Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

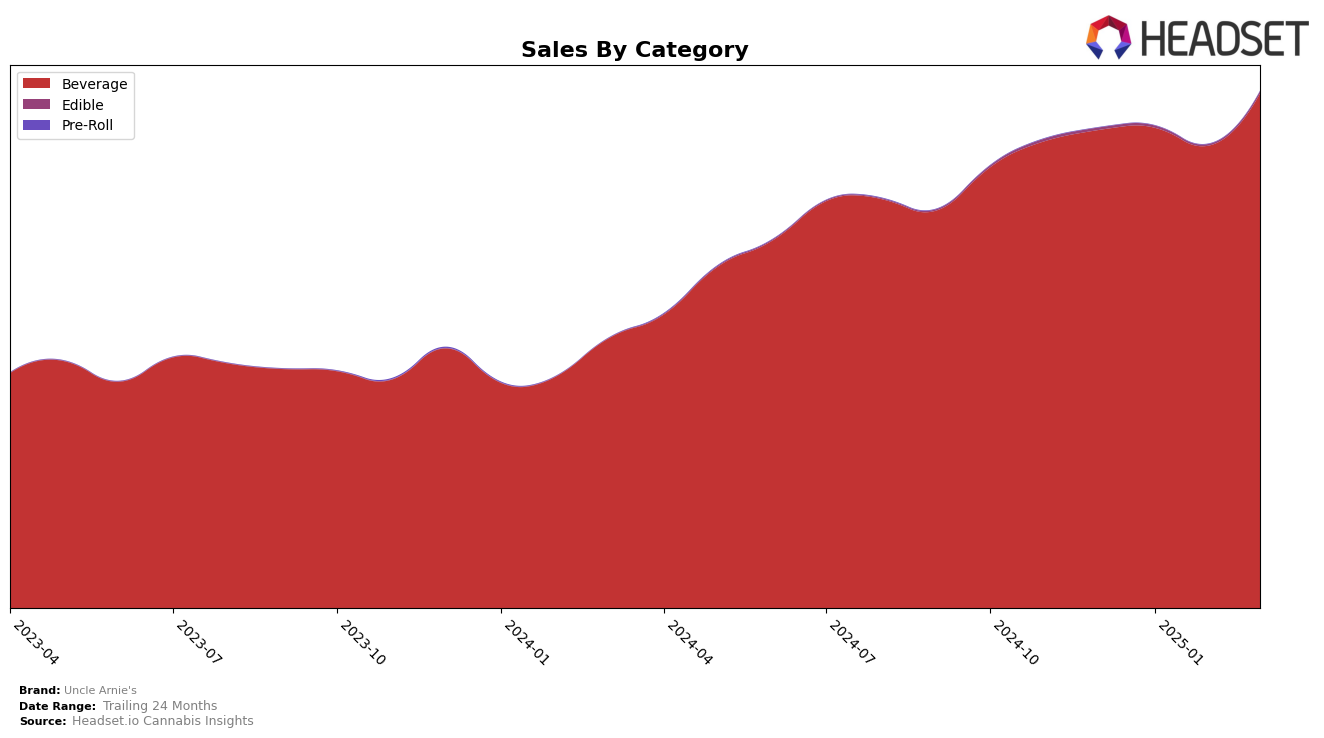

Uncle Arnie's has shown a consistent performance in the beverage category across several states, with notable stability in California where it maintained its position as the second-ranked brand from December 2024 through March 2025. Despite a slight dip in sales during February, the brand rebounded in March, indicating resilience in its market presence. Meanwhile, in Illinois, Uncle Arnie's has been the top-ranked beverage brand consistently throughout the same period, showcasing a strong foothold in this market with a notable increase in sales from February to March 2025.

In Nevada, the brand fluctuated slightly but remained within the top five, highlighting a stable yet competitive position. Sales figures suggest some challenges, as evident from the fluctuations in rank, but the brand maintained its fifth position in March 2025. However, in Oregon, Uncle Arnie's was ranked sixth in December 2024 but did not feature in the top 30 in subsequent months, which could indicate a need for strategic adjustments to regain market traction in that state.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Uncle Arnie's consistently holds the second rank from December 2024 through March 2025. Despite a slight dip in sales from December 2024 to February 2025, Uncle Arnie's rebounds in March 2025, indicating resilience and strong brand loyalty. The top position is dominated by St Ides, which maintains its lead with significantly higher sales figures, suggesting a robust market presence. Meanwhile, CANN Social Tonics consistently ranks third, with sales showing a slight fluctuation but remaining stable overall. Notably, Not Your Father's Root Beer shows a positive trend, moving up from sixth to fourth place by March 2025, which could indicate increasing consumer interest. This competitive positioning highlights Uncle Arnie's strong market presence, though the brand faces stiff competition from both established and emerging players in the California beverage category.

Notable Products

In March 2025, the top-performing product for Uncle Arnie's was the Strawberry Kiwi Shot (100mg THC, 2oz), maintaining its first-place ranking consistently since December 2024, with sales reaching 35,628 units. The Magic Mango Shot (100mg) climbed back to the second position after slipping to third in February, indicating a resurgence in popularity. The Sunrise Orange With Caffeine Shot (100mg THC, 2oz) also saw an improvement, moving from fourth to third place, showcasing a positive trend in its sales trajectory. The Pineapple Punch Shot (100mg THC, 8oz) experienced a slight decline, dropping from second place in February to fourth in March. Meanwhile, the Smackin' Apple Juice Shot (100mg THC, 8oz) remained steady at fifth place, showing consistent but lower sales figures compared to the top performers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.