Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

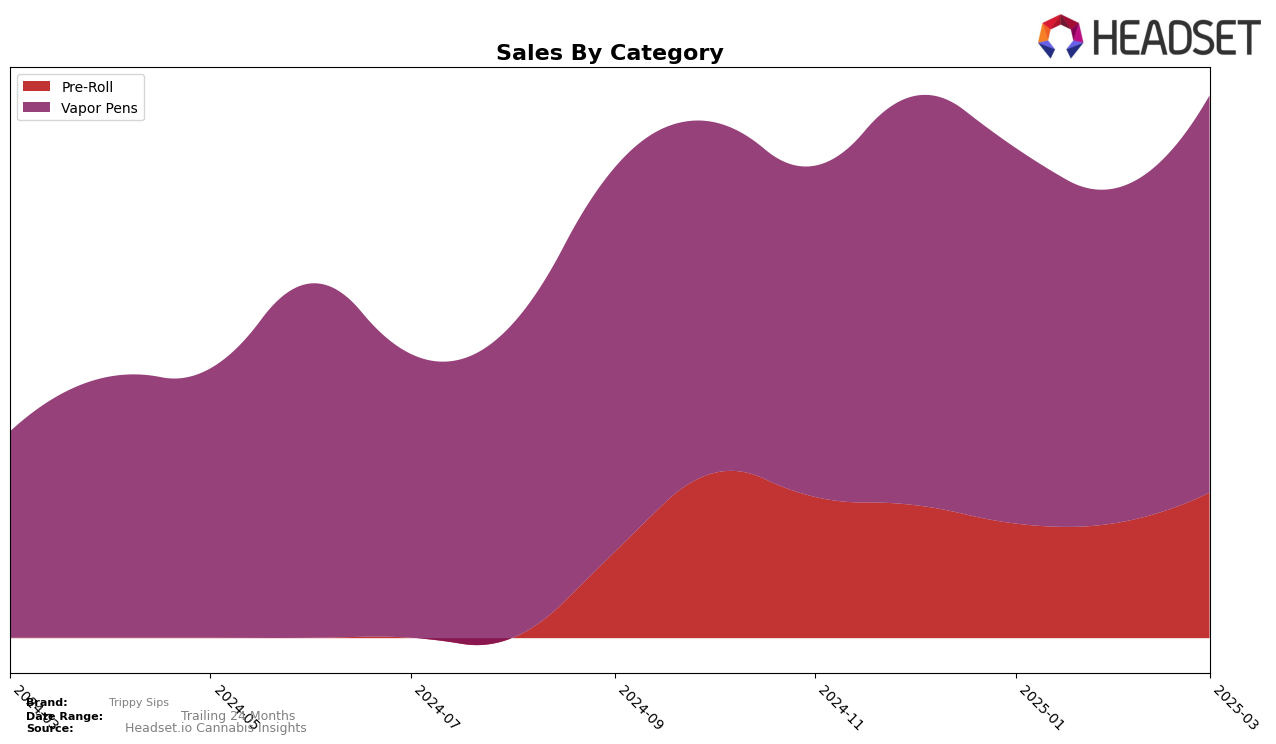

Trippy Sips has shown a varied performance across different categories and states, with notable movements in rankings. In Alberta, the brand has made significant strides in the Pre-Roll category, climbing from the 31st position in December 2024 to the 24th by March 2025. This indicates a positive trajectory, suggesting increased consumer interest or effective marketing strategies. However, their Vapor Pens have maintained a more stable ranking, hovering around the 12th and 13th positions, which may reflect consistent demand. While the Pre-Roll category saw a dip in sales in January and February, a rebound in March suggests a recovery or successful promotional efforts.

In Ontario, Trippy Sips' presence in the Pre-Roll category was minimal until March 2025 when they appeared in the rankings at the 94th position, indicating a late entry or increased competition. Meanwhile, their Vapor Pens have maintained a steady but low presence, ranking around the 30th position throughout the months. This stability might suggest a loyal customer base or consistent product performance. In Saskatchewan, the brand's performance in Pre-Rolls was less consistent, with rankings missing for some months, which could point to fluctuating market conditions or distribution challenges. However, their Vapor Pens have shown resilience, maintaining a position within the top 15, highlighting a stronger foothold in this category within the province.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Trippy Sips has shown a promising upward trajectory, moving from 13th to 12th place from December 2024 to March 2025. This improvement in rank highlights a positive trend in sales performance, especially when compared to competitors like 1964 Supply Co, which fluctuated between 14th and 18th place during the same period. Meanwhile, Good Supply maintained a steady position in the top 10, although their sales showed a slight decline, indicating potential market saturation or increased competition. Tribal and Endgame also remained consistent in their rankings, but with decreasing sales figures, which could suggest a shift in consumer preference towards brands like Trippy Sips. This data underscores the importance of strategic marketing and product differentiation for Trippy Sips to continue its ascent in the competitive vapor pen market in Alberta.

Notable Products

In March 2025, the Juicy 5 Variety Pack Infused Pre-Roll 5-Pack maintained its top position from February, leading the sales for Trippy Sips with a notable figure of 6,100 units sold. Following closely, the Kool Cherry Distillate Cartridge ranked second, consistent with its performance in February, although it had previously held the top spot in December and January. The Kool Grape Jammer Distillate Cartridge improved its rank to third in March, up from fourth place in the preceding two months. Caribbean Crush Distillate Cartridge slipped to fourth, continuing its downward trend from second in December. Lastly, the Caribbean Crush Distillate All-In-One Disposable debuted in fifth place, marking its entry into the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.