Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

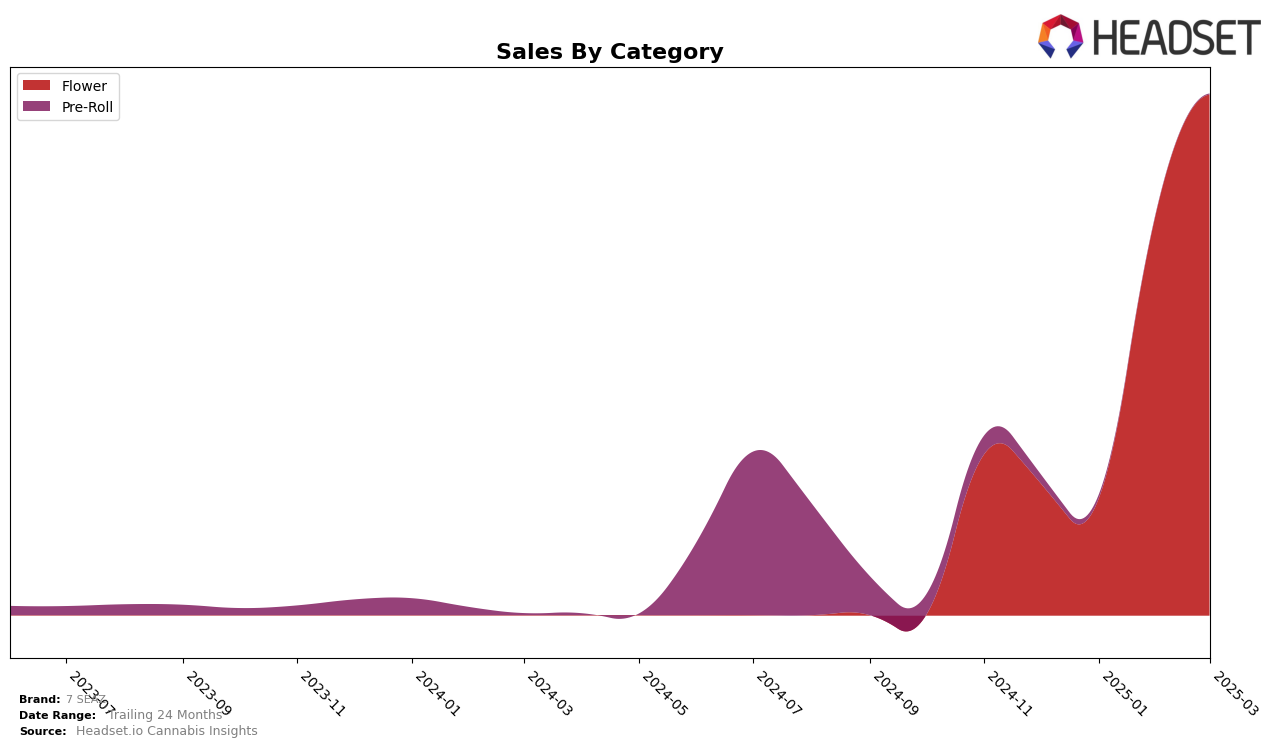

7 SEAZ has shown a noteworthy performance in the New York market, particularly in the Flower category. Starting from a position outside the top 30 in December 2024, the brand made a significant leap to rank 23rd by February 2025, and further improved to 19th place in March 2025. This upward trajectory suggests a strong market presence and growing consumer preference. The remarkable increase in sales from $123,593 in January to $550,874 in March underscores this positive trend, indicating a robust demand for their offerings in the state.

Despite the promising developments in New York, the absence of 7 SEAZ from the top 30 rankings in December and January highlights areas for potential growth and market penetration. This absence suggests that while the brand has made impressive strides recently, it still has room to improve its competitive standing. Observing these movements provides valuable insights into how 7 SEAZ is positioning itself within the market and the Flower category, hinting at strategic shifts that could be further explored by those interested in the brand's trajectory.

Competitive Landscape

In the competitive landscape of the New York flower category, 7 SEAZ has demonstrated a remarkable upward trajectory in recent months. Starting from a position outside the top 20 in December 2024, 7 SEAZ climbed to rank 19 by March 2025. This ascent is particularly impressive when compared to competitors such as Grassroots, which experienced a decline from rank 14 to 21 over the same period, and Platinum Reserve, which fell from rank 10 to 18. Meanwhile, Hepworth showed fluctuating ranks but maintained a stronger position overall. The sales growth for 7 SEAZ, especially from February to March 2025, indicates a positive consumer response, positioning the brand as a rising contender in the market. This trend suggests that 7 SEAZ is effectively capturing market share from established brands, making it a brand to watch in the New York flower category.

Notable Products

In March 2025, 7 SEAZ's top-performing product was Headband x Great White Shark (14g) in the Flower category, which climbed to the number one spot with sales reaching 1,221 units. Super Lemon Haze x Cheese Quake (14g) followed closely in second place, having made a strong entry into the rankings this month. Hawaiian Snow x Island Skunk (14g) secured the third position, showcasing consistent popularity. Colombian Gold x Black Magic (14g) was ranked fourth, maintaining a steady presence. Notably, Khalifa Kush x Cherry Pie (14g) experienced a drop to the fifth position from its previous second-place ranking in February.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.