Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

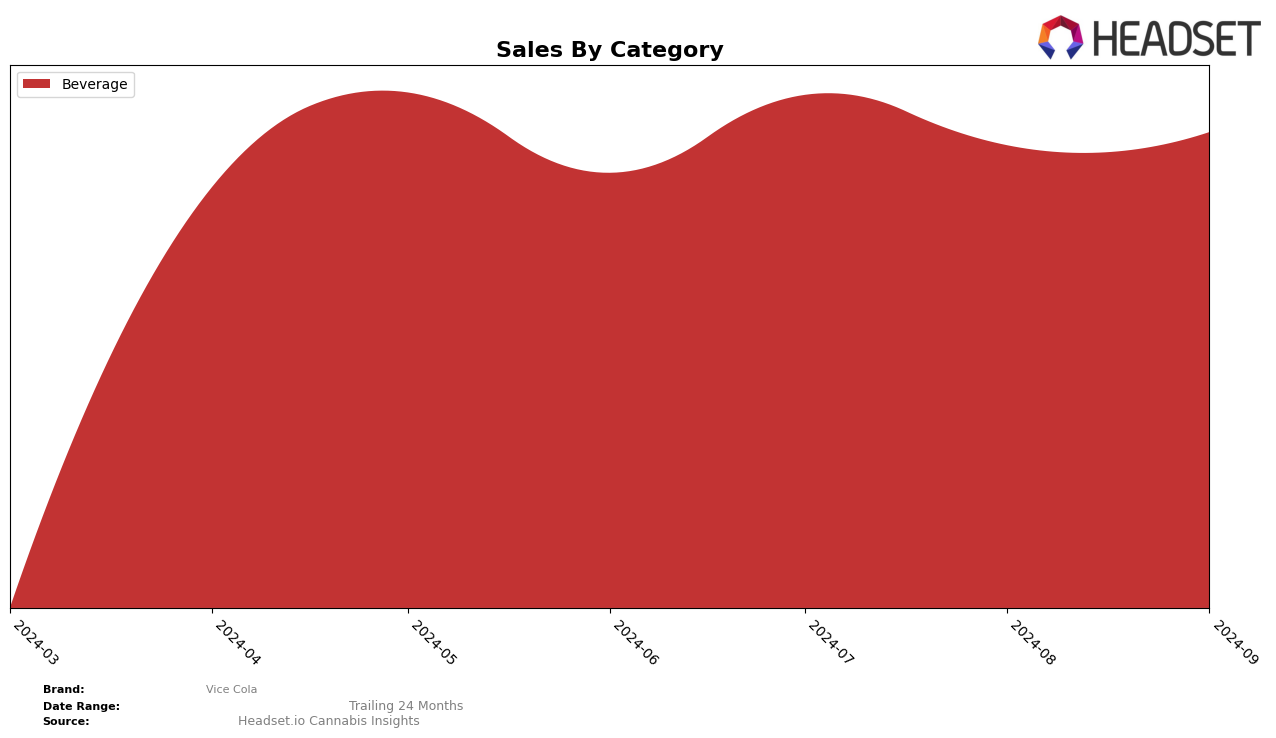

Vice Cola has shown a notable performance in the beverage category within the state of Washington over the summer months of 2024. The brand entered the top 30 rankings for the first time in July, securing the 19th position, which is a significant achievement considering it was not ranked in June. This upward movement suggests a growing consumer interest and possibly effective marketing strategies or product launches during that period. However, the absence of rankings in August and September indicates that Vice Cola might have faced challenges maintaining its momentum or that competition intensified, pushing it out of the top 30 once again. This fluctuation highlights the competitive nature of the cannabis beverage market in Washington.

Across other states and provinces, Vice Cola's performance remains less visible, as it did not make it into the top 30 rankings in any other regions in the provided data. This could be interpreted as a lack of presence or market penetration outside of Washington, or it might suggest that Vice Cola is focusing its efforts on a more localized strategy before expanding further. The absence of data in other states could be seen as a potential area of growth for Vice Cola, especially if they can replicate or exceed the success seen in Washington. Observing how Vice Cola adjusts its strategies in response to these dynamics will be crucial for understanding its future trajectory in the cannabis beverage market.

Competitive Landscape

In the Washington beverage category, Vice Cola has shown a fluctuating presence among the top cannabis brands, with its rank appearing in July 2024 at 19th place, but missing from the top 20 in other months such as June, August, and September 2024. This inconsistency suggests a challenge in maintaining a stable market position. In comparison, Cormorant has demonstrated a more consistent performance, ranking 20th in June and improving to 18th in July, before slightly dropping to 19th in August, and not ranking in September. Meanwhile, Passion Flower Cannabis only appeared in the rankings in June at 19th place, indicating a similar struggle to maintain a foothold in the competitive landscape. The sales trends for these brands highlight a volatile market environment, where Vice Cola's absence from the rankings in multiple months could potentially impact its visibility and consumer loyalty, suggesting a need for strategic marketing efforts to boost its presence and sales consistency.

Notable Products

In September 2024, Vice Cola's top-performing product was Cola (100mg) in the Beverage category, which rose to the number one spot with impressive sales of 614 units, marking a significant increase from previous months. Sleek Cherry Cola (100mg THC, 12oz) experienced a drop from its consistent first-place ranking in the preceding months to second place, with its sales decreasing to 295 units. Zero Cola (100mg THC, 12oz) maintained its steady third-place position throughout the months leading up to September. Vice Cola (10mg) held its fourth-place spot consistently from July to September, showing stable sales figures. Lastly, Zero Cola (10mg) ranked fifth, mirroring its August position and maintaining its sales level from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.