May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

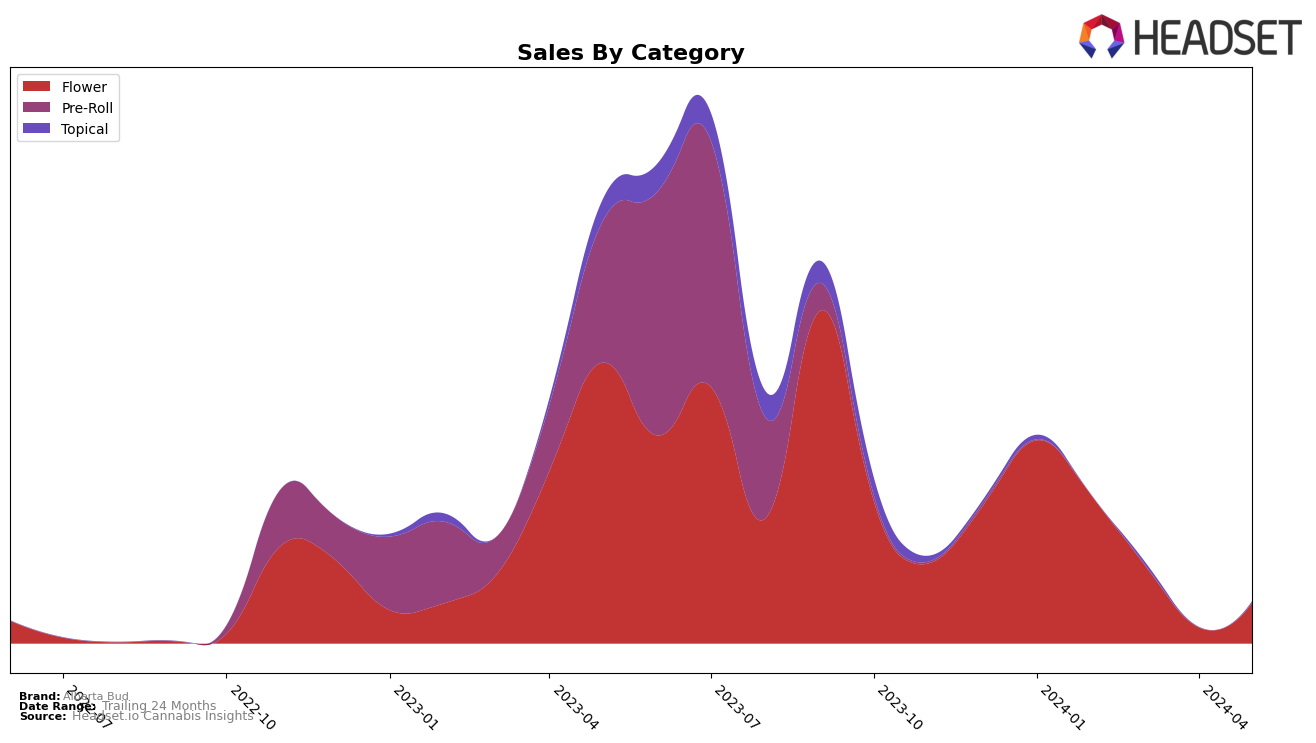

Alberta Bud has shown a mixed performance across various categories and states/provinces in recent months. Notably, in Alberta, the brand made a significant appearance in the Flower category in February 2024, securing the 98th rank with sales amounting to $24,093. However, the brand did not maintain its presence in the top 30 rankings in subsequent months, indicating a potential decline in market share or increased competition. The absence from the top 30 in March, April, and May suggests that Alberta Bud needs to reassess its strategy to regain a competitive edge in the Flower category within Alberta.

In other regions, Alberta Bud's performance has been less noteworthy, as the brand did not appear in the top 30 rankings across any other state or category during the specified period. This lack of presence could be a cause for concern, as it highlights the brand's limited market penetration outside of Alberta. The brand's focus might need to shift towards expanding its footprint and improving its rankings in other states to achieve broader market recognition. Monitoring these trends closely will be essential for stakeholders to understand Alberta Bud's positioning and growth opportunities in the highly competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Alberta Bud has experienced notable fluctuations in rank and sales over recent months. As of February 2024, Alberta Bud was ranked 98th, but it did not appear in the top 20 for subsequent months, indicating a potential decline in market presence. In contrast, Divvy and EXKA (XK) have shown more stable or improving trends. Divvy, for instance, was ranked 52nd in February 2024 and 66th in March 2024, while EXKA (XK) improved from 84th in February to 77th in March 2024. This suggests that Alberta Bud may need to reassess its market strategies to compete more effectively with these brands. Additionally, CountrySide Cannabis was ranked 97th in February 2024 but also did not appear in the top 20 in subsequent months, indicating similar challenges. These insights highlight the competitive pressures Alberta Bud faces and the importance of strategic adjustments to enhance its market position in Alberta's Flower category.

Notable Products

In May-2024, the top-performing product for Alberta Bud was Tangerine Dreamz (7g), which climbed back to the first position with sales of 112 units. Slurface (7g) dropped to the second rank, maintaining consistent sales figures from the previous month. Top Bud (3.5g) made a significant entry into the rankings, securing the third spot. Uppercut Punch (7g) remained steady at the third position for four consecutive months. The CBD:THC 1:1 Cool n Calm Cream (100mg CBD,100mg THC, 50ml) held its ground in the fourth position, showing stable performance in the Topical category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.