Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

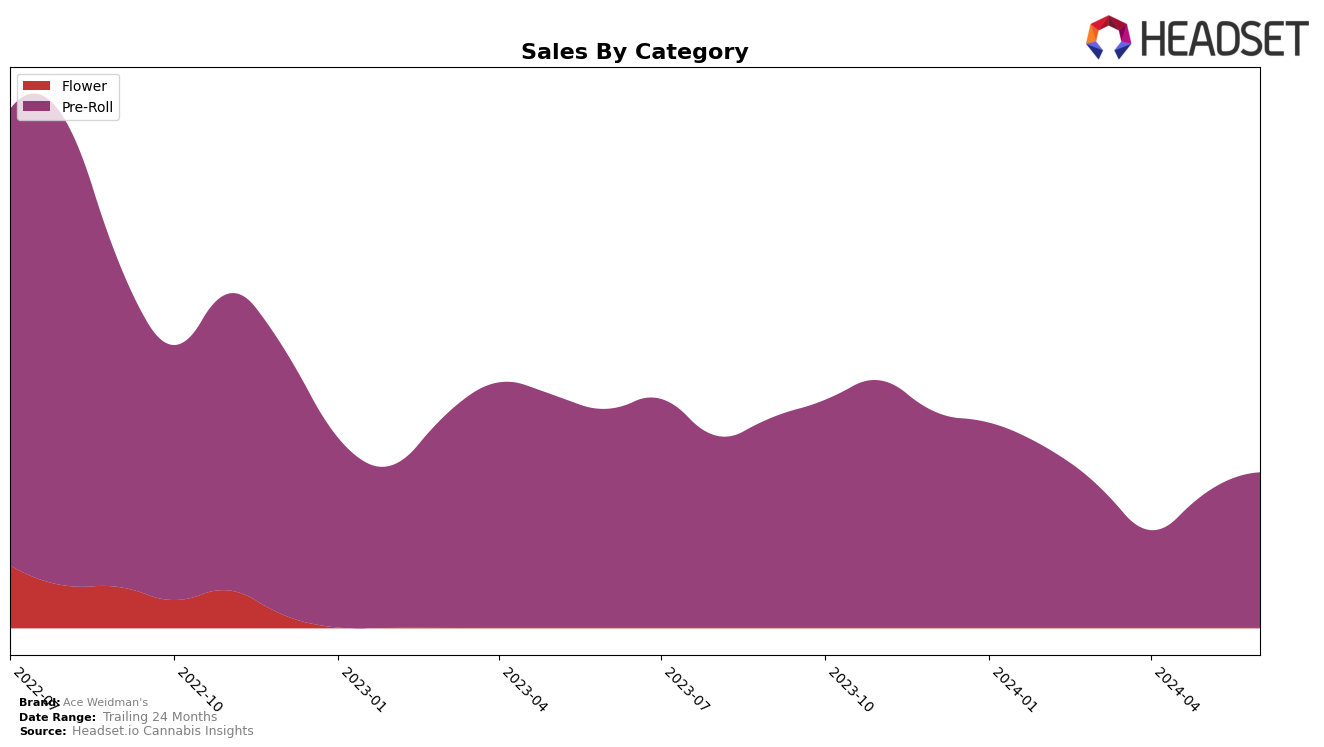

Ace Weidman's has shown varied performance across different categories and states in recent months. In Massachusetts, the brand's ranking in the Pre-Roll category experienced significant fluctuations. In March, Ace Weidman's was ranked 18th, but it dropped out of the top 30 in April. By May, the brand made a comeback to the 27th position and continued to improve, reaching the 24th spot in June. This upward trend suggests that the brand is regaining its foothold in the market after a brief dip. The sales figures also reflect this recovery, with a notable increase from $171,167 in April to $272,900 in June.

Despite the positive movement in Massachusetts, the absence of Ace Weidman's from the top 30 brands in April indicates a challenging period for the brand. This dip could be attributed to increased competition or market dynamics that temporarily affected their performance. However, the brand's ability to bounce back and improve its ranking in subsequent months is a testament to its resilience and potential for growth. Observing these trends can provide valuable insights into the brand's market strategies and consumer preferences.

Competitive Landscape

Ace Weidman's experienced notable fluctuations in rank within the Massachusetts pre-roll category over the past few months, reflecting a dynamic competitive landscape. In March 2024, Ace Weidman's held the 18th position but saw a significant drop to 33rd in April, before recovering to 27th in May and 24th in June. This volatility indicates a competitive pressure from brands like Cloud Cover (C3) and Root & Bloom, which have shown more consistent upward trends. For instance, Cloud Cover (C3) improved its rank from 29th in March to 22nd in June, while Root & Bloom climbed from 26th to 23rd in the same period. Additionally, At Ease made a remarkable leap from 62nd in March to 26th in June, suggesting increasing consumer interest. These shifts highlight the importance for Ace Weidman's to innovate and adapt its marketing strategies to maintain and improve its market position amidst fierce competition.

Notable Products

In June 2024, the top-performing product for Ace Weidman's was the 3 of A Kind - Biscotti Bliss Pre-Roll 3-Pack (1.5g), which secured the number one rank with sales of 2604 units. The Biscotti Bliss Pre-Roll (0.5g) maintained its second-place position from April 2024, showing strong and consistent performance. The Gelatti Cookies Pre-Roll (0.5g), which held the top rank from March to May 2024, dropped to third place in June. The Jelly Haze Pre-Roll (1g) entered the rankings at fourth place, while the 3 of a Kind - Astronaut Ice Cream Pre-Roll 3-Pack (1.5g) debuted at fifth. Notably, the top three products are all from the Pre-Roll category, indicating a strong preference for this type of product among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.