Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

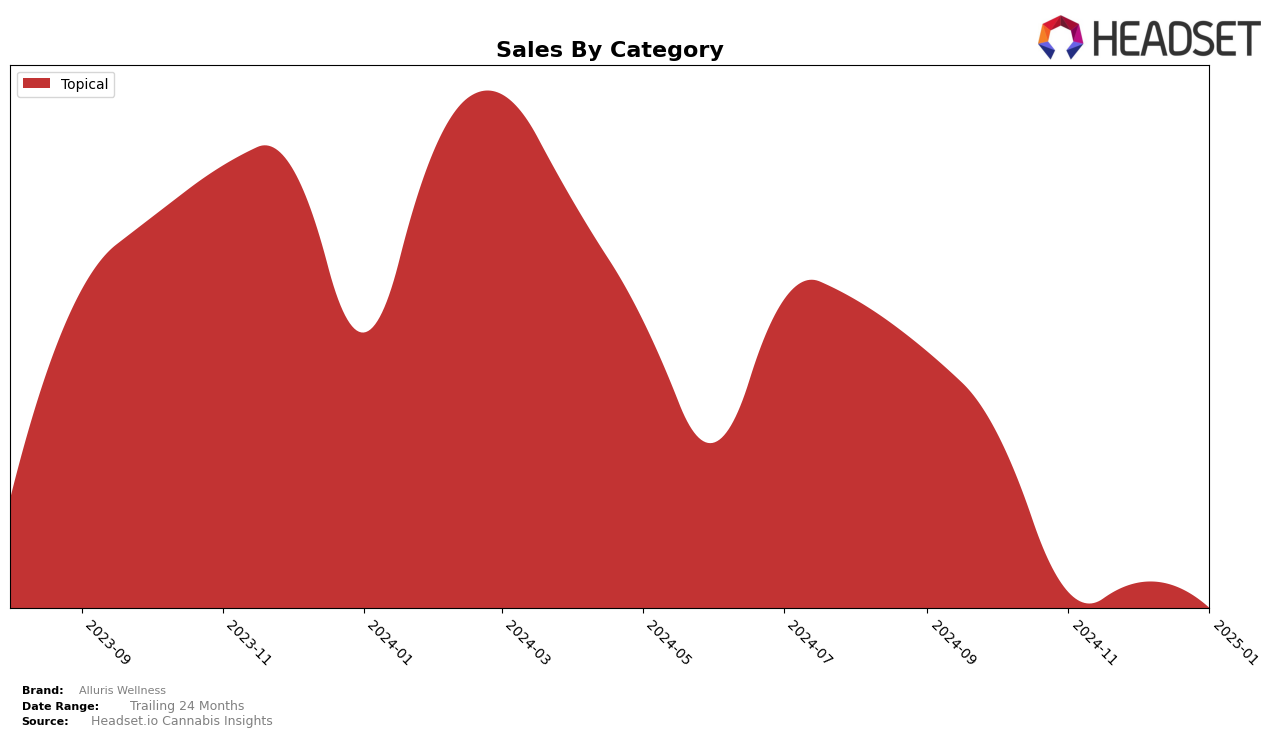

Alluris Wellness has shown a notable presence in the Topical category in Illinois, where it secured the 6th position in October 2024. This ranking indicates a strong foothold in the market, suggesting that their topical products resonate well with consumers in this state. However, their absence from the top 30 rankings in subsequent months raises questions about their continued competitiveness and market dynamics. This decline in visibility could suggest increased competition or shifts in consumer preferences within the topical category in Illinois. Understanding these movements is crucial for stakeholders looking to evaluate the brand's strategic positioning and potential areas for growth.

The lack of Alluris Wellness's presence in the top 30 rankings across other states or categories during this period highlights both opportunities and challenges for the brand. While their initial success in Illinois's topical market is commendable, expanding their reach in other states or diversifying their category presence could be beneficial. The absence of rank data in other markets suggests that Alluris Wellness either did not make a significant impact or was overshadowed by competitors. This could be a strategic area for the brand to explore further, as tapping into new markets or categories might provide avenues for growth and increased brand visibility.

Competitive Landscape

In the Illinois topical cannabis market, Alluris Wellness experienced a notable absence from the top 20 rankings after October 2024, where it initially held the sixth position. This indicates a potential decline in market visibility and sales performance compared to competitors. For instance, Nature's Grace and Wellness consistently maintained a strong presence, ranking second or third from October to December 2024, with sales figures significantly surpassing those of Alluris Wellness. Meanwhile, Pure Essentials also showed fluctuations, disappearing from the rankings in November but reappearing in December, albeit with lower sales than Nature's Grace and Wellness. These dynamics suggest that while Alluris Wellness initially had a foothold, it struggled to sustain its competitive edge, highlighting the need for strategic adjustments to regain market share and enhance brand visibility in the Illinois topical category.

Notable Products

In January 2025, the top-performing product from Alluris Wellness was the CBD/THC/CBG 1:1:1 Alluris Soothe Lotion in the Topical category, maintaining its number one rank since October 2024. Despite a consistent top ranking, its sales have decreased to 69 units from 117 units in December 2024. This product has shown remarkable stability in its leading position over the past months. The consistent ranking suggests a strong consumer preference for this particular formulation and category. The decline in sales figures might indicate seasonal trends or increased competition in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.