Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

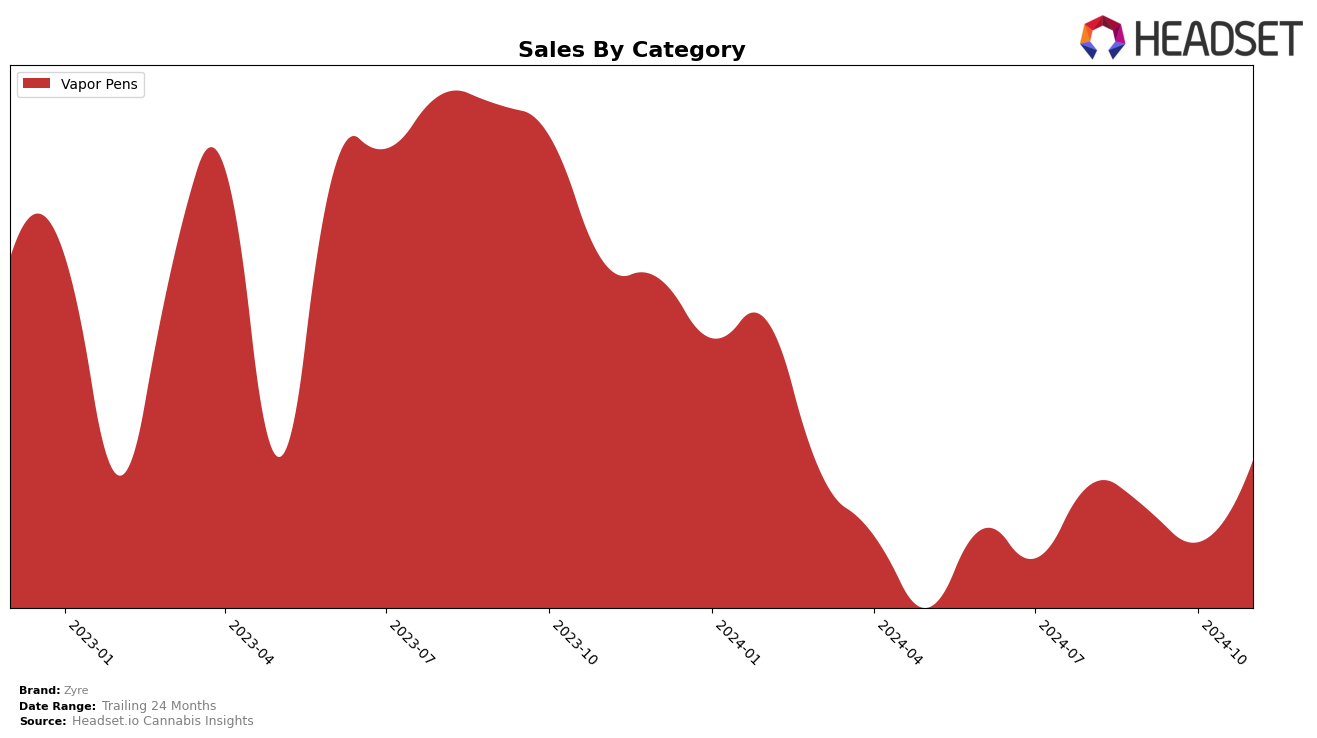

In the province of British Columbia, Zyre has shown a fluctuating performance in the Vapor Pens category over the past few months. Starting in August 2024, Zyre was ranked 24th, but the brand experienced a slight decline in September, dropping to 26th, and further to 31st in October. This dip in rankings could be a concern as it suggests a decrease in market presence. However, in November, Zyre managed to bounce back to the 28th position, indicating a potential recovery. The sales figures reflect this trend, with a notable increase from October to November, suggesting that Zyre may be regaining traction in the market.

It is important to note that Zyre's absence from the top 30 brands in October could highlight a competitive challenge or a shift in consumer preferences within the Vapor Pens category in British Columbia. The brand's ability to re-enter the top 30 by November is a promising sign, but maintaining and improving this position will be crucial for sustained success. Observing how Zyre navigates these market dynamics in the coming months will be key for stakeholders interested in the brand's long-term performance.

Competitive Landscape

In the competitive landscape of Vapor Pens in British Columbia, Zyre has experienced notable fluctuations in rank and sales over the past few months. Starting from a rank of 24 in August 2024, Zyre's position slipped to 31 by October before recovering slightly to 28 in November. This decline in rank coincided with a drop in sales from August to October, although there was a recovery in November. In contrast, Flyte maintained a steady decline in rank from 23 to 27, yet saw a significant increase in sales in November. Similarly, Slerp improved its rank from 32 to 26 in November, alongside a substantial boost in sales. Meanwhile, Contraband and Uncle Bob were not in the top 20 for the initial months but made a notable entry by November, with Contraband achieving a rank of 29. These dynamics suggest that while Zyre faces stiff competition, particularly from brands like Slerp and Flyte, there is potential for recovery and growth if strategic adjustments are made to capitalize on market trends.

Notable Products

In November 2024, Zyre's top-performing product was Recline 1.0 - Blueberry Pie Cured Resin Cartridge (1g) in the Vapor Pens category, maintaining its position as the number one product for the second consecutive month with impressive sales of 960 units. Launch 1.0 - Pineapple Punch Cured Resin Cartridge (1g) climbed back to the second position after a dip in October, indicating a resurgence in popularity. Spotlight 1.0 - Wild Strawberry Cured Resin Cartridge (1g) secured the third spot, showing consistent performance despite fluctuating rankings in previous months. Recline 1.0 - Blueberry Cured Resin Cartridge (1g) improved its standing, moving up to fourth place, marking a steady upward trend since August. Lastly, Spotlight - Wild Strawberry Cured Resin Cartridge (1g) rounded out the top five, though its rank has been on a decline since August, suggesting a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.