Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

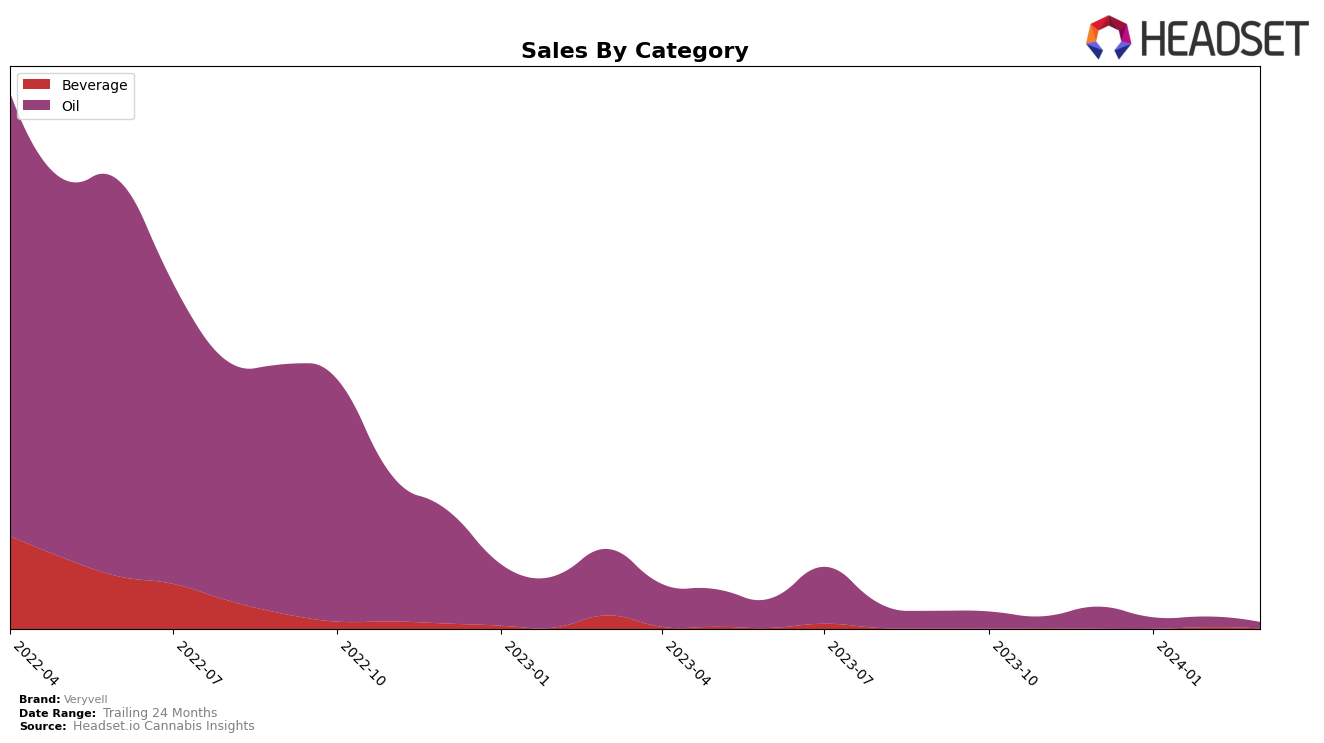

In the burgeoning cannabis market, Veryvell's performance across categories and states/provinces presents a mixed bag of results, indicative of the brand's fluctuating market presence. In Alberta, Veryvell made a notable entry into the Oil category rankings in January 2024 at 25th place and improved slightly to 24th in February, despite not being ranked in December 2023. This upward movement, although modest, signals a growing interest in Veryvell's offerings within the province. Conversely, in Ontario, the brand experienced significant volatility in the Oil category. After not being ranked in the top 30 in December 2023, Veryvell re-entered the rankings in March 2024 at 48th place, following an unranked February and a 51st place in January. This erratic performance suggests challenges in maintaining consistent market penetration and consumer interest in Ontario's competitive landscape.

Veryvell's performance in the Saskatchewan market, however, tells a story of resilience and potential growth. In the Oil category, the brand maintained a steady presence, ranking 18th in December 2023, improving to 16th in January 2024, and holding relatively steady through March 2024 with a slight dip to 20th place. This consistency in ranking, coupled with a notable sales figure of 1735 in December 2023, underscores Veryvell's strong foothold in the Saskatchewan market. Additionally, the brand's entrance into the Beverage category in February 2024 at 24th place, without prior ranking, could indicate a strategic expansion into new categories within the province. Contrastingly, in British Columbia, Veryvell's absence from the rankings after December 2023, where it was ranked 16th in the Oil category, suggests a potential retraction in market presence or consumer interest, an area of concern that could impact the brand's overall performance in this key market.

Competitive Landscape

In the competitive landscape of the cannabis oil category in Saskatchewan, Veryvell has experienced fluctuations in its market position, indicating a dynamic and competitive environment. Initially ranked 18th in December 2023, Veryvell improved its standing to 16th in January 2024, slightly dropped to 17th in February, and then experienced a further decline to 20th by March 2024. This trend suggests a challenge in maintaining its market position amidst aggressive competition. Notable competitors include FIGR, which also saw a decline from 19th to 22nd place, indicating a similar struggle. Conversely, Verse and Floresense have shown more volatility in their rankings, with Verse moving from 17th to 19th place and Floresense experiencing a significant drop from 12th to 18th. A new entrant, DayDay, emerged in the rankings in March 2024 at 21st position, introducing further competition. The shifting ranks and the entry of new competitors suggest a highly competitive market that Veryvell must navigate carefully to improve or maintain its sales and market position.

Notable Products

In March 2024, Veryvell's top-performing product was the CBD/THC 15:1 Exhale Drops (27ml) within the Oil category, reclaiming its number one rank with impressive sales of 28 units. Following closely, the Tingle Drops (30ml) also in the Oil category, secured the second rank, marking a significant jump from not being ranked previously to becoming one of the leading products. The CBD Sicilian Lemon Sparkling Water and CBD Strawberry Hibiscus Sparkling Water, both in the Beverage category, tied for the third position, which is notable considering they were unranked in the earlier months. The CBD:THC 1:1 Lemon Black Iced Tea Sparkling Beverage managed to maintain its fourth rank consistently over the past three months, demonstrating steady consumer interest. These rankings indicate a growing preference for oil products, with the Exhale Drops showing a notable increase in sales and the Tingle Drops making a significant entrance into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.