Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

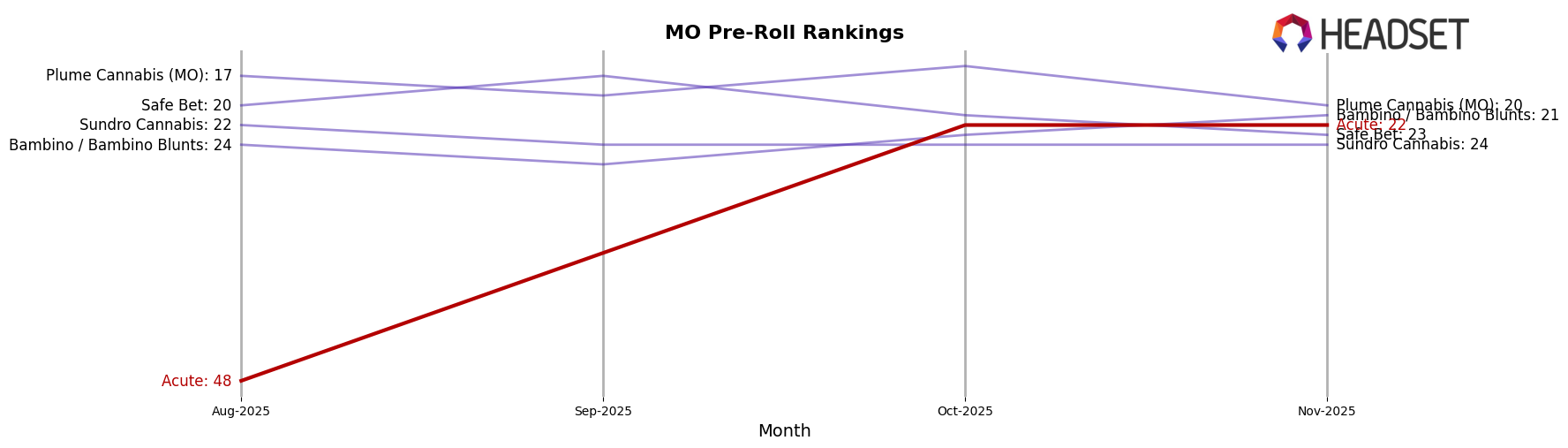

In Missouri, Acute has shown a notable upward trend in the Pre-Roll category. From August to November 2025, the brand's ranking improved from 48th to 22nd. This consistent climb indicates a strengthening position in the market. The sales figures reflect this positive momentum, with November sales reaching just over 205,000, a significant increase from August. However, Acute's performance in the Vapor Pens category tells a different story. The brand's ranking fell from 24th in August to 51st by November, suggesting a decline in market presence. This drop could be a point of concern if the trend continues, as it indicates a potential loss of consumer interest or increased competition in this category.

Acute's fluctuating performance across different categories in Missouri highlights the brand's challenges and successes within a competitive landscape. While the Pre-Roll segment shows promise with a steady rise in rankings, the Vapor Pens category presents a contrasting picture, with the brand slipping out of the top 30 by November. The disparity between these two categories might suggest a strategic pivot or reallocation of resources could be beneficial. Understanding the underlying factors driving these trends could provide valuable insights for stakeholders looking to optimize Acute's market strategy and capitalize on the growing popularity of their Pre-Roll products.

Competitive Landscape

In the Missouri Pre-Roll category, Acute has demonstrated a significant upward trajectory in its market position over recent months. Starting from a rank of 48 in August 2025, Acute has climbed to the 22nd position by October and maintained this rank in November. This rise is indicative of a robust growth strategy and increasing consumer preference. In contrast, Plume Cannabis (MO) experienced fluctuations, peaking at 16th in October but dropping to 20th in November, suggesting potential volatility in its market approach. Meanwhile, Safe Bet and Sundro Cannabis have seen a decline, with Safe Bet falling out of the top 20 by November and Sundro Cannabis maintaining a lower rank throughout. Acute's consistent improvement in rank, coupled with its sales growth, positions it as a rising competitor in the Missouri market, potentially challenging established brands in the near future.

Notable Products

In November 2025, the top-performing product from Acute was the Juice - Strawberry Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, securing the number 1 rank with sales of 1672 units. The Lemon Peel Distillate Disposable (1g) in the Vapor Pens category climbed to the 2nd position, showing a significant improvement from its 5th place in August 2025, despite a slight decrease in sales to 1362 units. The Pineapple Express Infused Pre-Roll 2-Pack (1g) ranked 3rd, maintaining a strong presence in the Pre-Roll category. Lemon Cherry Gelato Infused Pre-Roll 2-Pack (1g) came in at 4th, followed closely by the Pineapple Express Infused Pre-Roll 5-Pack (2.5g) at 5th. These rankings highlight a consistent preference for Pre-Roll products from Acute, with notable shifts in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.