Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

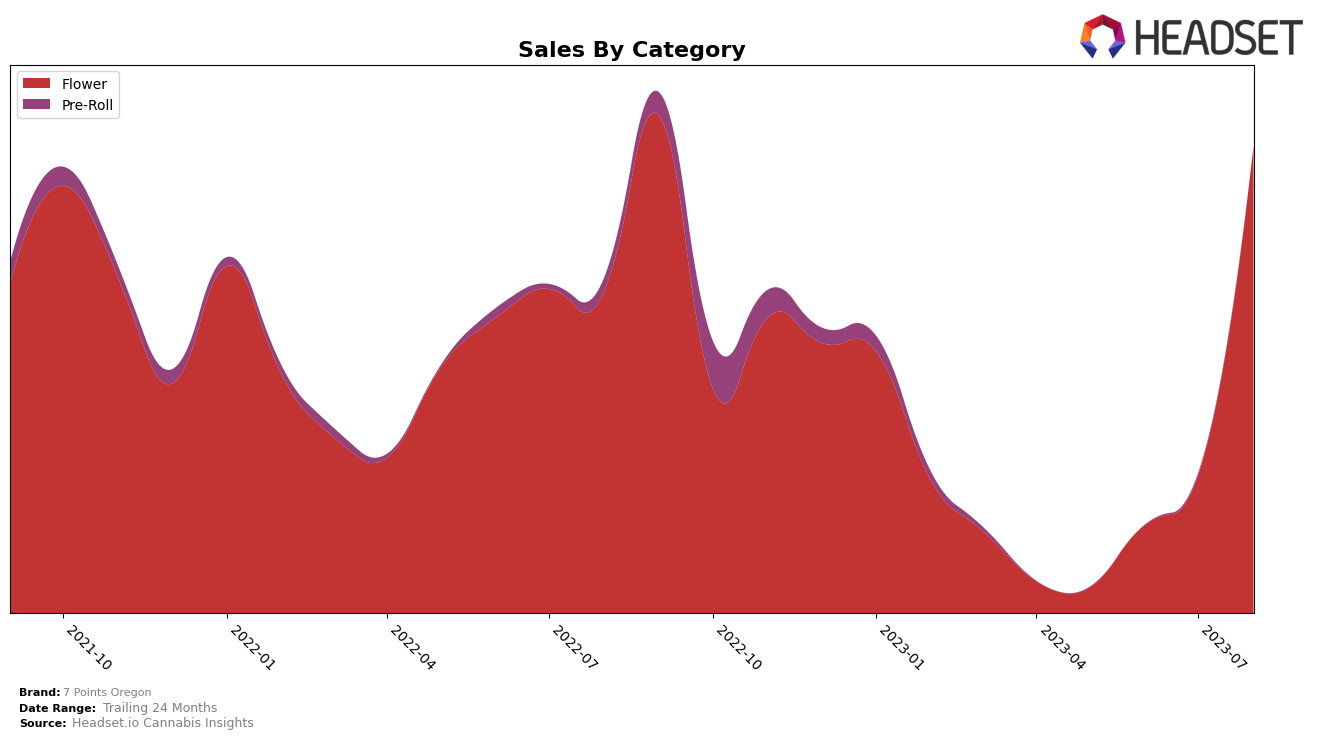

7 Points Oregon, a well-known cannabis brand, has shown a significant performance swing in the 'Flower' category in the state of Oregon. The brand made a remarkable jump in its rankings from July to August 2023, moving from the 97th position up to the 19th. This impressive leap forward indicates a strong positive trend for the brand in the state's flower category. However, it's worth noting that the brand was not among the top 20 in June 2023, which suggests there may have been some volatility in its performance.

Furthermore, the sales data for 7 Points Oregon also reflects this upward trend. In August 2023, the brand recorded sales of approximately $290,659, a significant increase from its July sales of $86,167. Unfortunately, the sales data for June and May 2023 is not available, but the sharp increase between July and August suggests a substantial growth in the brand's market share. This development indicates a promising future for 7 Points Oregon in the Oregon cannabis market, particularly in the flower category.

Competitive Landscape

In the Flower category in Oregon, 7 Points Oregon has seen a significant increase in rank, moving from outside the top 20 in May and June 2023 to 19th in August 2023. This suggests a positive trend in sales, although the exact figures are not disclosed. In comparison, Alter Farms has also improved its rank, but at a slower pace, moving from 78th to 18th over the same period. Oregon Roots, on the other hand, has seen a drop in rank from 9th to 17th, indicating a potential decrease in sales. Lucky Lion has maintained a relatively stable position around the 20th rank, while Nugz has fallen out of the top 20 in August after being ranked 32nd in July. These shifts in rank among competitors could present opportunities for 7 Points Oregon to further improve its position in the market.

Notable Products

In August 2023, the top-performing products from 7 Points Oregon were predominantly from the Flower category. The highest sales were recorded for Ghost OG x Purple Vapor Shake (Bulk) with a sales figure of 1759 units. This was followed by Voyager #1 (Bulk) and Super Miami (Bulk), occupying the second and third ranks respectively. The fourth and fifth positions were held by Apples and Bananas Little (Bulk) and Candy Crush (Bulk). Notably, Candy Crush (Bulk) improved its performance from the previous month, moving from the fourth to the fifth rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.