Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

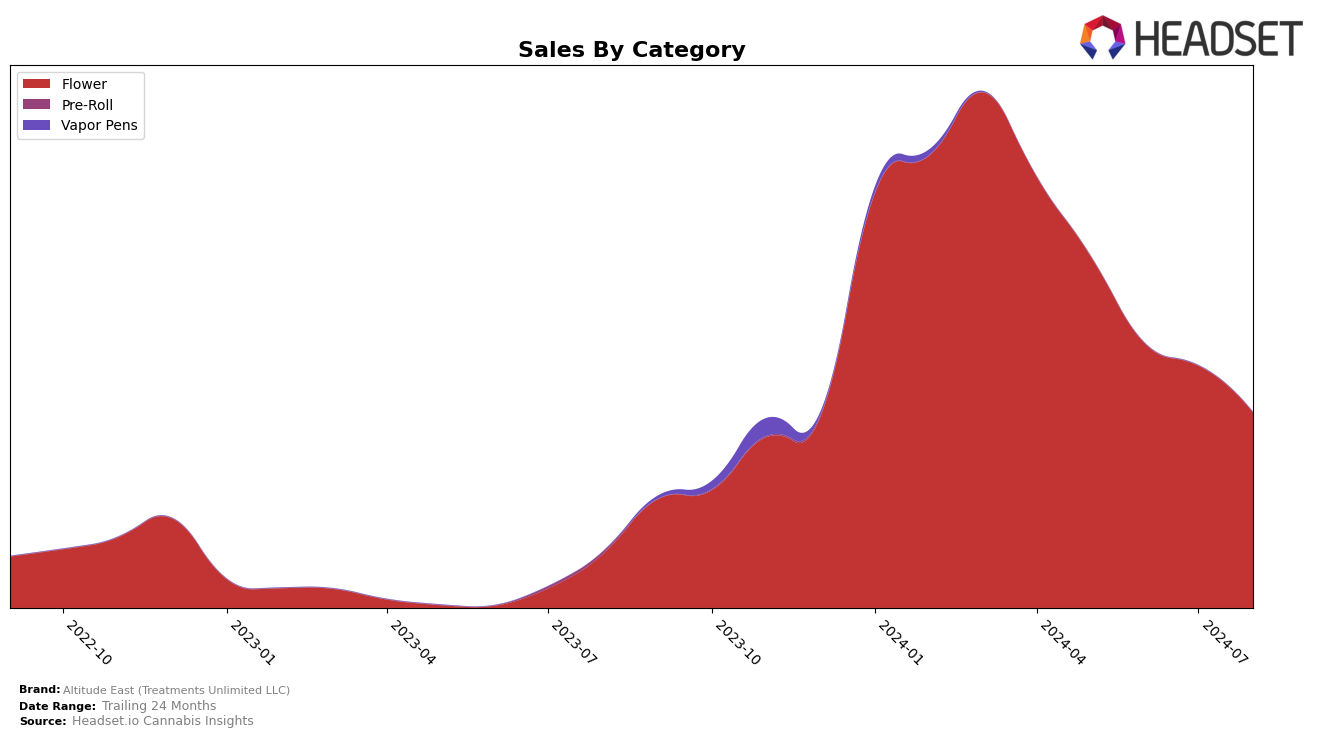

Altitude East (Treatments Unlimited LLC) has shown a noticeable decline in its performance in the Flower category within Massachusetts over the past few months. Starting from a solid ranking of 8th in May 2024, the brand slipped to 9th in June, 13th in July, and further down to 18th by August. This downward trend is reflected in their sales figures, with a significant drop from $1,200,464 in May to $662,617 in August. The consistent decline in both ranking and sales suggests that Altitude East is facing increasing competition or other challenges in the Massachusetts market.

It is also worth noting that Altitude East did not appear in the top 30 brands in any other state or category during this period, indicating a lack of broader market penetration or success outside of Massachusetts. This absence from other rankings could be seen as a missed opportunity for growth and diversification. The brand’s focus on the Flower category in Massachusetts might need to be complemented with strategic moves to explore other states or product categories to stabilize and potentially improve their market position.

Competitive Landscape

In the competitive landscape of the Flower category in Massachusetts, Altitude East (Treatments Unlimited LLC) has experienced a notable decline in rank and sales over the summer months of 2024. Starting at rank 8 in May, Altitude East dropped to rank 18 by August, indicating a significant shift in market position. This decline is contrasted by the performance of competitors such as Ocean Breeze, which, despite starting outside the top 20 in May, surged to rank 19 by August. Similarly, HelloHii showed a remarkable improvement, climbing from rank 38 in May to rank 17 in August. Meanwhile, Cheech & Chong's and Root & Bloom maintained relatively stable positions, with minor fluctuations. The overall trend suggests that Altitude East is facing increased competition and may need to reassess its strategies to regain its market share.

Notable Products

In August 2024, TT Sprinkles (3.5g) retained its position as the top-performing product for Altitude East (Treatments Unlimited LLC) with sales of 3,556 units. Wicked Runtz (3.5g) held steady in the second position, maintaining its rank from July 2024. HiFi #9 (3.5g) entered the rankings for the first time this month, securing the third spot. Platinum Garlic Popcorn (28g) and Captain's Candy (3.5g) also debuted in the top five, ranking fourth and fifth respectively. Notably, TT Sprinkles (3.5g) had a significant drop in sales compared to July 2024, while Wicked Runtz (3.5g) showed a slight decrease in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.