Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

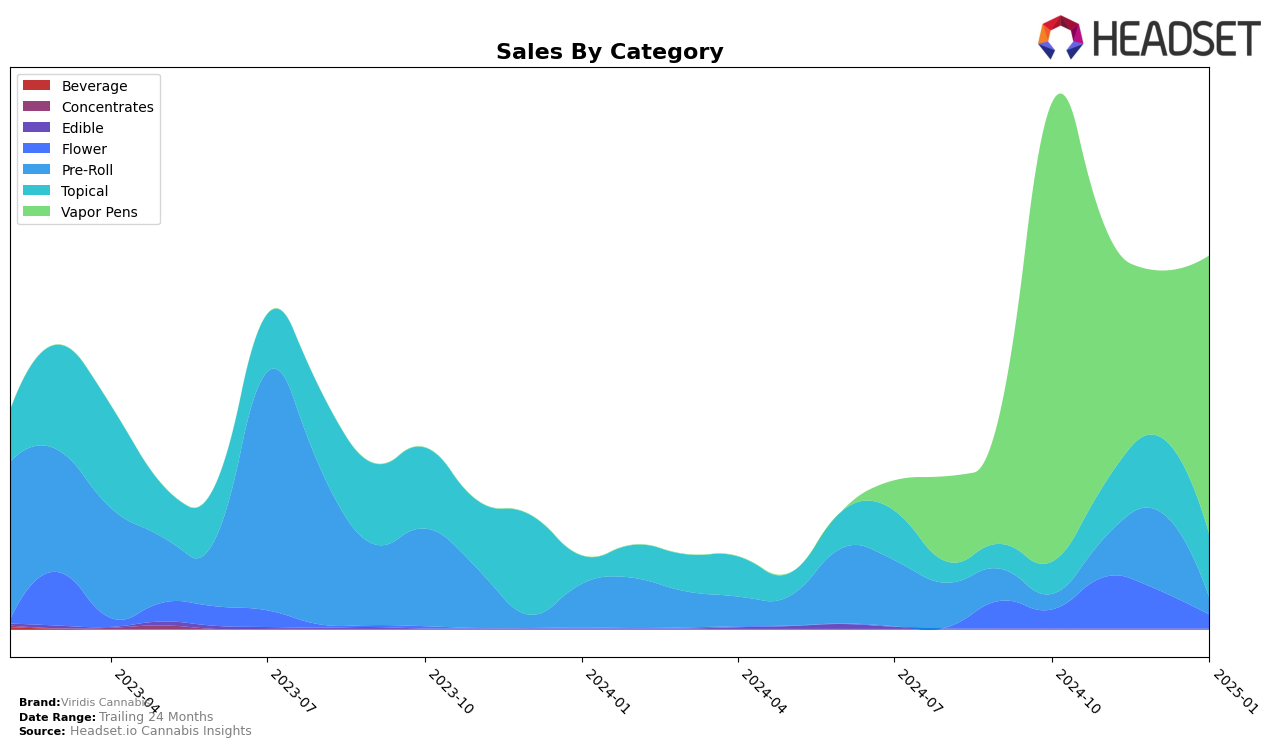

Viridis Cannabis has experienced notable fluctuations in its performance across different categories and regions, particularly in the vapor pen market in Alberta. The brand's ranking in this category has seen a downward trend from October 2024, where it was positioned at 50th, to December 2024, when it dropped to 72nd. However, there was a slight recovery in January 2025, with the brand moving back up to 63rd place. Despite these shifts, the brand did not make it into the top 30 rankings during this period, indicating potential challenges in maintaining a competitive edge in the Alberta vapor pen market.

Sales data reflects the brand's volatile performance, with a significant decline from October to December 2024, before showing some improvement in January 2025. This pattern suggests that while Viridis Cannabis may be struggling to secure a strong foothold in the Alberta vapor pen category, there are signs of resilience that could lead to better positioning in the future. The lack of top 30 rankings highlights areas for growth and strategic focus, especially in enhancing market presence and consumer engagement in this region. For a more comprehensive understanding of Viridis Cannabis's performance across other categories and regions, further analysis would be beneficial.

Competitive Landscape

In the Alberta vapor pens market, Viridis Cannabis has experienced fluctuating rankings over the past few months, indicating a dynamic competitive landscape. Starting at rank 50 in October 2024, Viridis Cannabis dropped to 68 in November and further to 72 in December, before climbing back to 63 in January 2025. This suggests a recovery in market position, albeit still below its initial October rank. In comparison, Western Cannabis showed a similar downward trend, starting at rank 32 in October and falling to 65 by January, which could indicate a broader market shift affecting multiple brands. Meanwhile, Slerp demonstrated a notable improvement, moving from rank 66 in October to 62 in January, surpassing Viridis Cannabis in the process. Juicy Hoots and Alchemy Pure entered the rankings later, with Juicy Hoots moving from 71 in December to 64 in January, indicating potential rising competition. These movements suggest that while Viridis Cannabis is regaining some ground, it faces increasing competition from both established and emerging brands in Alberta's vapor pen category.

Notable Products

In January 2025, the top-performing product from Viridis Cannabis was the FSE Terpene Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank since October 2024 with sales reaching 1085 units. The CBD Zen Citrus Cannabomb Bath Bomb (100mg CBD, 150g) held steady in the second position, showing a slight decrease from its December sales peak. Cool Pre-Roll 5-Pack (2.5g) consistently ranked third, with sales figures slightly dropping to 84 units from the previous month. Notably, the CBD MoveMint Balm (200mg CBD, 16.2mg THC, 60g) rose to fourth place after not being ranked in December, indicating a resurgence in popularity. Grape Pie (14g) in the Flower category retained the fifth position, despite a continued decline in sales since October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.