Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

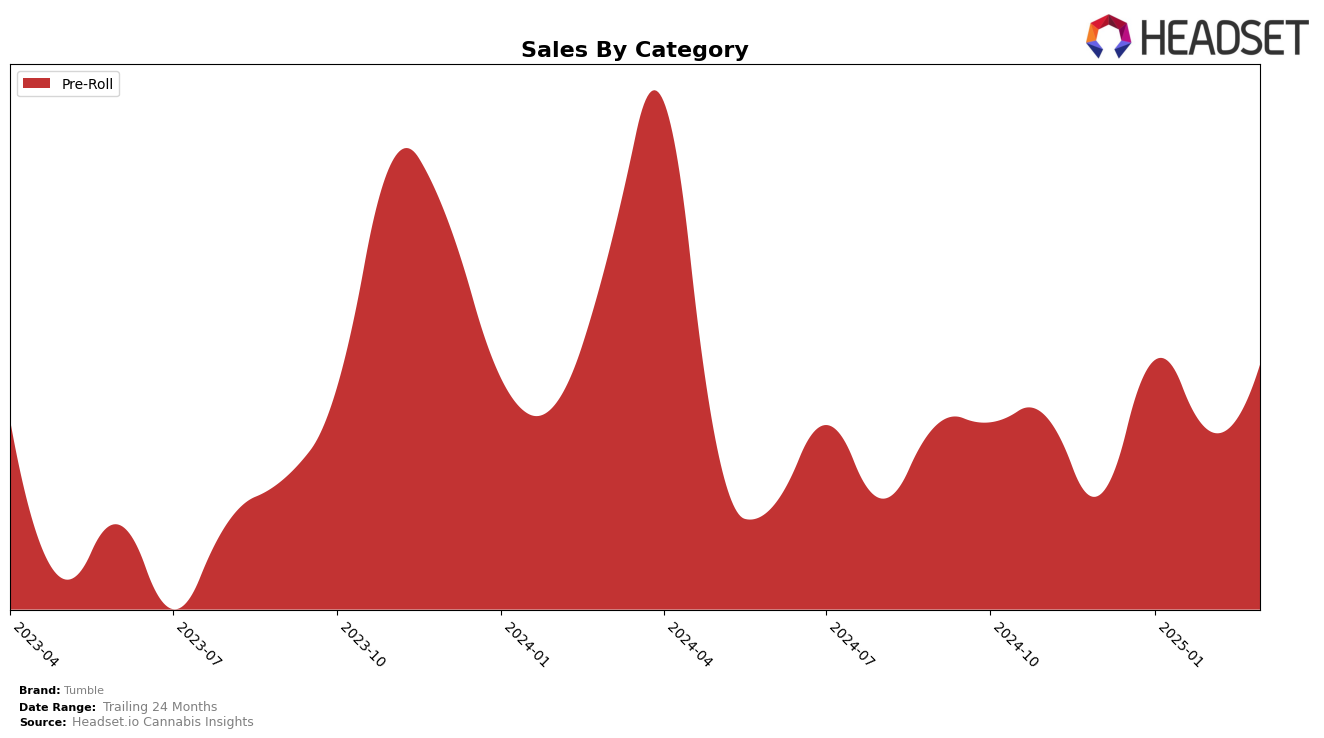

In the state of Arizona, Tumble has consistently maintained its position in the Pre-Roll category, holding steady at rank 6 from January to March 2025. This stability indicates a strong foothold in the market, as the brand has managed to sustain its ranking despite the competitive nature of the cannabis industry. The sales figures also reflect a positive trajectory, with a noticeable increase from December 2024 to March 2025, suggesting that Tumble's offerings are resonating well with consumers in this region. The brand's ability to maintain a top 10 position highlights its strategic positioning and consumer loyalty in Arizona.

Conversely, in Missouri, Tumble's performance in the Pre-Roll category shows a more fluctuating trend, with the brand not breaking into the top 30 rankings. Despite this, there is a positive aspect to note: Tumble's rank improved from 45 in February to 41 in March 2025. This upward movement, coupled with an increase in sales, might suggest growing consumer interest or effective marketing strategies in Missouri. However, the brand's absence from the top 30 indicates there is still significant ground to cover to achieve a more competitive standing in this market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, Tumble has shown consistent performance, maintaining its rank at 6th place from January to March 2025, after a slight improvement from 7th place in December 2024. This stability in ranking is noteworthy, especially when compared to Find., which experienced a decline from 6th to 8th place over the same period. Meanwhile, The Pharm consistently held the 5th position, indicating strong competition just above Tumble. Leafers also presented a formidable presence, dropping slightly from 3rd to 4th place by March 2025, yet still maintaining a significant lead in sales. Interestingly, Sluggers Hit, which was not in the top 20 until March 2025, emerged at 7th place, suggesting a potential new competitor for Tumble. This competitive dynamic highlights Tumble's resilience in maintaining its market position amidst fluctuating ranks and sales figures of its competitors.

Notable Products

In March 2025, the top-performing product from Tumble was the Blackberry Kush Diamond Infused Pre-Roll (1g), maintaining its position as the leading product since February, with sales reaching 2523 units. Following closely, the Cactus Chiller Diamond Infused Pre-Roll (1g) held the second rank, consistent with its performance in February, with a notable increase in sales. Jungle Punch Diamond Infused Pre-Roll (1g) ranked third, showing a slight decline from its top position in December and January. The Alien Technology Infused Pre-Roll (1g) debuted in the rankings at fourth place, indicating a strong market entry. Rounding out the top five is the Travelers - Pineapple Upside Down Cake Diamond Infused Pre-Roll 3-Pack (1.5g), which also made its first appearance in the rankings, suggesting a positive reception from consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.