Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

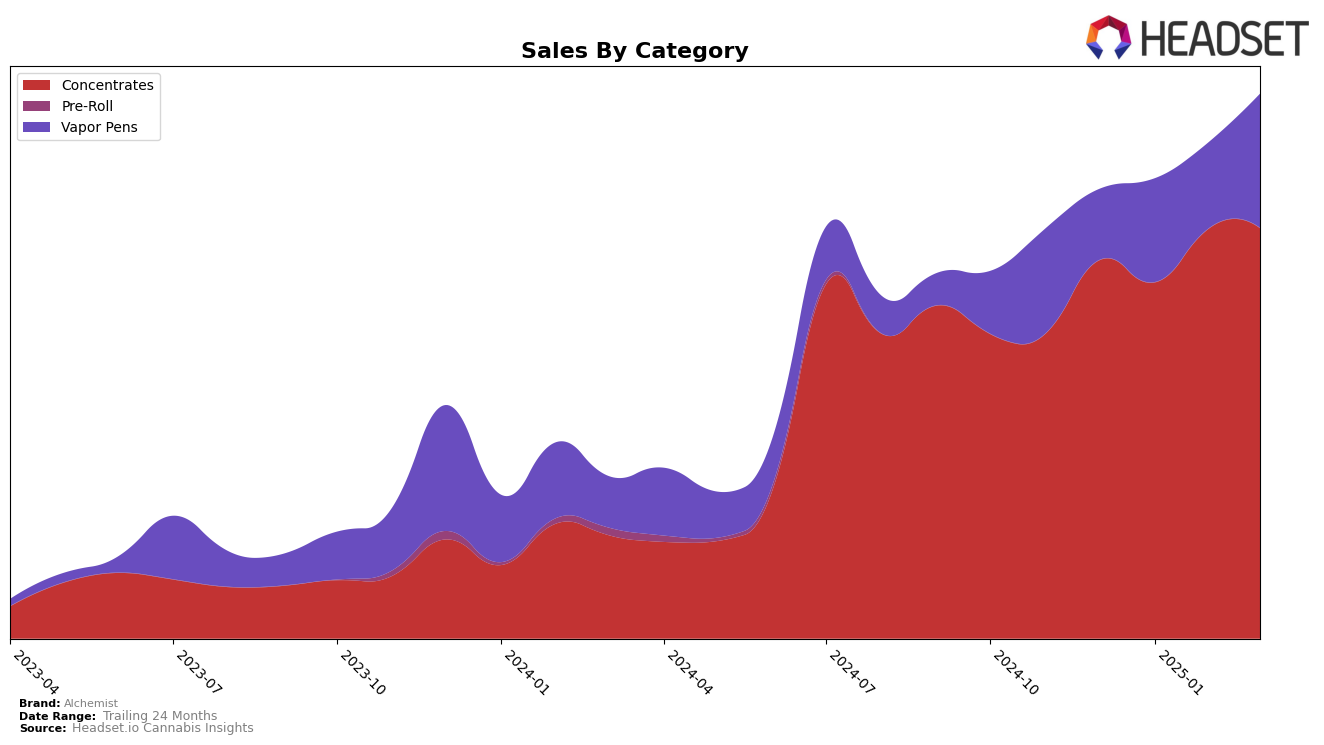

In the state of Maryland, Alchemist has shown consistent performance in the Concentrates category, maintaining a position within the top 11 brands from December 2024 to March 2025. The brand's rank fluctuated slightly, peaking at 9th place in February 2025, which indicates a positive reception and possibly effective product offerings or marketing strategies during that period. However, it's worth noting that Alchemist did not appear in the top 30 brands for the Vapor Pens category until March 2025, when it climbed to 37th place, a significant improvement from its previous ranking of 42nd in both January and February. This upward movement in Vapor Pens could suggest a growing interest in Alchemist's offerings in this category, potentially driven by changes in consumer preferences or successful promotional efforts.

The sales figures for Alchemist in Maryland provide further insight into its market dynamics. In the Concentrates category, the brand experienced a notable increase in sales from January to February 2025, with sales figures rising from $179,898 to $207,541. This surge could reflect seasonal demand or the impact of new product launches. On the other hand, the Vapor Pens category saw a steady increase in sales over the same period, culminating in a significant jump in March 2025. This trend might indicate a growing consumer base or enhanced product availability. Despite not being in the top 30 for Vapor Pens until March, the consistent sales growth suggests potential for Alchemist to further improve its ranking in the coming months.

Competitive Landscape

In the Maryland concentrates market, Alchemist has demonstrated a consistent yet competitive presence, maintaining a rank within the top 20 brands from December 2024 to March 2025. Despite a slight dip from 10th to 11th place in January 2025, Alchemist rebounded to 9th in February, before settling at 10th in March. This stability is notable, especially when compared to MPX - Melting Point Extracts, which improved its rank from 12th to 8th over the same period, indicating a stronger upward trajectory in sales. Meanwhile, Nature's Heritage experienced a downward trend, dropping from 2nd to 7th place, potentially opening opportunities for Alchemist to capture market share. Verano and Doctor Solomon's showed less volatility, with Verano improving slightly from 14th to 11th, and Doctor Solomon's maintaining a stable position around 12th. These dynamics suggest that while Alchemist remains a steady player, there is room for strategic maneuvers to enhance its competitive edge in the evolving Maryland concentrates market.

Notable Products

In March 2025, the top-performing product for Alchemist was Gelato 41 Cured Resin Cartridge (1g) in the Vapor Pens category, which rose to the number one spot with sales of 427 units. Alpha Dog Live Sugar & Sauce (1g) in the Concentrates category slipped to the second position, after leading in February. Rainbow Punch Live Resin Sugar & Sauce (1g) maintained its third-place ranking from the previous month. Motorbreath Live Resin Sugar (1g), which was the top seller in January, settled at fourth place in March. Deadband Cured Sugar (1g) remained consistent in the fifth position for both February and March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.