Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

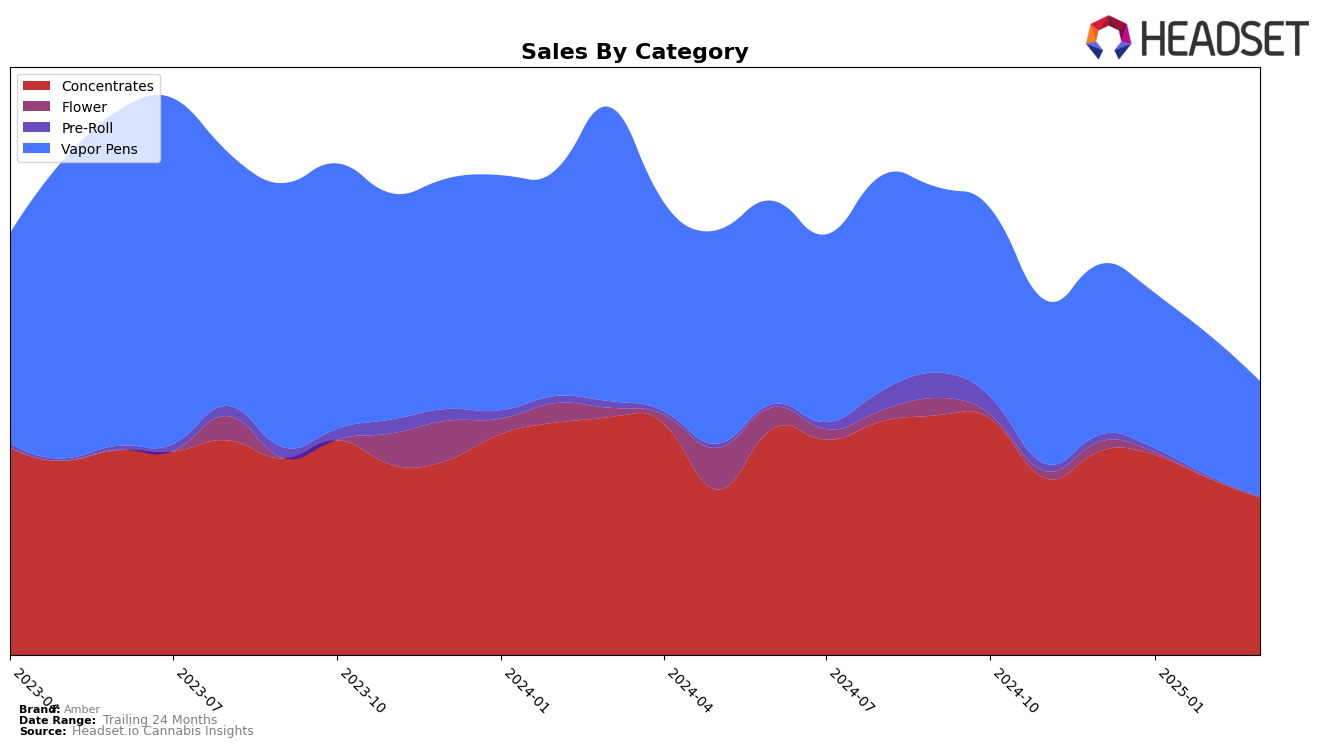

Amber's performance across different states and categories reveals some interesting trends. In Colorado, Amber has maintained a stronghold in the Concentrates category, consistently holding the number one rank from January to March 2025. This dominance is a testament to their robust market presence in the state, despite a slight decrease in sales from February to March. Conversely, in Illinois, Amber's rank in the Concentrates category has seen a decline, dropping from 17th in December 2024 to 27th by March 2025. This downward movement could indicate increased competition or shifting consumer preferences in the state.

In the Vapor Pens category, Amber's performance varies significantly across states. In Arizona, Amber has struggled to maintain a top position, with rankings fluctuating and eventually falling out of the top 30 by March 2025. This indicates a challenging market environment for Amber in Arizona. Meanwhile, in Maryland, Amber has shown resilience, improving its rank from 45th in December 2024 to 39th in March 2025, suggesting a positive reception among consumers. These variations highlight the diverse market dynamics Amber faces across different regions and product categories.

Competitive Landscape

In the competitive landscape of the Concentrates category in Colorado, Amber has shown a remarkable performance, consistently holding the top rank from January to March 2025. This upward trajectory is particularly notable given that Amber was ranked second in December 2024, indicating a successful strategic push that has allowed it to surpass Green Dot Labs, which slipped from first to second place over the same period. Despite Green Dot Labs experiencing a decline in sales from December 2024 to March 2025, Amber's sales have shown resilience, maintaining a strong lead. Meanwhile, Spectra has remained steady in third place, with sales showing a slight fluctuation but not enough to challenge Amber's dominance. This consistent performance by Amber in the top position highlights its growing influence and appeal in the Colorado concentrates market.

Notable Products

In March 2025, Black Triangle Wax (1g) emerged as the top-performing product for Amber, climbing from a previous rank of 5 in February to take the number 1 spot with sales of 3,825 units. Furious George Wax (1g) fell to the second position despite being the leader in February, indicating a slight drop in its sales momentum. Chemdawg Wax (1g) secured the third position, showing a significant improvement from not being ranked in February. Delicata Cookies Wax (1g) re-entered the top five, coming in fourth, while Lemoncello Haze Wax (1g) made its debut in the rankings at the fifth spot. This reshuffling of ranks highlights a dynamic market where product preferences are continually evolving.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.