Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

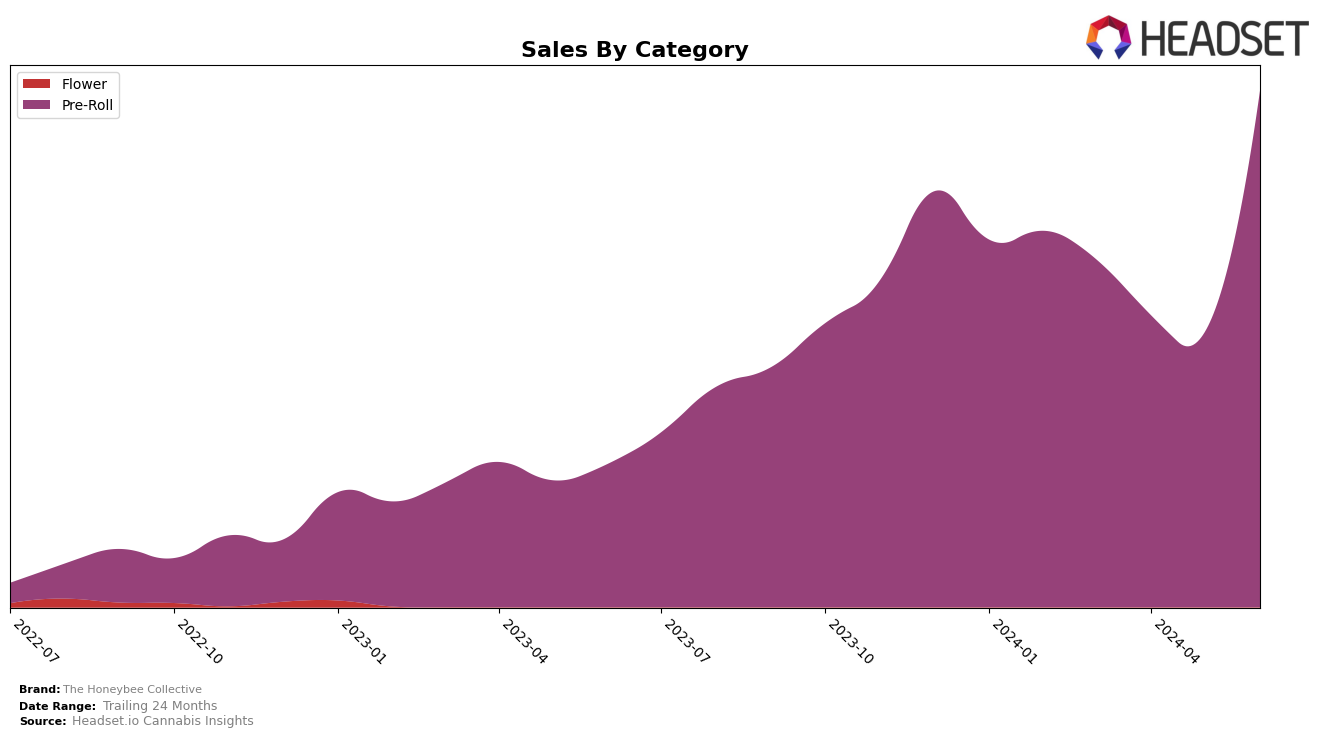

The Honeybee Collective has demonstrated varied performance across different states and categories over the past few months. In Colorado, the brand has struggled to break into the top 30 in the Pre-Roll category, with rankings fluctuating between 41st and 52nd from March to June 2024. This indicates a challenging market presence in Colorado, with a slight improvement towards June but still outside the top tier. The sales figures also reflect this struggle, although there was a notable increase in June compared to previous months, suggesting a potential positive trend for future performance.

Contrastingly, in New York, The Honeybee Collective has shown more promising results. The brand has consistently been close to the top 30 in the Pre-Roll category, finally breaking into the 25th position in June 2024. This upward movement is a significant achievement, reflecting increasing consumer acceptance and market penetration. The sales in New York have also seen a substantial rise, particularly in June, which could be indicative of successful marketing strategies or product reception in this state. This performance disparity between Colorado and New York highlights the importance of regional market dynamics in the cannabis industry.

Competitive Landscape

In the competitive landscape of the New York pre-roll market, The Honeybee Collective has shown a notable improvement in rank and sales over recent months. Starting from a rank of 35 in March 2024, The Honeybee Collective climbed to 25 by June 2024, indicating a positive trend in market presence. This upward movement is significant when compared to competitors like Cheech & Chong's, which only re-entered the top 30 in May 2024 and reached 26 by June 2024. Similarly, Leal has shown consistent performance, moving from rank 33 in March to 23 in June 2024. Meanwhile, Electraleaf and Hepworth have experienced fluctuations, with Electraleaf dropping from 19 to 24 and Hepworth from 21 to 27 over the same period. The Honeybee Collective's ability to surpass these brands in June, despite their higher initial rankings, suggests a strong growth trajectory and increasing consumer preference, making it a formidable player in the New York pre-roll market.

Notable Products

In June 2024, the top-performing product for The Honeybee Collective was Jelly Rancher Pre-Roll 2-Pack (1g), which skyrocketed to the number one position with impressive sales of $694. Gelato Cake Pre-Roll 10-Pack (5g) secured the second spot, followed by Bubble Gum x Chem 1 Pre-Roll 2-Pack (1g) in third place. Lilac Diesel Pre-Roll 10-Pack (5g) maintained its fourth-place ranking from April, showcasing consistent performance. Notably, Pause - Gazzurple Pre-Roll 2-Pack (1g) rounded out the top five. The rankings for these products have seen significant shifts, particularly for Jelly Rancher Pre-Roll, which jumped from fourth place in May to first in June.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.