Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

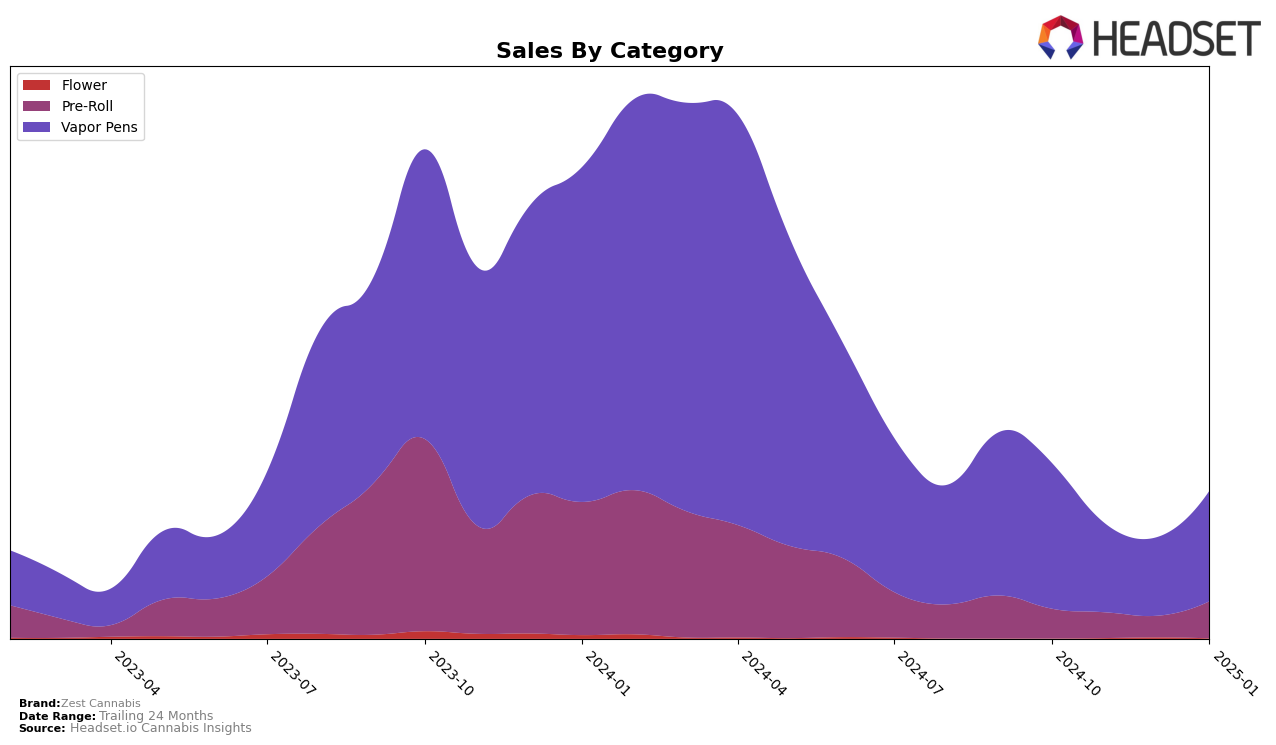

In recent months, Zest Cannabis has shown varying performance across different states and product categories, with some notable trends and shifts. In Alberta, the brand's presence in the Vapor Pens category has seen a significant upward trajectory. Although they were not ranked within the top 30 in November 2024, they managed to climb to the 70th position by January 2025, indicating a positive recovery and increased market penetration. This improvement is underscored by their sales, which more than doubled from November to January. Meanwhile, in Ontario, Zest Cannabis experienced a more fluctuating performance in the Vapor Pens category, with rankings oscillating between 47th and 70th position over the four months. Despite these fluctuations, the brand's sales in Ontario demonstrated resilience with a rebound in January 2025, suggesting potential for growth.

In Saskatchewan, Zest Cannabis has maintained a consistent presence in the Vapor Pens category, albeit with a slight dip in December 2024 where they barely held onto the 30th position. However, they managed to regain their standing by January 2025, ranking 25th. This indicates a stable foothold in the Saskatchewan market, although the brand's Pre-Roll category performance was less consistent, with no ranking in December 2024. The absence from the top 30 in that month highlights a potential area for improvement or increased competition in the Pre-Roll segment. Nonetheless, the brand's ability to bounce back to 36th position by January 2025 suggests a strategic focus on regaining market share in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Zest Cannabis has experienced notable fluctuations in its ranking and sales performance over the past few months. Starting from a rank of 47 in October 2024, Zest Cannabis saw a decline to 70 by December, before rebounding to 54 in January 2025. This volatility is contrasted by brands like Glacial Gold, which maintained a relatively stable position, albeit outside the top 50, and ChillBilly, which made a significant leap from rank 60 to 31 in December. Despite the challenges, Zest Cannabis's sales in January 2025 showed a promising recovery, surpassing its competitors such as Roilty Concentrates and Stunnerz, indicating potential for further growth if this upward trend continues. The competitive dynamics highlight the importance of strategic positioning and market responsiveness for Zest Cannabis to maintain and improve its standing in the Ontario vapor pen market.

Notable Products

In January 2025, Cherry Blast Shatter Liquid Diamond Cartridge (1g) maintained its position as the top-performing product for Zest Cannabis, leading the Vapor Pens category with a sales figure of 1681 units. Pink Lemon Liquid Diamond Cartridge (1g) also held steady in the second rank, showing consistent performance across the months. Banana RNTZ Liquid Diamond Cartridge (1g) improved its rank to third after a brief absence in December, indicating a resurgence in popularity. Kush Berry Infused Pre-Roll 5-Pack (2.5g) rose to fourth place from fifth, suggesting increased consumer interest in pre-rolls. Notably, Melon Haze Live Resin Diamond Infused Pre-Roll 5-Pack (2.5g) entered the rankings at fifth, highlighting a new trend in infused pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.