Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

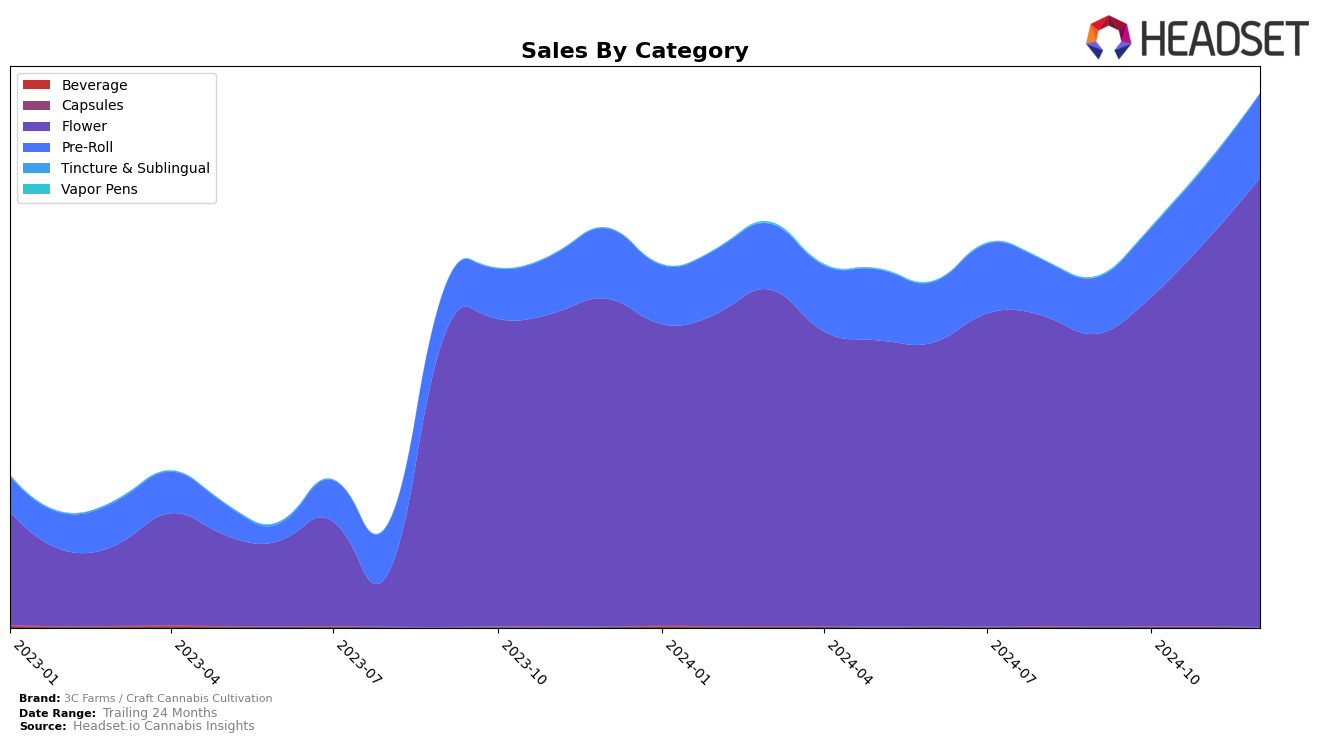

In the competitive landscape of cannabis brands, 3C Farms / Craft Cannabis Cultivation has shown notable performance in the California market, particularly in the Flower category. Over the last four months of 2024, the brand has made a significant leap from not being in the top 30 in September to securing the 24th position by December. This upward trajectory suggests a strong growth momentum, reflecting an increasing consumer preference for their Flower products. The steady climb in ranking, coupled with a substantial increase in sales from September to December, indicates a robust market presence and possibly an effective strategy in expanding their consumer base within California.

In contrast, while the Pre-Roll category also shows improvement in rankings, 3C Farms / Craft Cannabis Cultivation did not manage to break into the top 30, remaining outside this threshold throughout the observed period. Despite this, there was a positive trend in sales figures, which grew consistently from September to December. This suggests that while the brand may not be a leading player in the Pre-Roll category, it is still gaining traction and possibly building a niche market. The absence from the top 30 could be seen as a challenge, yet the consistent sales growth hints at potential for future improvement in market standing within the California Pre-Roll segment.

Competitive Landscape

In the competitive landscape of the California flower category, 3C Farms / Craft Cannabis Cultivation has shown a notable upward trajectory in rankings from September to December 2024, moving from 39th to 24th place. This improvement in rank is indicative of a consistent increase in sales, which rose from $685,130 in September to $1,051,355 in December. In contrast, Cream Of The Crop (COTC) experienced fluctuations, dropping to 41st in October before recovering to 25th by December, suggesting volatility in their sales performance. Meanwhile, Maven Genetics maintained a relatively stable position, ending at 26th in December, closely trailing 3C Farms. Dime Bag (CA) saw a decline from 14th to 23rd, indicating a potential decrease in market share, while Traditional Co. showed slight improvement, moving from 24th to 22nd. The data suggests that 3C Farms is gaining momentum in the market, potentially capturing customers from competitors with less stable trajectories.

Notable Products

In December 2024, 3C Farms / Craft Cannabis Cultivation's top-performing product was Tahoe OG (3.5g) in the Flower category, maintaining its leading position from previous months with a notable sales figure of 7246. Anunnaki OG (3.5g) also retained its second place, showing consistent performance across the months. Jack Kraken (3.5g) secured the third position, maintaining its November rank, indicating steady demand. Sasquatch Sap (3.5g) ranked fourth, improving from its fifth position in October, reflecting a positive trend. Tahoe OG Pre-Roll (1g) remained in fifth place, demonstrating stable sales performance throughout the latter part of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.