Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

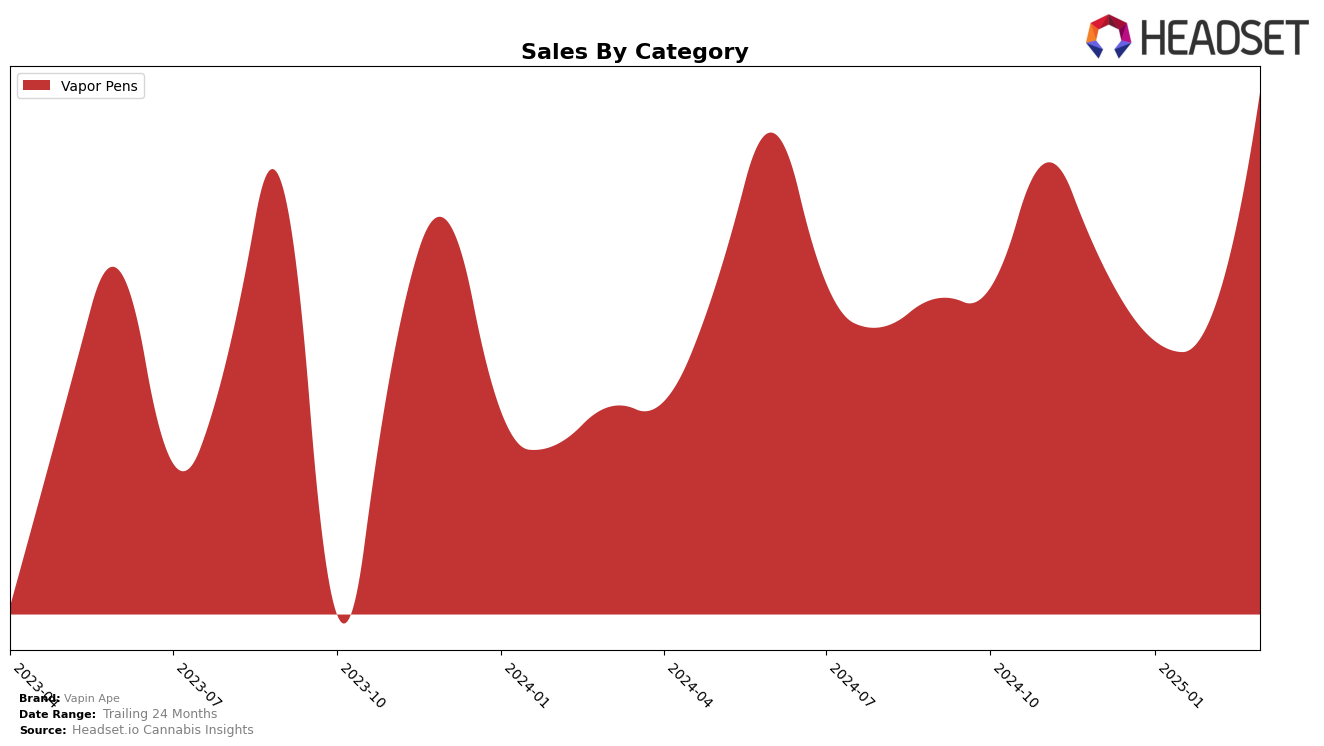

In the state of Illinois, Vapin Ape's performance in the Vapor Pens category shows a consistent presence outside the top 30 rankings from December 2024 through March 2025. This indicates a challenging market environment for the brand in Illinois, where they have not yet secured a spot among the leading competitors. Despite this, the brand's sales figures in Illinois have experienced fluctuations, with a notable increase in January 2025 followed by a decline in February and March. This trend suggests that while Vapin Ape may not be a top contender in Illinois, there are opportunities for growth if they can capitalize on market dynamics.

In contrast, Vapin Ape has maintained a strong position in the Vapor Pens category in Michigan, consistently ranking within the top 11 from December 2024 to March 2025. The brand's stable ranking at 10th position in February and March 2025 reflects a solid foothold in the Michigan market. Moreover, the sales trend in Michigan shows a positive trajectory, with a significant sales increase in March 2025, highlighting the brand's potential for further expansion and dominance in this state. This performance comparison between Illinois and Michigan underscores the varying levels of market penetration and success Vapin Ape experiences across different regions.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Vapin Ape has shown resilience and a steady performance amidst fluctuating market dynamics. Over the period from December 2024 to March 2025, Vapin Ape maintained a consistent rank, moving from 11th to 10th position, reflecting a stable market presence. Notably, Rove experienced a decline in rank from 8th to 12th, indicating a potential opportunity for Vapin Ape to capture market share from a once stronger competitor. Meanwhile, Dragonfly Cannabis improved its position significantly from 19th to 11th, suggesting a rising competitive threat. Play Cannabis and Galactic maintained strong positions at 9th and 8th respectively, with Play Cannabis showing a notable upward sales trend. Vapin Ape's sales figures indicate a positive growth trajectory, especially in March 2025, which could be leveraged to strengthen its market position further against these competitors.

Notable Products

In March 2025, Pineapple Haze HTE Distillate Disposable (1g) maintained its position as the top-performing product for Vapin Ape, with sales reaching 8,551 units. Grape Runtz Full Spectrum Disposable (1g) consistently held the second rank, closely following the leader with strong sales figures. Animal Mints HTE Distillate Disposable (1g) remained steady in third place, showing consistent performance over the months. Black Cherry Kush Full Spectrum Distillate Disposable (1g) climbed to fourth place from fifth in February, indicating a positive trend. Gelato Dream Plus HTE Distillate Disposable (1g) retained its position in the top five, despite fluctuating ranks earlier in the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.