Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

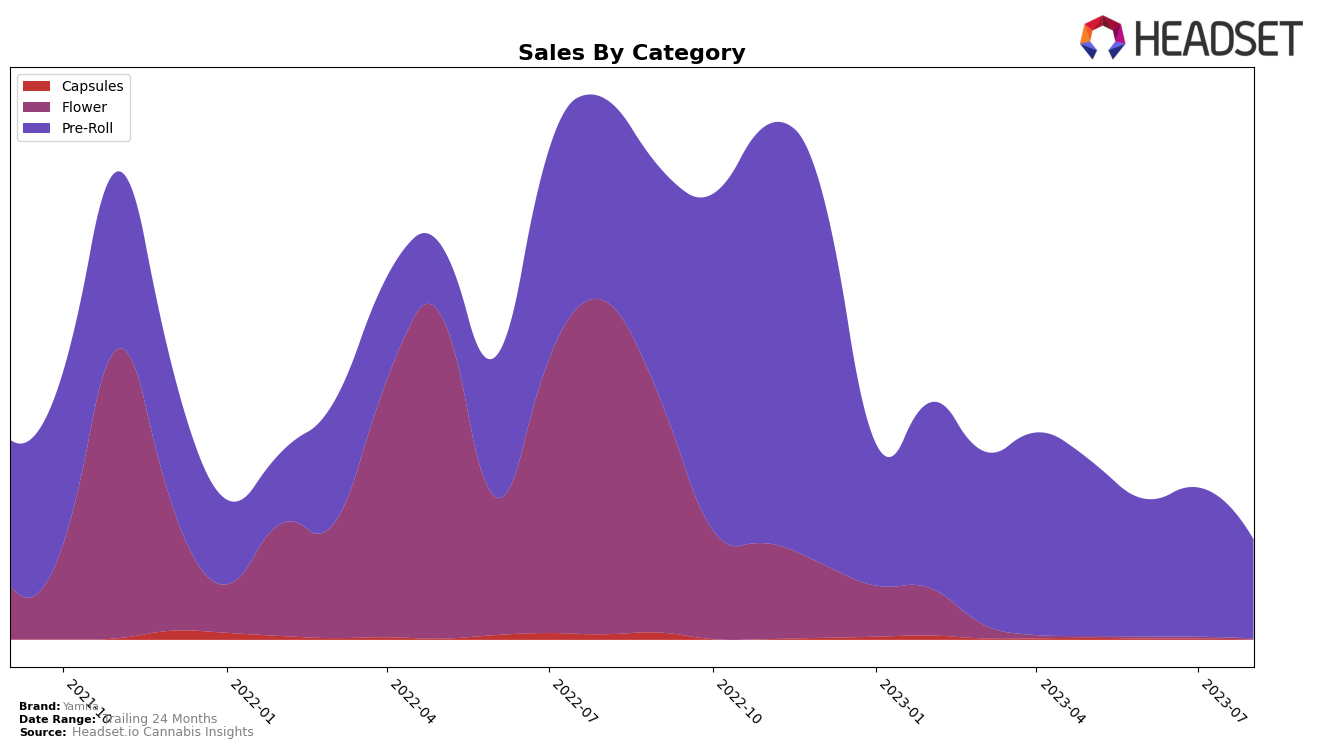

Starting with the Capsules category, Yamna has shown consistent performance in the state of Massachusetts over the past four months. The brand has maintained its position in the top 10, ranking 9th in August, July, and June, and 8th in May. However, it's important to note that despite this consistency in ranking, there has been a significant downward trend in sales from May to August. This might suggest a decrease in market share or increased competition within the Capsules category.

Turning our attention to the Pre-Roll category, Yamna's performance has been less consistent. In Massachusetts, the brand's ranking fluctuated between 58th and 74th place over the past four months. While the brand did not make it into the top 20 in any of these months, it's worth noting that there was an upward trend in sales from May to July, indicating a potential increase in popularity or successful marketing efforts. However, this trend did not continue into August, which may be a cause for concern or an area for further investigation.

Competitive Landscape

In the Pre-Roll category in Massachusetts, Yamna has seen some fluctuation in its ranking over the past few months. In May, Yamna held a strong position at 58, but by August, it had slipped to 74. This indicates a decrease in sales, although it's worth noting that Yamna's sales were still higher than some of its competitors. For instance, Old Pal and Gibby's Garden both had lower sales than Yamna in August, despite Old Pal having a higher rank. On the other hand, Berkshire Roots and Curaleaf have consistently ranked higher than Yamna, with Curaleaf notably absent from the top 20 brands in June. This suggests that while Yamna has faced some challenges, it still holds a competitive position in the market.

Notable Products

In August 2023, the top-performing product from Yamna was the 'White Gravy Cannagar (2g)' from the Pre-Roll category, with an impressive sales figure of 518 units. This is a significant increase from its ranking of second place in July and fourth in June. The 'Orange Strollo Live Resin Infused Cannagar (2.5g)', also in the Pre-Roll category, ranked second in August. The 'NF1 Infused Cannagar (2.4g)' moved up two places from July to secure the third spot in August. Interestingly, the 'Orange Strollo Infused Blunt (2.5g)', which was the top seller in July, slipped to fifth place in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.