Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

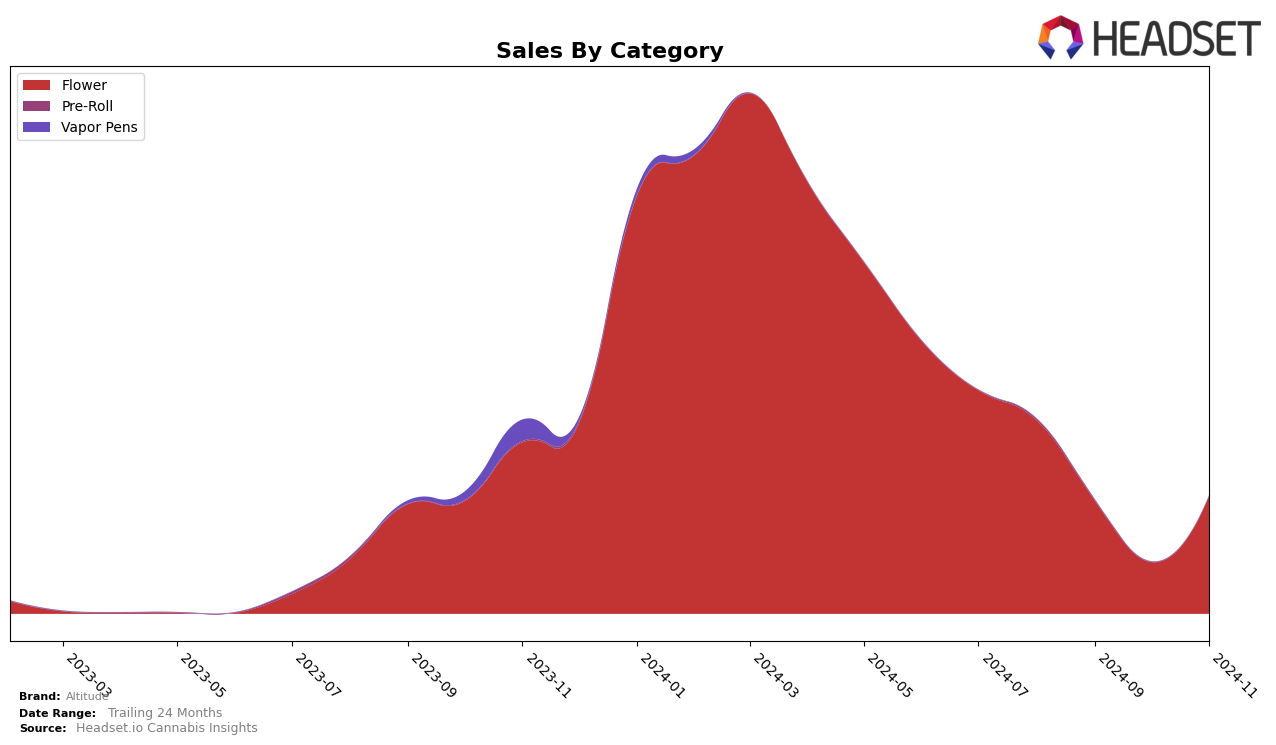

In the state of Massachusetts, Altitude has experienced fluctuating performance in the Flower category over the past few months. Starting from a promising position in August 2024 with a rank of 18, the brand saw a significant drop to rank 35 in September and further slipped out of the top 30 in October. However, November marked a recovery as Altitude climbed back to rank 27. This volatile movement indicates potential challenges in maintaining consistent market presence, but the rebound in November suggests strategic adjustments might be positively impacting their sales trajectory.

It's noteworthy that Altitude was not ranked within the top 30 brands in Massachusetts for the Flower category during October, which could be seen as a setback for the brand. This absence from the top rankings highlights a period of diminished visibility and possibly sales performance, which they managed to partially recover from by November. Such fluctuations can provide insights into the competitive dynamics of the Massachusetts market, where maintaining a steady rank requires continuous adaptation and innovation. Altitude's ability to bounce back into the rankings by November is a positive sign, potentially indicating effective strategies to regain market share.

Competitive Landscape

In the Massachusetts flower category, Altitude has experienced significant fluctuations in its ranking over the past few months, reflecting a dynamic competitive landscape. Starting from a strong position at 18th in August 2024, Altitude saw a sharp decline to 35th in September and further down to 60th in October, before rebounding to 27th in November. This volatility highlights the intense competition from brands like Shaka Cannabis Company, which maintained a top-tier presence, ranking consistently around 11th to 13th before dropping to 28th in November. Meanwhile, Local Roots showed a notable rise from 45th in August to 18th in September, although it settled at 25th by November. In House maintained a relatively stable mid-tier position, fluctuating between 20th and 29th. The competitive dynamics suggest that while Altitude has the potential to regain its footing, it faces significant challenges from both established and rising brands in the Massachusetts market.

Notable Products

In November 2024, Rancid Rainbow (3.5g) emerged as the top-performing product for Altitude, reclaiming its position from August and boasting a notable sales figure of 3088 units. TT Sprinkles (3.5g) secured the second position, maintaining its consistent ranking from September. Guava Tart (3.5g) made a strong entry into the rankings, achieving third place with impressive sales. Gush Mints (3.5g) and Superboof (3.5g) tied for the fourth position, demonstrating a competitive edge among new entries. Compared to previous months, Rancid Rainbow saw a significant rebound in rank and sales, while TT Sprinkles showed stability in its performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.