Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

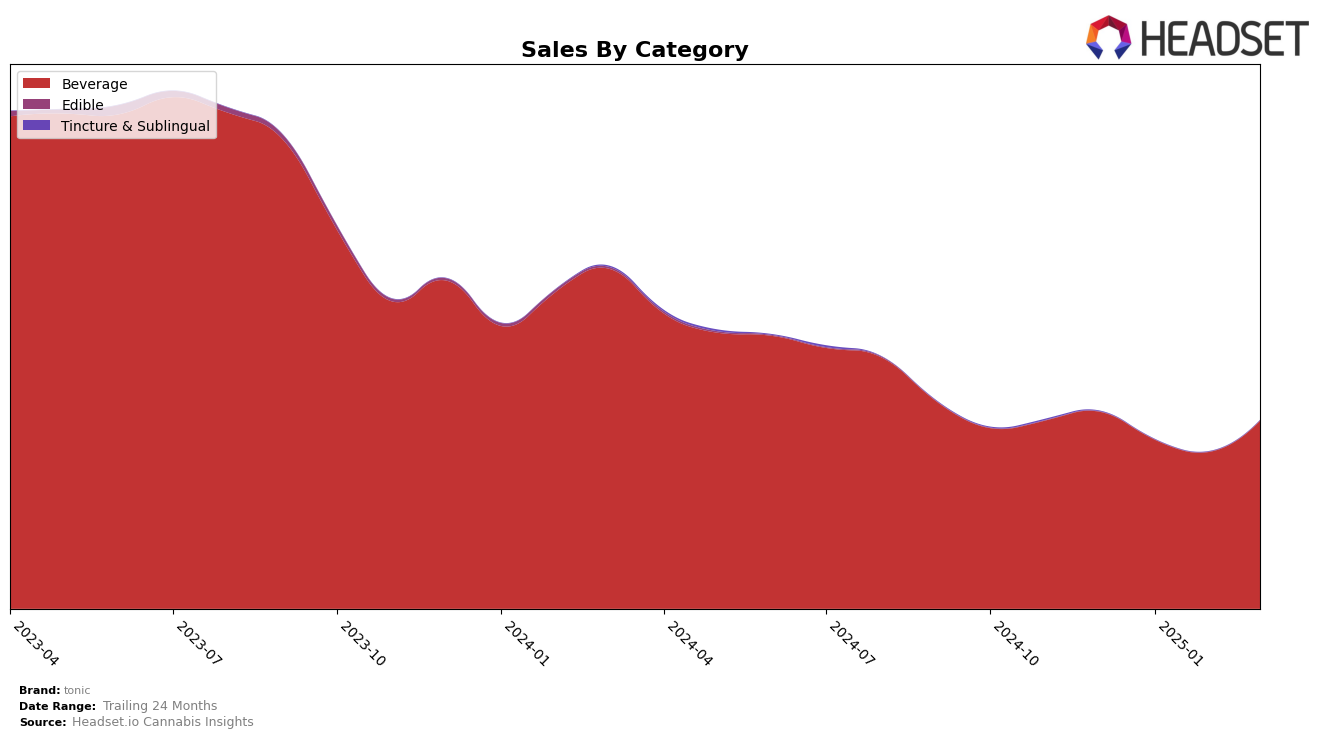

In the beverage category, Tonic has shown varied performance across different states, with notable movements in its rankings. In Arizona, the brand started at the 7th position in December 2024 and experienced a dip to 9th in February 2025 before climbing back to a commendable 5th place by March 2025. This upward movement suggests a recovery and potential growth in consumer interest or market strategies. Meanwhile, in Illinois, Tonic maintained a strong presence, consistently ranking at 4th place from December 2024 through February 2025, before advancing to 3rd place in March 2025, indicating a solid foothold and possibly increasing market share in the state.

Conversely, in Michigan, Tonic demonstrated remarkable stability by consistently holding onto the 2nd position from December 2024 through March 2025. This consistency might reflect a strong brand loyalty or a well-established market strategy in the state. However, the absence of Tonic in the top 30 brands in other states or categories could be seen as a gap or an area for potential growth. The fluctuation in sales figures, such as the significant jump in Arizona from February to March 2025, suggests dynamic market conditions and possibly successful promotional efforts or seasonal demand changes.

Competitive Landscape

In the Illinois beverage category, Tonic has shown a promising upward trajectory in terms of rank, moving from 4th place consistently from December 2024 to February 2025, to 3rd place by March 2025. This improvement in rank suggests a positive reception and increased consumer interest, despite facing stiff competition from leading brands. Notably, Uncle Arnie's has maintained its top position throughout this period, boasting significantly higher sales figures. Meanwhile, Journeyman consistently held the 2nd rank, although its sales have shown a downward trend. Tonic's rise to 3rd place in March 2025 indicates it has surpassed CQ (Cannabis Quencher), which dropped from 3rd to 4th place, despite CQ's strong sales performance. This shift highlights Tonic's growing market presence and potential to capture a larger market share in the Illinois beverage sector.

Notable Products

In March 2025, Raspberry Lemonade Tonic (100mg THC, 12oz) maintained its top position in the tonic lineup, achieving impressive sales of 7,032 units. The CBD/THC 1:1 Citrus Lime Tonic (100mg CBD, 100mg THC, 12oz) climbed to the second spot, up from fourth place in previous months, indicating a significant boost in consumer preference. Mandarin Orange Tonic (100mg THC, 12oz) slipped to third place despite consistent performance in earlier months. Mango Pineapple Seltzer (100mg THC, 12oz) rose to fourth position, showcasing a recovery from its earlier fifth-place ranking. Finally, CBD/THC 1:1 Tropical Punch Tonic rounded out the top five, experiencing a slight drop in rank compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.