Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

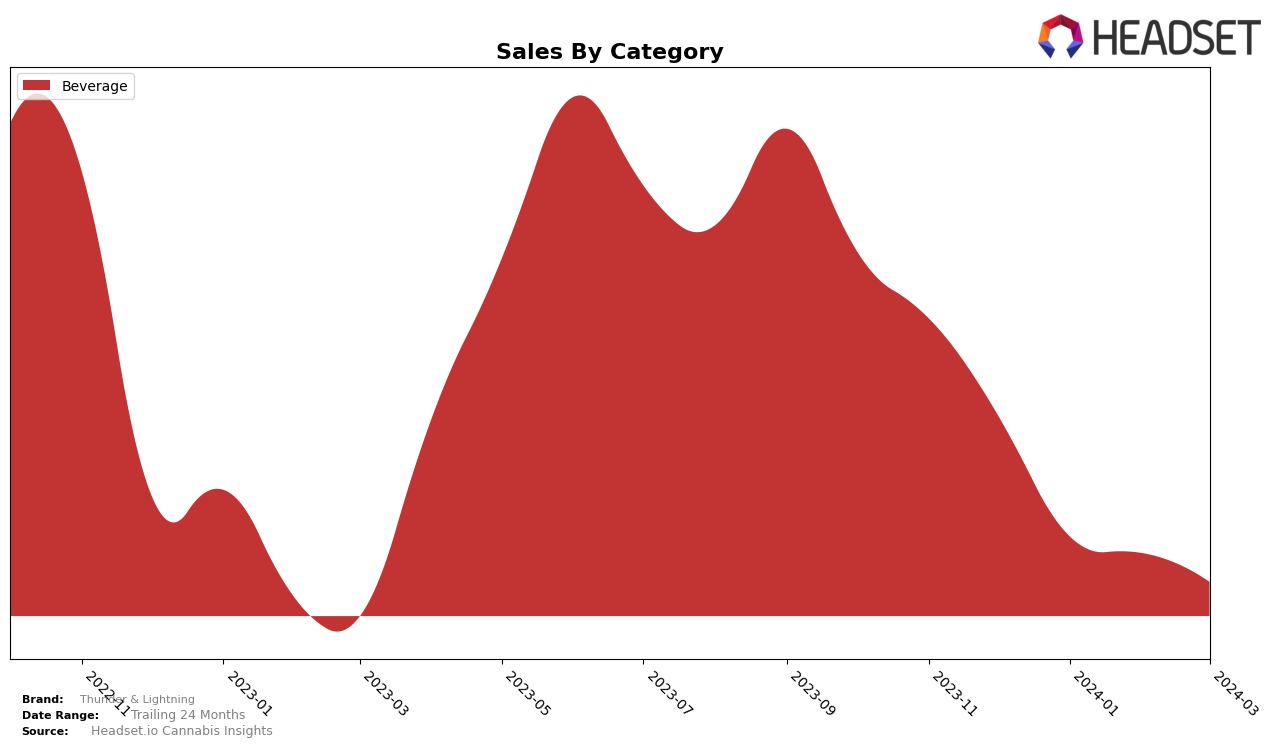

In the competitive cannabis beverage sector, Thunder & Lightning's performance has seen varied success across different regions. In California, the brand struggled to maintain a position within the top 50, fluctuating from rank 42 in December 2023 to 44 in March 2024, indicating a slight decline in market presence. This trend was mirrored in its sales figures, which saw a significant drop from December to January, before partially recovering over the following months. Contrastingly, in Illinois, Thunder & Lightning maintained a strong position within the top 10 from December 2023 to February 2024, although data for March 2024 is missing, suggesting a potential slip out of the top rankings or an absence of data. This performance highlights the brand's strength in the Illinois market, despite the lack of information for the latest month.

Looking north to Canada, Thunder & Lightning's trajectory in Ontario presents a more concerning picture, with a gradual decline from rank 38 in December 2023 to 55 in March 2024. This downward trend is starkly reflected in sales numbers, plummeting from 6911 in December 2023 to just 554 by March 2024, marking a significant loss in market share. However, the brand's performance in Saskatchewan tells a different story, showcasing a notable improvement, moving from rank 25 in December 2023 to 18 in March 2024. This upward movement, coupled with a near doubling of sales from January to February 2024, suggests a growing acceptance and preference for Thunder & Lightning's offerings within this market. These contrasting dynamics across states and provinces underline the importance of localized strategies and the variable nature of consumer preferences in the cannabis industry.

Competitive Landscape

In the competitive landscape of the beverage category in California, Thunder & Lightning has experienced a fluctuating position in the rankings over the recent months. Starting at rank 42 in December 2023, it saw a dip to rank 50 in January 2024, before slightly recovering to rank 43 in February and settling at rank 44 by March 2024. This indicates a challenging period for Thunder & Lightning, especially when compared to its competitors. For instance, Viola showed significant improvement, moving from rank 61 in December to rank 49 by March, suggesting a strong upward trajectory in both rank and sales. Similarly, Autumn Brands maintained a more stable position in the top 50, indicating consistent consumer preference. Space Gem and Pure Beauty also demonstrated resilience, with Space Gem maintaining a steady rank around the 40s and Pure Beauty showing recovery in March. These dynamics suggest that while Thunder & Lightning is facing stiff competition, there are opportunities for recovery and growth if it can navigate the market effectively and respond to consumer trends.

Notable Products

In March 2024, the top-performing product for Thunder & Lightning was the CBD/THC 1:2 Thunder Pop Lime Mate Energy Drink (10mg CBD, 20mg THC) within the Beverage category, maintaining its number one rank consistently from December 2023 through March 2024. This product saw sales figures of 528 units in March, indicating a strong consumer preference despite a declining trend from December's 1305 units. No other products were mentioned, so direct comparisons within the brand are limited to this standout item. The consistent ranking at the top spot underscores its popularity and market dominance within Thunder & Lightning's portfolio. This analysis highlights the sustained consumer interest in this product, despite a gradual decrease in sales over the observed months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.