Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

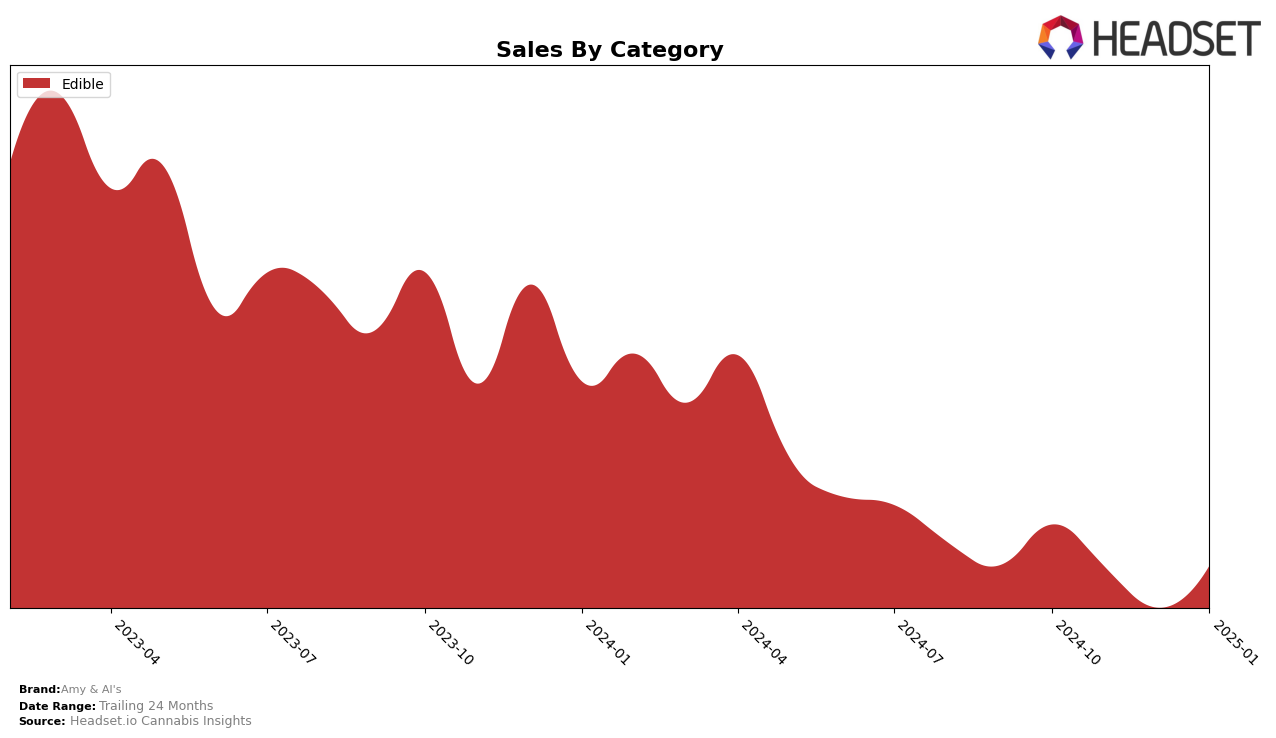

Amy & Al's has shown a consistent presence in the Arizona edibles market over the past few months, although there have been some fluctuations in their ranking. Starting from October 2024, the brand was ranked 19th, and while they improved slightly to 18th in November, they dropped to 21st in December before returning to 19th in January 2025. This oscillation in rankings suggests a competitive environment where Amy & Al's is maintaining its position but facing challenges to climb higher. Interestingly, despite these ranking changes, their sales figures reveal a dip from October to December, followed by a slight recovery in January, indicating that while they are managing to stay within the top 30, the market dynamics are impacting their sales performance.

Notably, Amy & Al's absence from the top 30 in other states or provinces across different categories could be seen as a potential area for growth or as a reflection of their strategic focus on Arizona. The edibles category in this state seems to be their stronghold, but the lack of presence in other markets could be either a missed opportunity or a deliberate choice to concentrate their efforts where they have established a foothold. The data suggests that while they have a solid standing in Arizona edibles, expansion or increased competitiveness in other regions could be a future consideration for the brand.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Arizona, Amy & Al's has experienced fluctuating rankings over the past few months, indicating a dynamic market position. As of January 2025, Amy & Al's held the 19th rank, a slight improvement from December 2024 when it slipped to 21st. This recovery suggests a positive response to market strategies, though the brand remains under pressure from competitors like BITS, which has shown a consistent upward trend, climbing from 21st in October 2024 to 17th by January 2025. Meanwhile, Sublime has experienced a decline, dropping from 15th to 18th in the same period, potentially opening opportunities for Amy & Al's to capitalize on shifting consumer preferences. Despite these challenges, Amy & Al's sales have shown resilience, particularly in January 2025, where they saw a rebound, contrasting with the declining sales of Sublime and the fluctuating performance of Grow Sciences and Tru Infusion. This competitive analysis highlights the importance for Amy & Al's to continue adapting its strategies to maintain and improve its market position amidst a competitive and evolving market.

Notable Products

In January 2025, the top-performing product for Amy & Al's was the Hybrid Brownie (100mg), maintaining its first-place ranking for the fourth consecutive month with a sales figure of 4,727 units. The Hybrid Chocolate Chip Cookie 10-Pack (100mg) held steady in second place, mirroring its consistent performance from previous months. The Hybrid Snickerdoodle Cookies 10-Pack (100mg) rose to third place, showing an increase in sales from December. Meanwhile, the Hybrid Peanut Butter Cookie 10-Pack (100mg) dropped to fourth place, although it still maintained a strong sales performance. Rounding out the top five, the Hybrid Brownie Bites (400mg) remained in fifth place, but with a notable increase in sales compared to prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.