Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

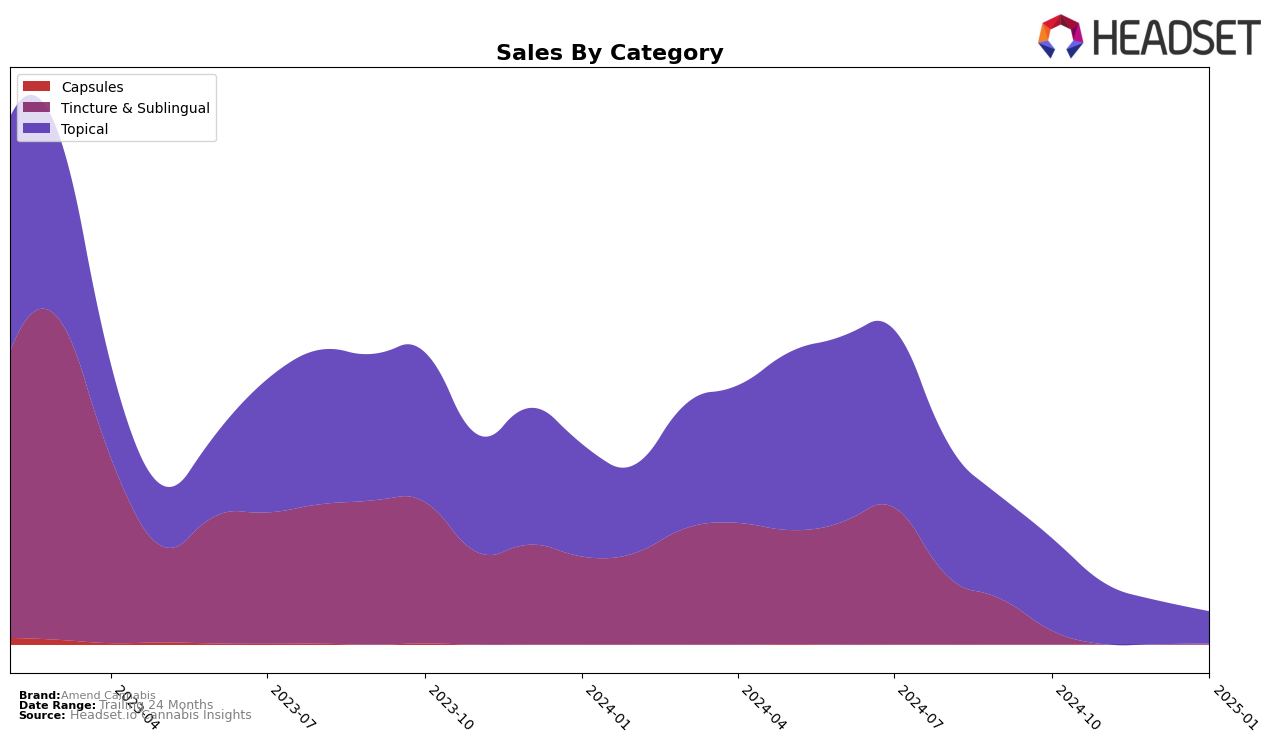

Amend Cannabis has shown a notable presence in the Missouri market, particularly within the Topical category. The brand held a steady position, ranking 5th in October 2024, but experienced a gradual decline in subsequent months, moving to 6th in November and 7th in December before dropping out of the top 30 by January 2025. This downward trend in rankings is reflected in their sales figures, which decreased from $21,553 in October to $10,243 by December. The absence of a rank in January signifies a challenge for Amend Cannabis to maintain its competitive edge in the Missouri Topical market.

While Amend Cannabis has faced challenges in maintaining its rank within the Missouri Topical category, the brand's initial strong performance indicates potential for recovery and growth. The decline in sales and ranking highlights the competitive nature of the market, suggesting that Amend Cannabis may need to reassess its strategies to regain its footing. Observing these movements can provide insights into market dynamics and consumer preferences, which are crucial for any brand aiming to strengthen its position and expand its market share. Understanding these shifts can help stakeholders make informed decisions about potential opportunities and areas for improvement.

Competitive Landscape

In the Missouri topical cannabis market, Amend Cannabis has experienced notable fluctuations in its competitive standing over recent months. Starting from a rank of 5th in October 2024, Amend Cannabis saw a decline to 6th in November and further to 7th in December, before dropping out of the top 20 by January 2025. This downward trend contrasts with competitors like Vlasic Labs, which improved from 6th to 4th place over the same period, and Heartland Labs, which maintained a strong position, fluctuating between 4th and 5th. The emergence of Drool into the 6th position by January 2025 further highlights the competitive pressures Amend Cannabis faces. These shifts suggest a need for strategic adjustments by Amend Cannabis to regain market share and improve its ranking amidst intensifying competition.

Notable Products

In January 2025, the top-performing product from Amend Cannabis was the CBD/THC 1:1 Transdermal Lotion (500mg CBD, 500mg THC) in the Topical category, maintaining its first-place ranking from November 2024. This product recorded notable sales of 74 units for the month. The newly introduced CBD/THC/CBC 1:1:1 Transdermal Lotion (50mg CBD, 50mg THC, 50mg CBC) also secured the top spot in the Topical category, indicating strong market reception. The CBD/THC/CBC 1:1:1 Transdermal Lotion (500mg CBD, 500mg THC, 500mg CBC), which was previously ranked first in October and December 2024, slipped to second place. Meanwhile, the CBD/THC 1:1 Amend Infused Balm (50mg CBD, 50mg THC) re-entered the rankings at third position, showing a resurgence in popularity after its absence in prior months. The CBD/THC 1:1 Amend Tincture (400mg CBD, 400mg THC) made its debut in the rankings at fourth place, highlighting growing interest in the Tincture & Sublingual category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.