Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

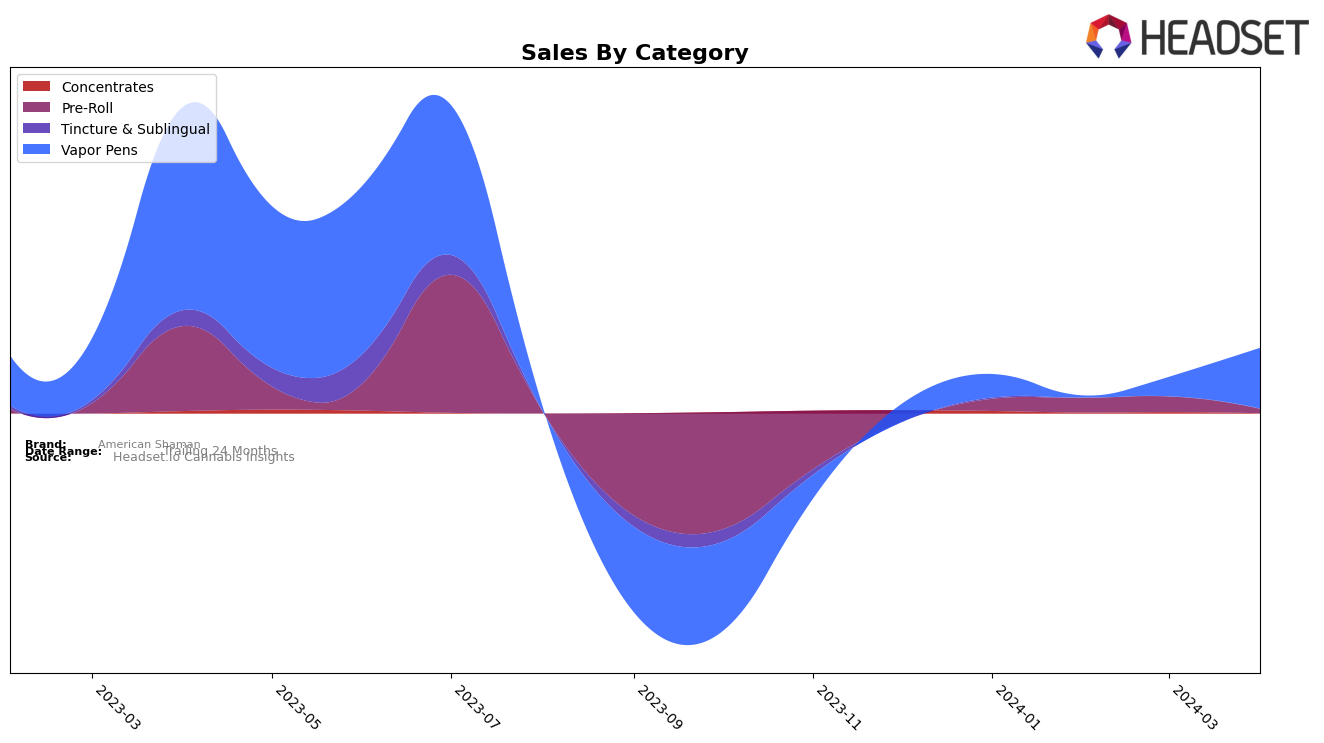

In Missouri, Missouri, American Shaman has shown a noteworthy performance in the Vapor Pens category, although it has experienced some fluctuations in rankings over the recent months. Starting in January 2024, the brand was not within the top 30 brands, ranking at 70th, which indicates a significant challenge in penetrating the market or gaining traction against competitors. However, there was a notable improvement by April 2024, where it climbed up to the 60th position. This upward movement suggests an effective strategy or increased consumer acceptance, although it's still outside the top 30 brands. The sales figures reflect this trajectory, with a notable increase from $10,600 in January to $27,544 in April, indicating a positive response from the market and potential for further growth.

Despite the initial setback in the competitive landscape of Missouri's cannabis market, American Shaman's performance in the Vapor Pens category demonstrates resilience and potential for growth. The absence from the top 30 rankings in the early months of 2024 could be viewed as a significant hurdle; however, the subsequent improvement in rankings and sales suggests that the brand is beginning to make its mark. This progress, particularly in a specialized category like Vapor Pens, is crucial for understanding the brand's market dynamics and consumer preferences. It's important for stakeholders to monitor these trends, as they offer insights into the brand's strategic positioning and potential areas for expansion or increased market share within Missouri.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Missouri, American Shaman has shown a notable trajectory despite facing stiff competition. Initially ranked 70th in January 2024, it did not place in the top rankings for February and March but made a significant leap to the 60th position by April 2024. This jump in rank is underscored by a substantial increase in sales from January to April, indicating a growing consumer interest or successful marketing efforts. Competitors such as Sundro Cannabis, which consistently ranked higher from January to April, and Franklin's Stash House, which made its appearance in the rankings in March and improved by April, highlight the dynamic nature of the market. Other brands like Provisions and MiDose have seen fluctuations in their rankings and sales, suggesting a competitive environment where brand positioning can significantly shift within a few months. American Shaman's recent performance could signal a positive trend in its market positioning, potentially challenging its competitors if the momentum continues.

Notable Products

In April 2024, American Shaman saw Pineapple Express Distillate Vooz Pod (1g) leading its sales chart within the Vapor Pens category, marking a significant jump to the top position from its previous ranking of 5th in January, with sales figures reaching 325 units. Following closely was Leia OG Live Resin Pod (1g), which also showed a notable performance by moving up to the 2nd position from its prior 3rd rank in March, underscoring a consistent demand. Gorilla Glue #4 Distillate Vooz Pod (1g) made it to the third spot, maintaining a strong presence in the lineup despite a drop from the top position in January. Skywalker OG Distillate Vooz Pod (1g) ranked fourth, indicating a slight improvement from its previous 2nd position in March, suggesting a fluctuating yet strong customer interest. Lastly, Cookies & Cream Pre-Roll (1g) entered the top five for the first time in April, highlighting a diversifying interest among American Shaman's clientele towards different product categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.