Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

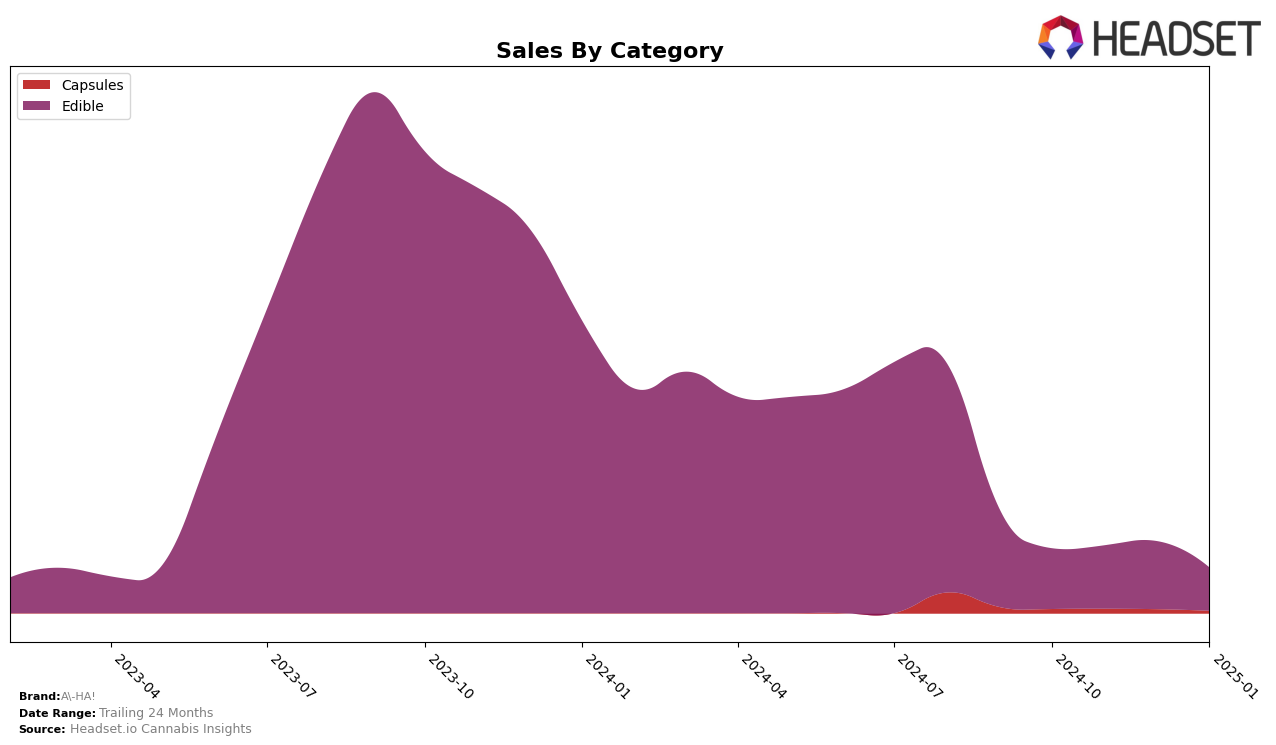

In the Canadian cannabis market, A-HA! has shown a consistent presence in the Edible category across two key provinces: Alberta and Ontario. In Alberta, A-HA! re-entered the top 30 rankings in November 2024 and maintained its position through January 2025, signaling a stable demand for its products. This stability is somewhat contrasted by the sales figures, which saw a slight dip from November to January, indicating potential market saturation or increased competition. In Ontario, A-HA! started strong in October 2024, holding the 23rd position, but gradually slipped down to 26th by January 2025. Despite this decline in ranking, the sales figures in Ontario display a more pronounced drop, suggesting that the brand might need to reassess its marketing or product strategies to regain its footing.

The fluctuations in rankings and sales in both provinces highlight the competitive nature of the Edible market segment. Alberta's consistent ranking suggests a loyal customer base or effective brand positioning, though the sales decline could be a point of concern for sustained growth. On the other hand, Ontario's trend of declining sales and rankings might reflect challenges in maintaining consumer interest or facing stiff competition from other brands. A-HA!'s absence from the top 30 in October 2024 in Alberta and its eventual entry in November could be seen as a positive development, indicating a successful push into the competitive space. However, the downward trajectory in Ontario suggests that A-HA! may need to innovate or adapt to local consumer preferences to improve its market performance.

Competitive Landscape

In the Ontario edible category, A-HA! experienced a notable shift in its competitive positioning from October 2024 to January 2025. Initially ranked 23rd in October, A-HA! saw a decline in rank to 26th by January 2025. This downward trend in rank is mirrored by a significant decrease in sales, particularly from December 2024 to January 2025. In contrast, Indiva maintained a stable position at 25th throughout the same period, indicating consistent performance despite a dip in sales in January. Meanwhile, Spot improved its rank from 27th to 24th, showcasing a positive trajectory in sales, especially between November and December 2024. Wildflower Canada, although not a direct threat to A-HA!'s position, showed a slight improvement in rank from 30th to 28th, despite fluctuating sales. These dynamics suggest that A-HA! may need to reassess its market strategies to regain its competitive edge in the Ontario edible market.

Notable Products

In January 2025, the top-performing product from A-HA! was the Milk Chocolate Live Rosin Waffle Cones 2-Pack (10mg), which maintained its number 1 rank consistently from October 2024 with a notable sales figure of 2,235 units. The Hash Rosin Chocolate Cups 2-Pack (10mg) also held steady at the second position throughout the same period, showing stable performance. The Wild Berries Soft Chew 2-Pack (10mg) improved its rank from fourth in December 2024 to third in January 2025, indicating a positive sales trend. The Raspberry Lemonade Hash Rosin Duos Gummies 2-Pack (10mg) moved up to fourth place, showcasing an increase in popularity since its previous fifth position in November 2024. Lastly, the Milk & White Chocolate Hash Rosin Cups 2-Pack (10mg) remained in fifth place, maintaining its position since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.