Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

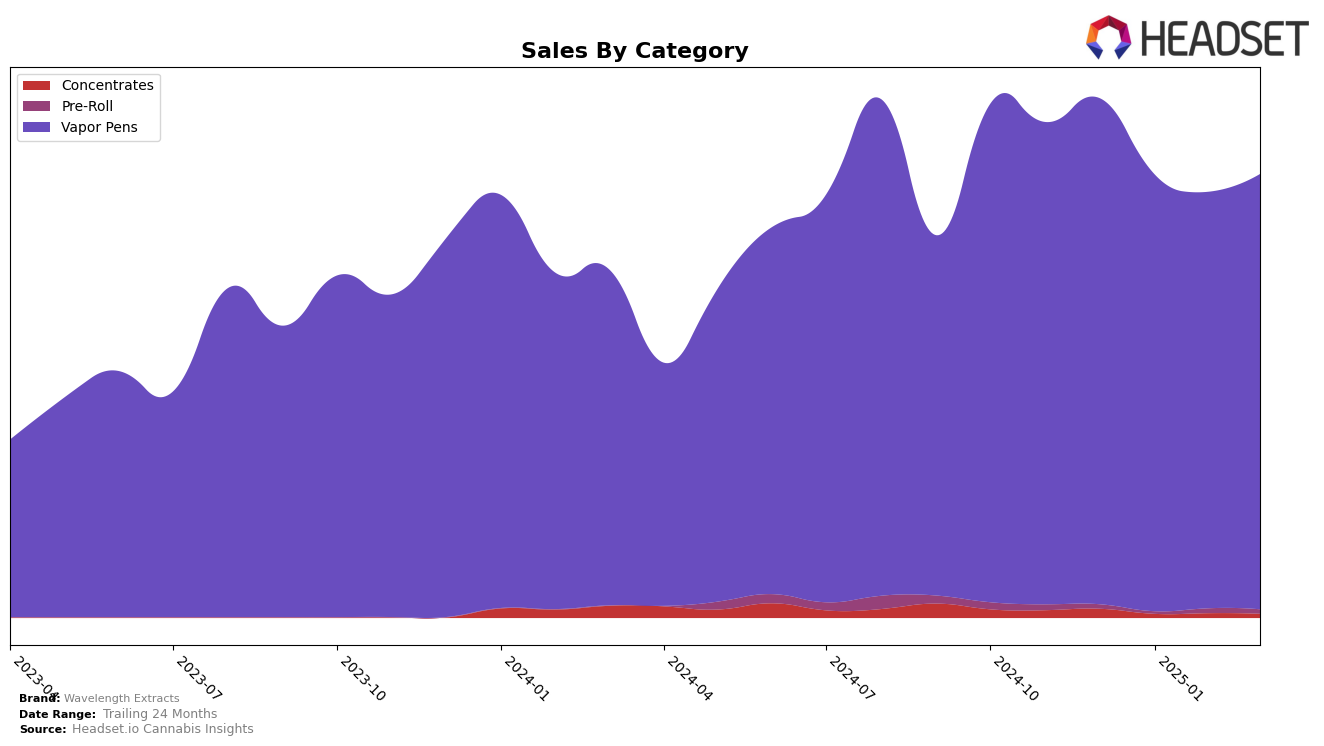

Wavelength Extracts has shown varied performance across different states and categories. In Colorado, the brand's ranking in the Vapor Pens category has experienced a decline, dropping from 37th place in December 2024 to 43rd by March 2025. This downward trend is mirrored by a decrease in sales, suggesting a potential challenge in maintaining market share in this competitive segment. In contrast, the brand's performance in Missouri tells a different story. Here, Wavelength Extracts maintained a strong presence, ranking within the top 10 for most of the observed period, although slipping to 11th place in March 2025. Despite this slight dip, sales have shown resilience, with a notable increase in March 2025 compared to the previous months.

The performance of Wavelength Extracts in Missouri's Vapor Pens category highlights the brand's ability to adapt and thrive in certain markets. The fluctuation in rankings—6th in December 2024 and 11th in March 2025—indicates a highly competitive environment, yet the brand's ability to remain within or near the top 10 is commendable. This is particularly significant given the absence of a top 30 ranking in other states or categories, as observed in Colorado. The varying results across states suggest that while Wavelength Extracts faces challenges in some regions, it continues to find opportunities for growth and stability in others, particularly in states where its market strategies align well with consumer preferences.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Wavelength Extracts has experienced notable fluctuations in its ranking, which could impact its market positioning and sales strategy. As of December 2024, Wavelength Extracts held a strong position at rank 6, but by March 2025, it had slipped to rank 11. This decline in rank might be attributed to the competitive pressures from brands like Elevate (Elevate Missouri), which consistently maintained a competitive edge, ranking between 8 and 11 over the same period. Additionally, STIIIZY and Indi Vapes have shown resilience in the market, with Indi Vapes improving its rank to 10 by March 2025. Despite these challenges, Wavelength Extracts' sales figures have remained relatively stable, indicating a loyal customer base that could be leveraged to regain higher rankings. Understanding these dynamics and the performance of competitors can provide valuable insights for Wavelength Extracts to strategize effectively in the evolving Missouri vapor pen market.

Notable Products

For March 2025, the top-performing product from Wavelength Extracts is Amplitude - Jack Herer Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from January and reclaiming it from February. This product achieved notable sales of 3,490 units. In second place is Amplitude - Northern Lights Distillate Cartridge (1g), which dropped from its top position in February. Fruit Bedrock Distillate Cartridge (1g) ranks third, showing improvement from its fifth-place ranking in February. Lastly, Amplitude - Clementine Distillate Cartridge (1g) and Amplitude - Tiger's Blood Distillate Cartridge (1g) hold the fourth and fifth positions, respectively, with Clementine moving down from third place in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.