Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

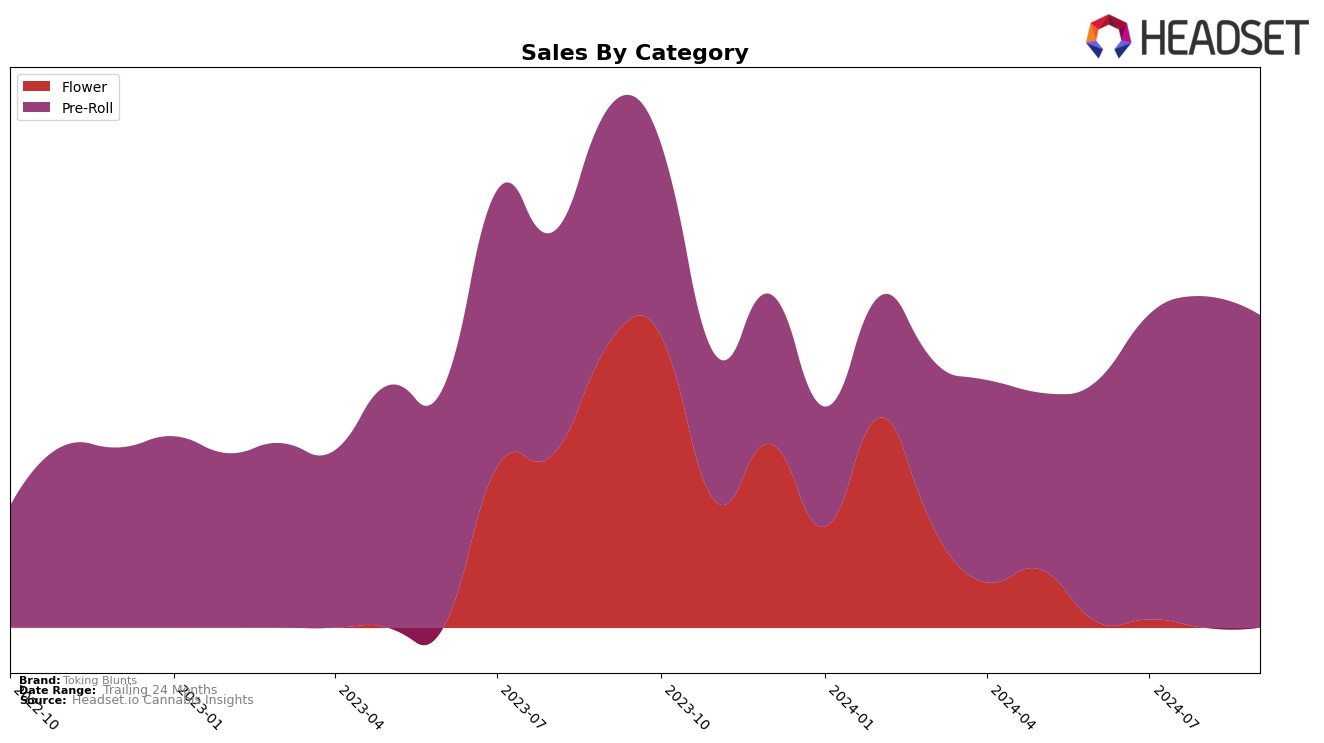

In the Oregon market, Toking Blunts has shown a noteworthy performance in the Pre-Roll category over the past few months. Starting from June 2024, the brand was ranked 34th, which indicated that it was not in the top 30. However, by July, it climbed to the 27th position, entering the top 30 and showcasing a positive trend. Although there was a slight dip to 31st in August, Toking Blunts managed to regain momentum and improve to 28th in September. This fluctuation highlights the brand's resilience and ability to recover its standing in a competitive market.

Despite not being consistently in the top 30, Toking Blunts' sales figures in the Oregon market reveal an upward trajectory, with a peak in August. The increase from June's sales to July's represents a substantial growth, suggesting that the brand is gaining traction among consumers. The subsequent sales figures in August and September indicate a strong market presence, even though the rank dipped slightly in August. This data suggests that while Toking Blunts may face challenges in maintaining a top 30 rank consistently, its sales performance reflects a growing consumer base and potential for further market penetration.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Toking Blunts has shown a fluctuating yet promising trajectory in recent months. While the brand did not make it into the top 20 rankings from June to September 2024, it has demonstrated a positive trend in sales, particularly from June to August, before experiencing a slight dip in September. Notably, Rebel Spirit and Derby's Farm have been consistent competitors, with Rebel Spirit dropping from 13th to 30th place and Derby's Farm experiencing a notable rank drop from 14th to 27th in September. Meanwhile, Drewby Doobie / Epic Flower has maintained a more stable position, ranking slightly higher than Toking Blunts throughout the period. Despite these challenges, Toking Blunts' ability to increase sales from June to August suggests potential for upward mobility in the rankings, particularly as some competitors face declining sales and rankings.

Notable Products

In September 2024, Toking Blunts saw the Girl Scout Cookies Blunt (1g) rise to the top spot in sales, with a notable sales figure of 2353 units. The Bloint - Ghost Train Haze Blunt (1g) maintained strong performance, securing the second position, slightly down from its top rank in August. Wedding Cake Blunt (1g) climbed to the third rank, showing consistent improvement over the months. Sherbert Blunt (1g) dropped to fourth place, despite previously holding the second rank in July and August. Acapulco Gold Blunt (1g) entered the rankings in September, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.