Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

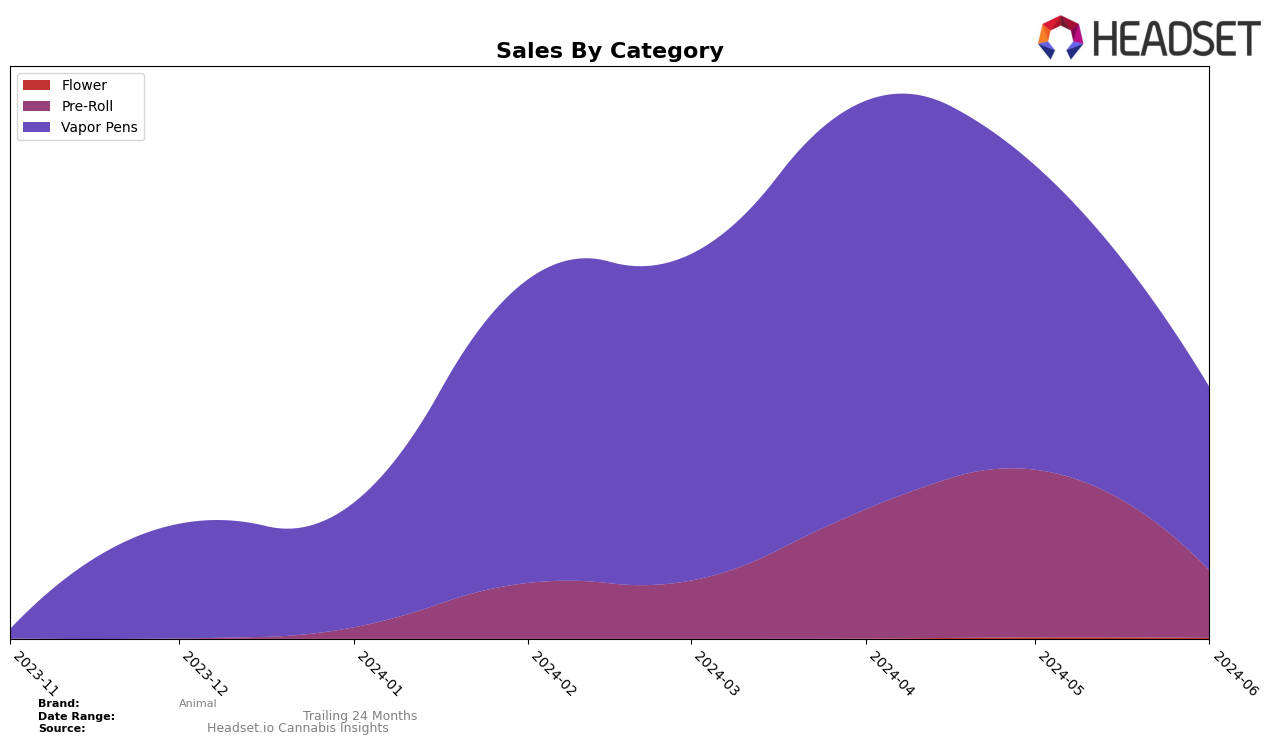

The performance of Animal in the Vapor Pens category has seen significant fluctuations across different states and provinces. In Alberta, Animal's ranking dropped from 43rd in March 2024 to 64th in April 2024, and it did not make it into the top 30 in subsequent months. This decline indicates a loss of market presence in Alberta's Vapor Pens category. Conversely, in Ontario, the brand has shown more stability, maintaining a rank within the top 25 throughout the period, although it did experience a slight drop from 16th in April to 25th in June 2024. These trends highlight the varying levels of competitive performance and market penetration Animal faces in different regions.

In the Pre-Roll category, Animal's performance has been mixed across New York and Ontario. In New York, the brand entered the rankings at 56th place in April and maintained this position in May before dropping to 64th in June 2024, suggesting a struggle to gain traction in this category. Ontario presents a more volatile picture, with Animal's rank oscillating from 92nd in March to 48th in May, before falling back to 97th in June. Such movements indicate that while Animal has moments of strong performance, it faces challenges in sustaining its market position in the Pre-Roll segment across these regions.

Competitive Landscape

In the Ontario Vapor Pens category, Animal has experienced notable fluctuations in its rank and sales over the past few months. Starting strong in March 2024 at rank 17, Animal climbed to rank 16 in April, but then saw a decline to rank 18 in May and further dropped to rank 25 in June. This downward trend in rank is mirrored by a significant decrease in sales, from a peak in April to a much lower figure in June. In contrast, competitors like Wagners have shown a steady improvement, moving from rank 31 in March to rank 23 in June, indicating a consistent upward trajectory in both rank and sales. Similarly, Phyto Extractions has made notable gains, climbing from rank 41 in March to rank 24 in June. On the other hand, Nugz and Purple Hills have maintained relatively stable positions, with minor fluctuations. These competitive dynamics suggest that while Animal initially held a strong position, it faces significant challenges from rising competitors, necessitating strategic adjustments to regain market share.

Notable Products

In June 2024, the top-performing product from Animal was Orange Tsunami Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with sales of 4224 units. High Potency Infused 50+ Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, which held the top spot in May, dropped to the second rank with notable sales figures. High Potency 90+ Distillate Cartridge (1g) in Vapor Pens slipped to the third rank from its previous second position. Wintergreen OG Distillate Disposable (1g) maintained its fourth position consistently from April to June. NYC Diesel Distillate Cartridge (1g) debuted in the rankings at fifth place, marking its first appearance in the dataset.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.