis market in Michigan, maintaining a spot within the top 20 itself is commendable. Despite these fluctuations, The Helping Friendly Hemp Company has demonstrated a stable presence in the market, and it will be interesting to see how the brand performs in the future.

Competitive Landscape

In the Tincture & Sublingual category in Michigan, The Helping Friendly Hemp Company has seen a slight improvement in rank from 19th in July 2023 to 16th in September 2023, indicating a positive trend. However, it's worth noting that the company is still trailing behind some of its key competitors. For instance, Apothecare has consistently maintained a higher rank, ranging from 13th to 14th over the same period. Similarly, HOH Hempnotize has also outperformed The Helping Friendly Hemp Company, albeit with a slight drop in rank from 13th in August to 15th in September. On the other hand, Kynd Cannabis Company and Green Gruff have shown more fluctuating ranks, with Green Gruff making a significant leap from 27th in June to 17th in September, surpassing The Helping Friendly Hemp Company. This data suggests a highly competitive market with dynamic shifts in brand performance.

Notable Products

In September 2023, the top selling product from The Helping Friendly Hemp Company was the 'CBD Full Spectrum Tincture (2000mg CBD, 30ml)', moving up from third place in August. It sold 34 units, marking its highest sales figure for the four-month period. The 'CBD Orange Broad Spectrum Tincture (1000mg CBD)' dropped to second place after holding the top spot in both July and August. The 'CBD Wild Cherry Maximum Strength Full Spectrum Soft Chews 3-Pack (150mg CBD)' maintained a consistent performance, ranking third for the third consecutive month. The 'CBD Berry Broad Spectrum Tincture (1000mg CBD, 30ml)' and 'CBD Blue Raspberry Maximum Strength Full Specrum Soft Chews 3-Pack (150mg CBD)' did not make the top three in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.