Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

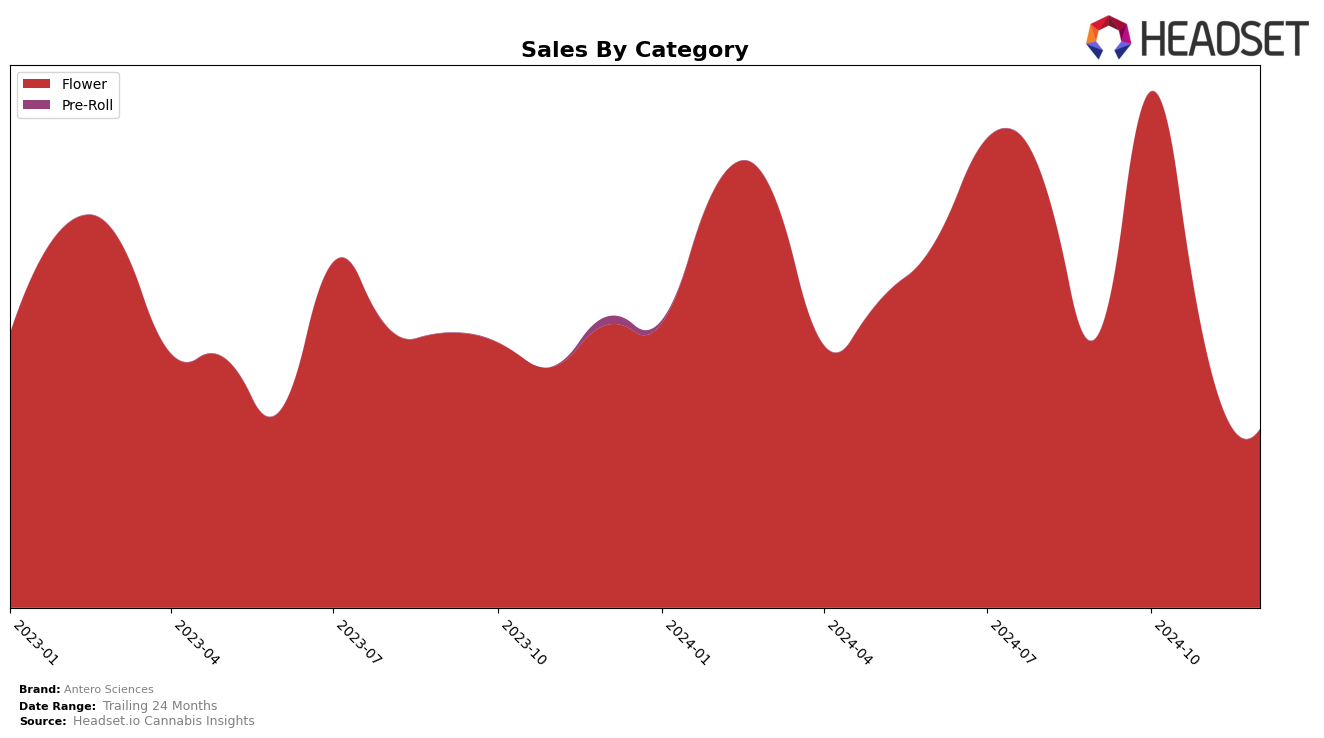

Antero Sciences has shown a dynamic performance in the Colorado market, particularly within the Flower category. Notably, the brand made a significant leap from a rank of 30 in September 2024 to 12 in October 2024, which indicates a strong surge in consumer interest or successful marketing strategies during that period. However, this momentum was not sustained, as the rankings dipped back to 27 in November and 30 in December. This fluctuation suggests that while Antero Sciences can capture the market's attention, there may be challenges in maintaining consistent consumer engagement or supply chain issues affecting their performance.

It is important to observe that Antero Sciences did not appear in the top 30 brands across any other categories or states, which might suggest a need for diversification or stronger presence in other markets. The absence from other rankings could be seen as an area for improvement, particularly if the brand aims to expand its footprint beyond Colorado. The sales figures in October 2024, which were notably higher than other months, indicate that there is potential for growth if the brand can replicate whatever factors contributed to that month's success. Understanding and leveraging these insights could be key for Antero Sciences as they navigate the competitive cannabis landscape.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Antero Sciences has demonstrated notable fluctuations in its market position over the last few months of 2024. In October, Antero Sciences achieved a significant leap to the 12th rank, indicating a robust sales performance compared to its competitors. However, by December, it slipped back to the 30th position, suggesting a potential decline in market traction or increased competition. Notably, Boulder Built showed a strong performance in October, securing the 22nd rank, which might have contributed to the competitive pressure on Antero Sciences. Meanwhile, The Colorado Cannabis Co. and Sunshine Extracts consistently ranked lower, indicating that despite Antero Sciences' rank fluctuations, it still outperformed these brands in terms of market presence. This dynamic suggests that while Antero Sciences has the potential to climb the ranks, maintaining a consistent strategy is crucial to sustaining its competitive edge in the Colorado Flower market.

Notable Products

In December 2024, Blue Razzicle Shake (1g) emerged as the top-performing product for Antero Sciences, achieving the number one rank with sales figures reaching 9,592 units. Blue Cheese (Bulk) followed closely as the second-best seller, marking its debut in the rankings. Strawberry Sugar (Bulk) maintained its third position from November, indicating consistent performance over the months. Sherb Crasher (Bulk) entered the rankings at fourth place, while White Truffle Popcorn (Bulk), previously ranked third in September, rounded out the top five. The movement in rankings highlights a dynamic shift, with some products newly appearing in the top tier while others like White Truffle Popcorn experienced a decline since September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.