Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

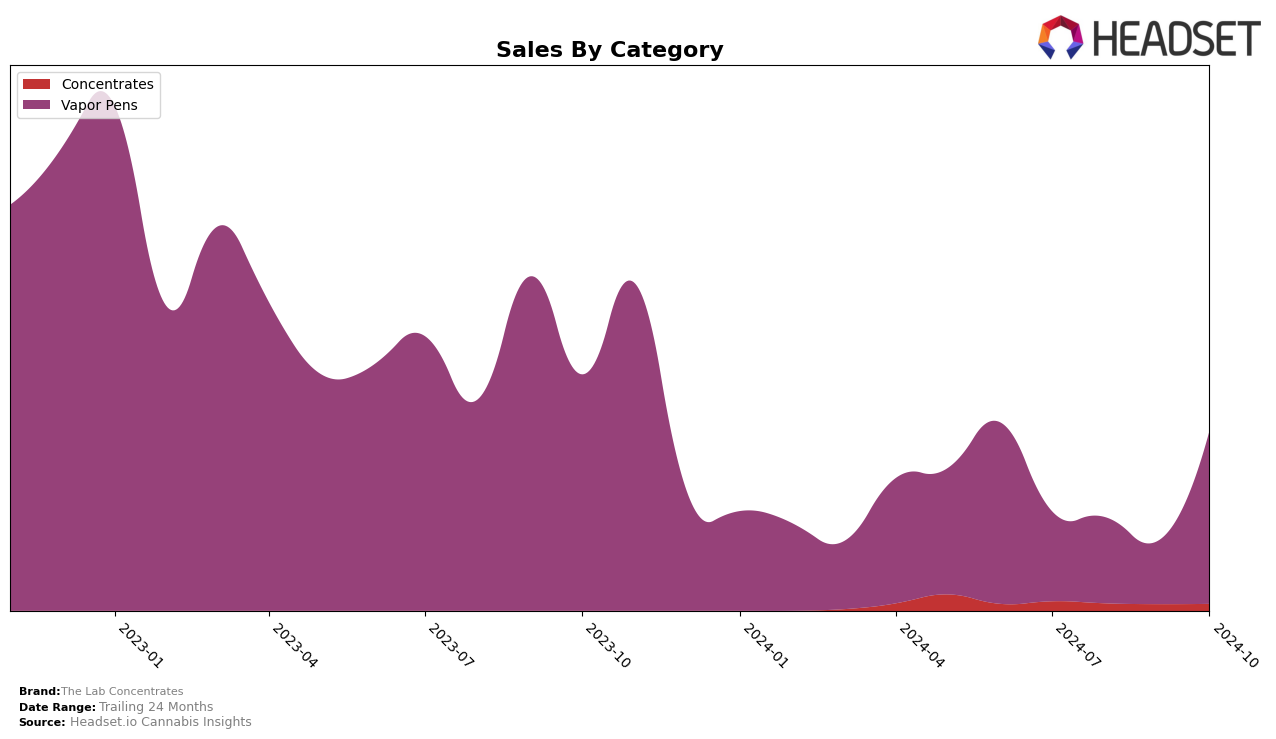

The Lab Concentrates has shown a notable upward trajectory in the Vapor Pens category in Massachusetts. Starting from a rank of 84 in July 2024, the brand climbed to the 64th position by October 2024, indicating a significant improvement. This rise in ranking corresponds with a substantial increase in sales, particularly in October, suggesting a growing consumer base in the state. However, in Nevada, the brand did not maintain a top 30 position by October 2024, which might be a signal of competitive challenges or market saturation in that region.

In Ohio, The Lab Concentrates experienced a fluctuating performance in the Vapor Pens category. While the brand was not in the top 30 in September, it made a comeback in October, securing the 28th spot. This rebound could be indicative of successful marketing efforts or shifts in consumer preferences. The absence from the top 30 in September highlights a potential volatility in brand performance, which could be due to various external factors affecting the market dynamics in Ohio. Such movements suggest that while The Lab Concentrates has potential, maintaining consistent performance across different states presents a challenge.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, The Lab Concentrates has shown a remarkable improvement in its market position, particularly in October 2024, where it climbed to the 28th rank from being outside the top 20 in September. This surge in rank coincides with a significant increase in sales, indicating a positive reception from consumers. In contrast, The Botanist experienced fluctuations, dropping out of the top 20 in August but recovering to the 25th position in October, with sales consistently higher than The Lab Concentrates. Meanwhile, Superflux maintained a relatively stable presence, peaking at 26th in September before settling at 30th in October, suggesting a competitive but less volatile performance. Nectar made a notable entry into the rankings in October, achieving the 27th position, just ahead of The Lab Concentrates, which could indicate emerging competition. The Solid consistently outperformed The Lab Concentrates in sales and rank, although it slightly dipped to 29th in October. These dynamics highlight the competitive pressures and opportunities for The Lab Concentrates to further capitalize on its recent upward trend in Ohio's vapor pen market.

Notable Products

In October 2024, Mendo Breath Distillate Disposable (0.5g) emerged as the top-performing product from The Lab Concentrates, leading the sales with a notable figure of 1010 units sold. Following closely, Strawberry Cough Distillate Disposable (0.5g) secured the second position, while Sunset Sherbet Distillate Disposable (0.5g) ranked third. Watermelon Zkittles Distillate Disposable (0.5g) experienced a slight drop, moving from second place in September to fourth in October, despite an increase in sales to 630 units. Lastly, DB OG Distillate Disposable (0.5g) rounded out the top five, maintaining a stable presence in the rankings. The rankings indicate a dynamic shift with new entries and changes in consumer preferences from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.