Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

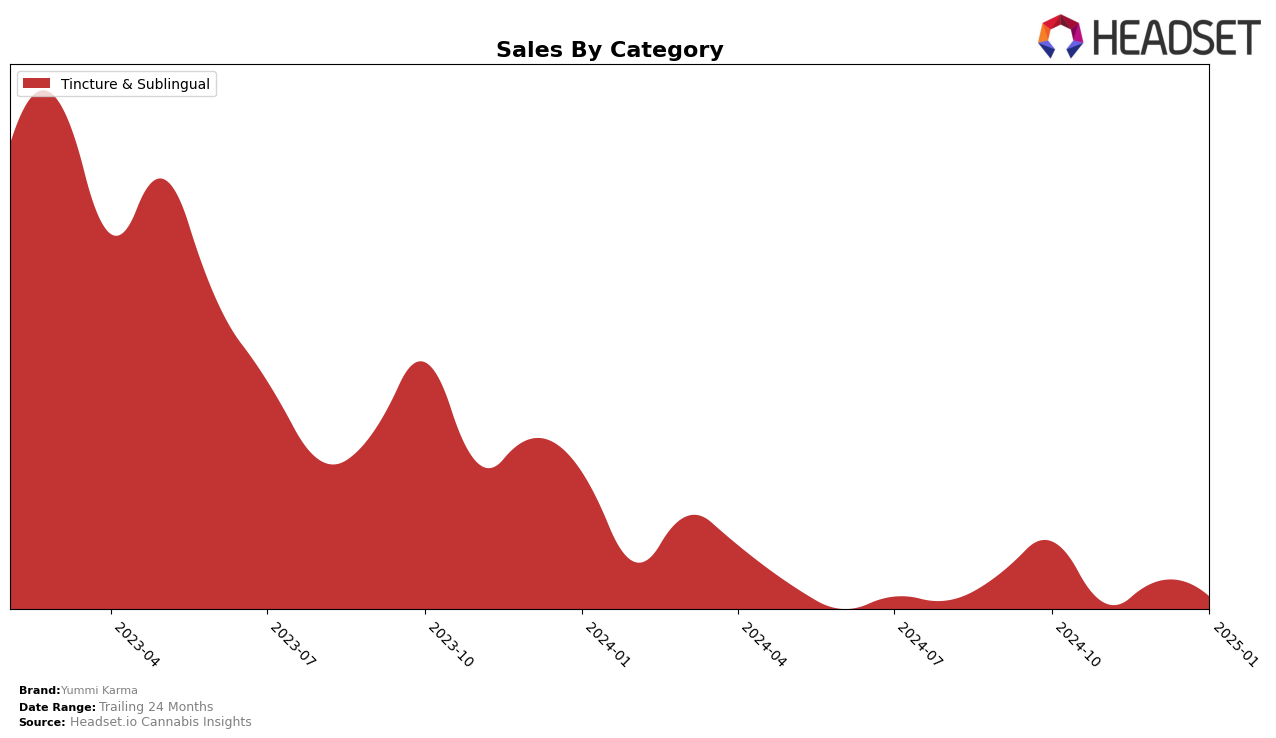

Yummi Karma has shown a consistent performance in the Tincture & Sublingual category in California, maintaining a strong presence with a rank of 2.0 from October to December 2024, before slightly dropping to 3.0 in January 2025. This slight decline in ranking could suggest increased competition or a seasonal shift in consumer preferences. Despite this, the brand's sales figures have remained relatively stable, with a notable peak in October 2024. The consistency in ranking within the top three highlights Yummi Karma's strong market position and consumer loyalty in California's tincture and sublingual market.

Interestingly, Yummi Karma does not appear in the top 30 brands in any other states or provinces for the Tincture & Sublingual category, indicating a concentrated market presence primarily in California. This could be seen as a limitation in their market reach or a strategic focus on a single, robust market. The absence of rankings in other regions suggests potential growth opportunities if the brand decides to expand its distribution or marketing efforts beyond California. This focused performance in California could serve as a strong foundation for future growth, should Yummi Karma choose to explore other markets.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Yummi Karma has shown a consistent presence, maintaining a strong position in the market. From October 2024 to January 2025, Yummi Karma held the second rank for three consecutive months before dropping to third in January 2025. This slight decline in rank coincides with a modest fluctuation in sales, which decreased from $418,536 in October 2024 to $385,328 in January 2025. Despite this, Yummi Karma remains a formidable competitor, outperforming brands like Mary's Medicinals and VET CBD, which consistently ranked fourth and fifth, respectively. However, Care By Design emerged as a notable competitor, climbing from third to second place in January 2025, surpassing Yummi Karma. Meanwhile, Papa & Barkley maintained its dominance in the top position throughout the period. These dynamics suggest a competitive market where Yummi Karma must strategize to regain its higher rank and potentially increase its sales to maintain its competitive edge.

Notable Products

In January 2025, the top-performing product from Yummi Karma was the Lights Out Marshmallow Natural Sleep Tincture, maintaining its first-place rank since October 2024, with sales of 2929 units. Following closely, the Drift Away Bedtime Tincture held steady in the second position, although its sales dipped slightly compared to December 2024. The Wicked Apple Broad Spectrum Tincture consistently ranked third over the past months, with a slight decrease in sales to 922 units. The CBD/THC 1:1 Watermelon Tincture improved its ranking from fifth in November to fourth in December, maintaining this position in January with increasing sales. Meanwhile, the Birthday Cake Tincture, which was unranked in October and November, rose to fourth in December and settled at fifth in January, showing a positive trend in sales growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.