Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

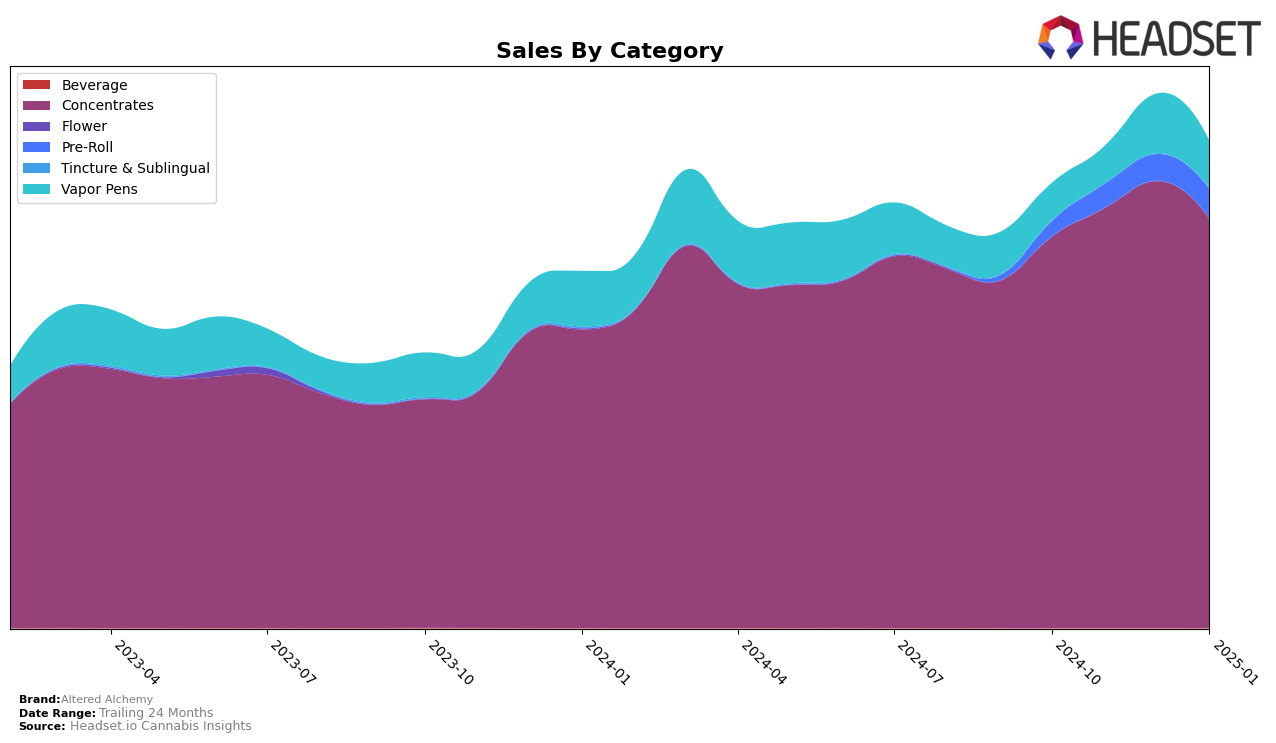

Altered Alchemy has demonstrated a commanding presence in the Oregon market, particularly within the Concentrates category. Over the past four months, they have consistently maintained the number one rank, showcasing their dominance and consumer preference in this segment. This steady top position suggests a strong brand loyalty and effective product offerings that resonate well with consumers. In contrast, the Pre-Roll category presents a different picture. Altered Alchemy was not in the top 30 in October 2024 but made significant strides by climbing to the 28th position by January 2025. This upward trend indicates potential growth opportunities and increasing consumer interest in their Pre-Roll products.

In the Vapor Pens category, Altered Alchemy has also shown positive momentum. Starting with a rank of 34 in October 2024, they improved to 26 by January 2025. This improvement in ranking reflects a growing acceptance and possibly a strategic focus on enhancing their Vapor Pen offerings. However, it's noteworthy that despite these gains, they remain outside the top 20, indicating room for further growth and market penetration. The absence of Altered Alchemy in the top 30 for other states or provinces could be seen as a limitation, suggesting that their current market strength is largely concentrated in Oregon. This presents both a challenge and an opportunity for expansion into new markets where their brand is not yet established.

Competitive Landscape

In the Oregon concentrates market, Altered Alchemy has maintained a dominant position, consistently ranking first from October 2024 through January 2025. This unwavering top rank highlights its strong market presence and consumer preference over competitors. Notably, White Label Extracts (OR) has seen a slight decline in its ranking, moving from second in October 2024 to third in subsequent months, indicating a potential challenge in maintaining its competitive edge. Meanwhile, Red Eye Extracts (OR) has shown a positive trend by climbing from fourth to second place, suggesting an increase in market traction and possibly capturing some of the market share from White Label Extracts. Despite these shifts among competitors, Altered Alchemy's sales have shown a steady increase over the months, peaking in December 2024, which underscores its robust brand loyalty and effective market strategies in the Oregon concentrates category.

Notable Products

In January 2025, Altered Alchemy's top-performing product was Amaretto Sour Cured Resin (1g), leading the sales with a notable figure of 7058 units sold. Following closely, Tropicali Cured Resin (1g) secured the second rank, while Purple Milk Cured Resin (1g) took the third position. Adios MF Cured Resin (1g) and RS11 Cured Resin (1g) rounded out the top five, ranking fourth and fifth, respectively. Compared to previous months, these products have shown a strong debut, as no prior rankings were recorded for October through December 2024. This suggests a strategic launch or marketing push in January that significantly boosted their performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.