Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

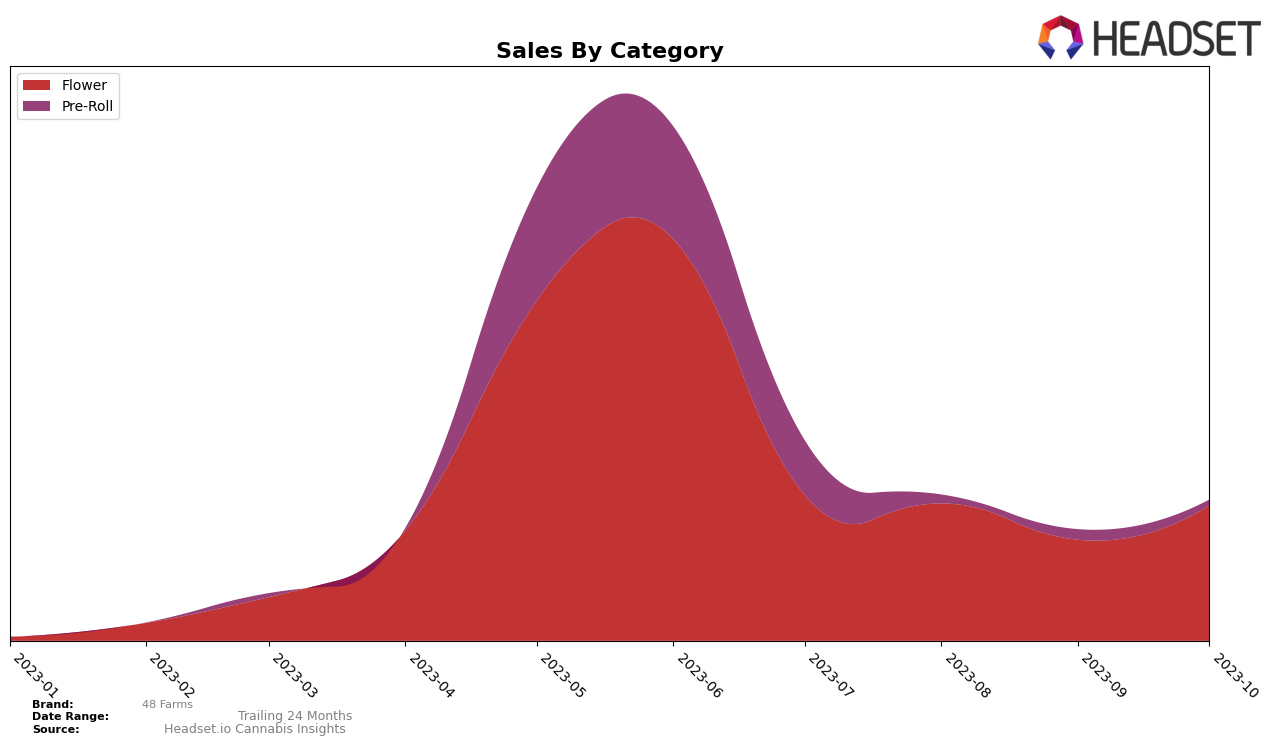

In the Flower category, 48 Farms has shown a remarkable performance in Arizona. They started off at rank 23 in July 2023, but by October 2023, they had improved to rank 20. This upward movement in ranks, despite a dip in sales in September 2023, indicates a positive trend for the brand. Interestingly, while the sales figures fluctuated, the overall trend shows a promising potential for growth in the Flower category in this state.

However, when we look at the Pre-Roll category in Arizona, 48 Farms seems to be facing a challenging time. The brand started at rank 17 in July 2023 but slipped to rank 40 in August 2023. This downward trend continued through September and October 2023. This suggests that despite the brand's efforts, it has been unable to make a significant impact in the top 20 brands in the Pre-Roll category in Arizona during these months. This could be due to a variety of factors, including increased competition or changing consumer preferences. It will be interesting to see how 48 Farms addresses this in the future.

Competitive Landscape

In the Flower category within the Arizona market, 48 Farms has experienced a fluctuating competitive landscape. While 48 Farms maintained a consistent presence in the top 25 brands from July to October 2023, it saw a slight dip in rank from 23rd to 25th between July and September, before climbing back up to 20th in October. In comparison, Fig Farms and Daze Off showed a similar pattern, but remained consistently lower in rank. Conversely, HiBuddy and Item Nine Labs demonstrated a stronger upward trend, with HiBuddy notably jumping from 46th to 19th place. In terms of sales, 48 Farms experienced a slight decrease from July to September, but saw an increase in October, indicating a potential recovery. However, it's worth noting that both HiBuddy and Item Nine Labs exhibited a more significant growth in sales during this period.

Notable Products

In October 2023, the top-performing product from 48 Farms was 'Big Bagg (3.5g)' from the Flower category, maintaining its top position from the previous month with a remarkable sales figure of 9698 units. The second highest performing product was 'Banana Pancakes (3.5g)', also from the Flower category, which moved up two places from its September rank. 'Rainbow Dosido (3.5g)', another Flower category product, secured the third position, same as in September. 'The Soap (3.5g)', a Pre-Roll category product, climbed one position to become the fourth best-selling product. Lastly, 'Papa Don (3.5g)' made its debut in the top five, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.