Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

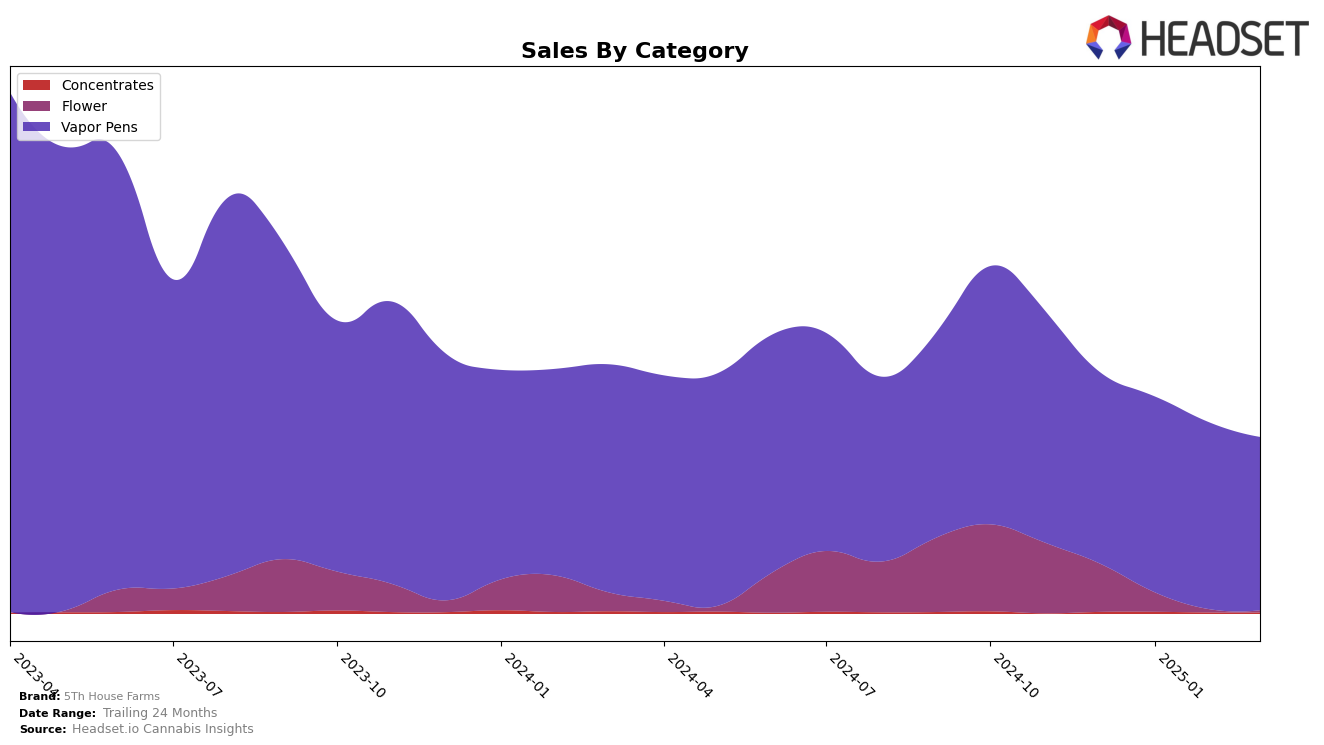

In the state of Washington, 5Th House Farms has shown a consistent presence in the Vapor Pens category, maintaining a position within the top 30 brands. Starting from December 2024, they held the 28th spot, slightly improving to the 27th in January and February 2025, before slipping back to 29th in March 2025. This fluctuation indicates a relatively stable yet competitive positioning within the market. However, the slight drop in March could signal increasing competition or a need for strategic adjustments to regain or improve their standing.

Despite these rank changes, 5Th House Farms has experienced a decline in sales from January to March 2025, with March figures showing a notable decrease compared to previous months. This downward trend in sales, despite maintaining a rank within the top 30, suggests external market pressures or internal challenges that might be affecting their performance. The absence of a ranking in other states or categories could imply a limited market reach or focus, highlighting potential areas for growth or diversification. Understanding these dynamics could offer insights into the brand's strategic direction and potential opportunities for expansion.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, 5Th House Farms has maintained a relatively stable position, with its rank fluctuating slightly from 28th in December 2024 to 29th by March 2025. This stability is noteworthy amidst the dynamic shifts observed among competitors. For instance, SKÖRD demonstrated a significant improvement, climbing from 45th to 30th place, which suggests a strong upward trend in their sales performance. Meanwhile, Treehaus Cannabis experienced a notable recovery, moving from 39th to 27th, indicating a resurgence in market presence. Conversely, Hellavated remained consistent, hovering around the 30th position, while Canna Organix improved its rank from 39th to 28th, closely trailing 5Th House Farms. These shifts highlight the competitive pressure 5Th House Farms faces, emphasizing the need for strategic initiatives to enhance its market position and sales growth in the evolving vapor pen market.

Notable Products

In March 2025, the top-performing product for 5Th House Farms was the Granddaddy Purple Distillate Disposable (1g) in the Vapor Pens category, achieving the number one rank with sales of 1097 units. The Berry White Distillate Cartridge (1g) climbed to the second position, showing a notable improvement from its fifth rank in February. The Wedding Cake Live Resin Cartridge (1g) maintained a consistent second-place position for two consecutive months, February and March. Meanwhile, the Jack Herer Distillate Cartridge (1g) secured the third spot in March, rising from its previous third rank in January. Lastly, the Gorilla Glue #4 Distillate Cartridge (1g) debuted in the rankings at fourth place in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.