Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

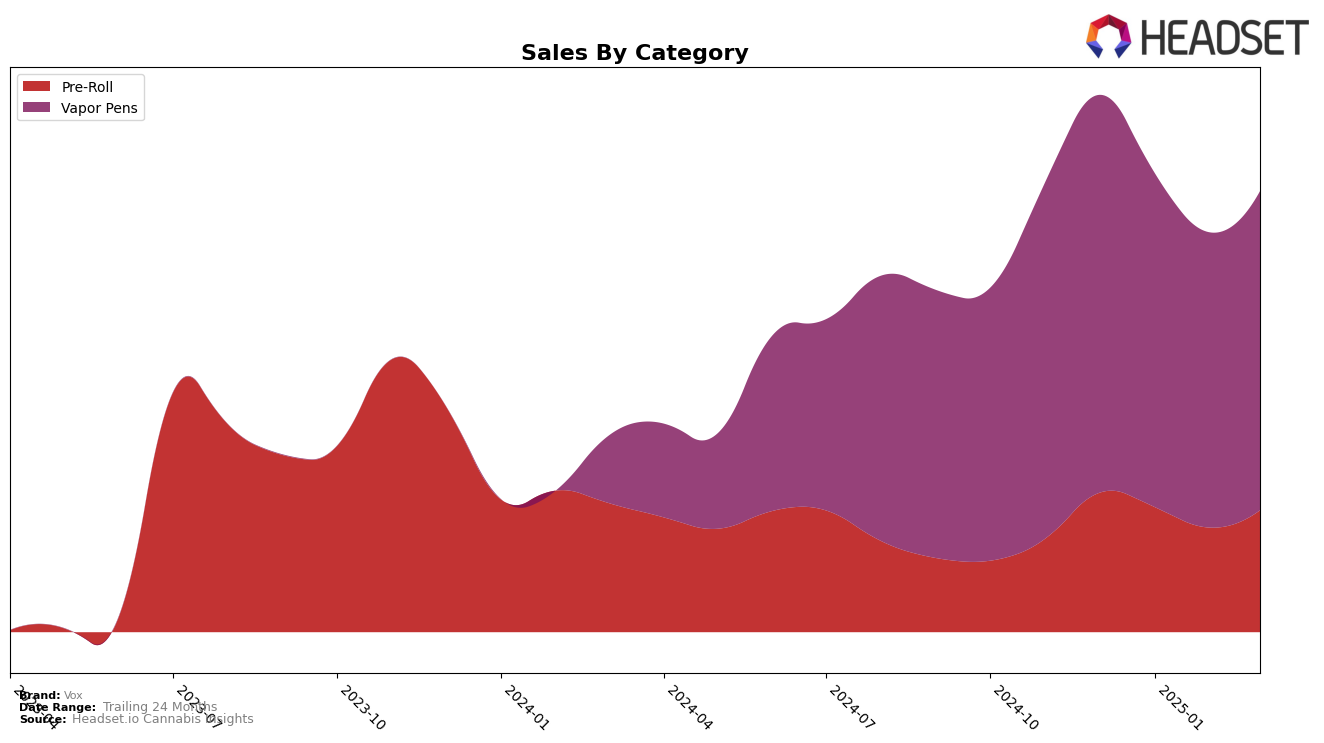

Vox's performance in the Pre-Roll category has shown some interesting trends across different regions. In Alberta, the brand has been gradually climbing the ranks, moving from 39th in December 2024 to 33rd by March 2025. This upward movement is noteworthy, especially considering the increase in sales during March 2025, which suggests a positive reception of their products. In contrast, in British Columbia, Vox did not rank in the top 30 in December 2024, but by March 2025, they were positioned at 82nd, indicating a slow but steady entry into the market. Meanwhile, in Ontario, the brand's ranking has seen a slight decline from 57th to 64th, which could be attributed to various market dynamics or competitive pressures.

In the Vapor Pens category, Vox has maintained a strong presence in British Columbia, consistently ranking within the top 6 positions over the months, reflecting a stable consumer base and potentially effective marketing strategies. However, in Alberta, there has been a gradual decline from 14th to 19th, which might suggest increased competition or shifts in consumer preferences. In Ontario, the brand's performance has been relatively stable, hovering around the mid-30s, with a slight improvement in March 2025. This consistency might indicate a loyal customer segment or effective distribution channels in the region. Overall, Vox's performance across these categories and regions highlights both opportunities and challenges in maintaining and expanding market presence.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Vox has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 5th, Vox saw a dip to 6th place in January and February, before regaining its 5th position in March. This fluctuation is indicative of a competitive market where brands like Sticky Greens and Fuego Cannabis (Canada) have shown strong performances, with Sticky Greens notably climbing from 8th to 4th place in February. Despite these shifts, Vox's sales trajectory shows resilience, with a recovery in March sales after a dip in February, suggesting effective strategies to reclaim market share. Meanwhile, DEBUNK consistently maintained a top 3 position, highlighting the competitive pressure Vox faces in this category. These dynamics underscore the importance of strategic positioning and innovation for Vox to maintain and improve its standing in the British Columbia vapor pen market.

Notable Products

In March 2025, the top-performing product from Vox was Puffz - Blueberry Pom Pom Distillate Disposable (1.2g) in the Vapor Pens category, maintaining its first place ranking for the fourth consecutive month with sales of 5826 units. Following closely, Puffz- Tango Strawmango Distillate Disposable (1.2g) held steady at the second position, continuing its consistent performance from previous months. Puffz- Tango Strawmango Distillate Cartridge (1.2g) improved its standing from fifth in January to third place by March, showing a notable upward trend. Big Shiny Popz Crushable Mixer Diamond Infused Pre-Roll 5-Pack (2.5g) maintained its fourth position, while Puffz- Peach Melonberry Distillate Disposable (1.2g) dropped from third in January to fifth in March. Overall, the rankings indicate strong and stable demand for Vox's Vapor Pens, with some fluctuations observed in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.