Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

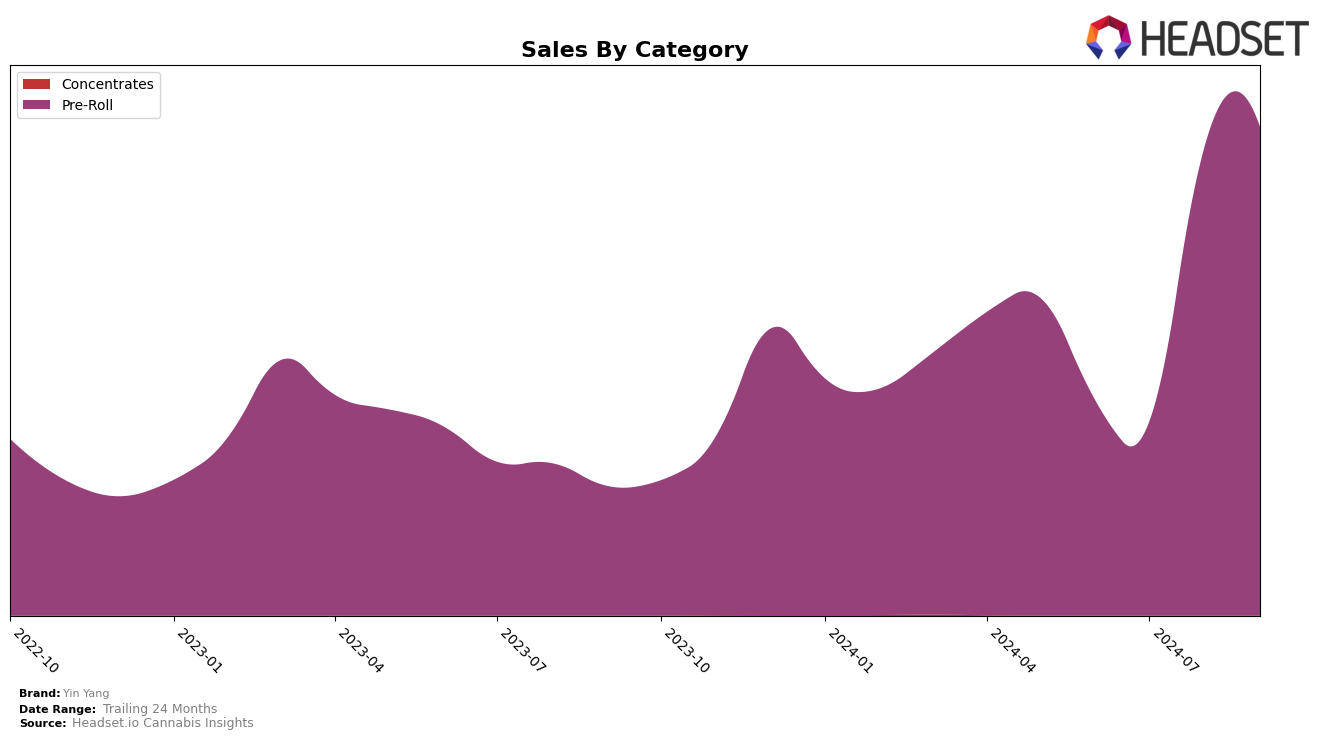

Yin Yang has shown a remarkable performance trajectory in the Pre-Roll category within Oregon. Starting from June 2024, the brand was positioned at the 30th rank, indicating a relatively modest presence in the market. However, by August, Yin Yang made a significant leap to the 11th position, which it maintained through September. This upward movement suggests a strong consumer response and possibly effective market strategies that have propelled the brand forward. The increase in sales from July to August, where they more than doubled, is indicative of this growth trend and highlights the brand's potential to sustain or even improve its market position further.

Despite the impressive gains in Oregon, it's worth noting that Yin Yang did not make it into the top 30 brands in any other states or provinces during this period. This absence could be seen as a potential area for growth, suggesting that while the brand has a strong foothold in Oregon, there's an opportunity to expand and replicate its success in other markets. The focus on Pre-Rolls might indicate a specialization strategy, which could be leveraged in new regions to capture market share. Understanding the factors behind their success in Oregon could provide insights into how Yin Yang might approach expansion into other states or categories.

Competitive Landscape

In the competitive landscape of the Oregon Pre-Roll category, Yin Yang has demonstrated a remarkable upward trajectory in recent months. Starting from outside the top 20 in June and July 2024, Yin Yang surged to an impressive 11th rank by August and maintained this position in September. This rise is particularly notable when compared to competitors such as TKO / TKO Reserve, which experienced a decline from 6th to 12th place over the same period, and Kaprikorn, which showed improvement but remained behind Yin Yang at 13th in September. Meanwhile, Kites maintained a steady 10th rank, indicating consistent performance. Yin Yang's sales growth aligns with its ranking improvement, suggesting effective market penetration and consumer acceptance. This momentum positions Yin Yang favorably against its competitors, indicating potential for continued growth in the Oregon Pre-Roll market.

Notable Products

In September 2024, the top-performing product for Yin Yang was the Don't Worry x Be Happy Pre-Roll 56-Pack (28g) in the Pre-Roll category, which secured the number one rank with sales of 1,332 units. The Puff Puff Pass x Sticky Icky Pre-Roll 56-Pack (28g) followed closely in second place, while the Foxy Brown x Big Yang Theory Pre-Roll 2-Pack (1g) dropped from its previous top position in August to rank third. Skipper x Gilligan Pre-Roll 56-Pack (28g) and Boats & Hoes x Catalina Wine Mixer Pre-Roll 56-Pack (28g) occupied the fourth and fifth positions, respectively. Notably, the Foxy Brown x Big Yang Theory Pre-Roll experienced a significant decrease in rank from first in August to third in September, reflecting a shift in consumer preference within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.