Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

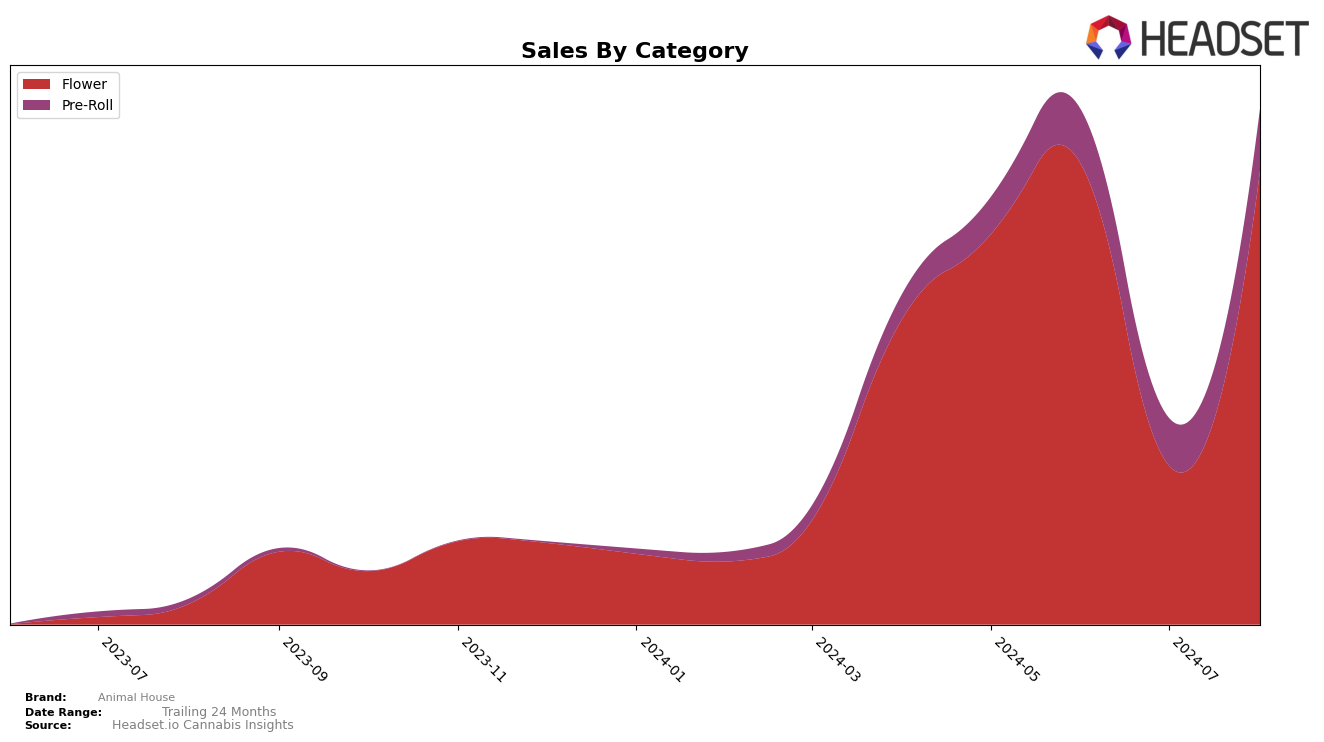

Animal House has demonstrated a fluctuating performance across different categories and states. In New York, the brand's presence in the Flower category has seen significant ups and downs over the past few months. Notably, Animal House ranked 15th in May 2024, dropped to 21st in June, fell out of the top 30 in July, and then rebounded to 17th in August. This volatility indicates a competitive market where Animal House is striving to maintain its position. Despite the fluctuations, the brand experienced a notable sales increase from June to August, suggesting a recovery and potential growth in market share. In the Pre-Roll category, Animal House's performance in New York has been less stellar, with rankings consistently outside the top 30. The brand's ranking hovered around the 50s, peaking at 49th in August 2024. This indicates that while Animal House is present in the Pre-Roll market, it faces significant competition and has yet to establish a strong foothold. However, the steady increase in sales over the months suggests that there is potential for growth if the brand can improve its market strategy and product offerings in this category.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Animal House has experienced notable fluctuations in its rank and sales over the past few months. Starting at rank 15 in May 2024, Animal House dropped out of the top 20 in June and July, before making a significant comeback to rank 17 in August. This volatility contrasts with the more stable performance of competitors like Alchemy Pure, which improved its rank from 19 in May to 15 in August, reflecting a consistent upward trend. Similarly, Ithaca Organics Cannabis Co. showed a steady rise, moving from rank 33 in May to 16 in August. Meanwhile, Grassroots and Hepworth have shown mixed results, with Hepworth experiencing a significant drop from rank 5 in May to 19 in August. These dynamics suggest that while Animal House has the potential for strong sales, it faces stiff competition and must stabilize its market position to maintain and grow its customer base.

Notable Products

In August 2024, the top product for Animal House was Notorious Cherry (3.5g) in the Flower category, with a significant sales figure of 3463 units, climbing from its previous absence in the rankings. Grape Ape (3.5g), also in the Flower category, secured the second position, up from its unranked status in July, with notable sales. Bread and Butter (3.5g) maintained a steady performance, ranking third for the second consecutive month. Rainbow Runtz (3.5g) held the fourth position, consistent with its ranking in July. Jelly Donuts Infused Pre-Roll 3-Pack (1.5g) entered the rankings for the first time in August, taking the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.