Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

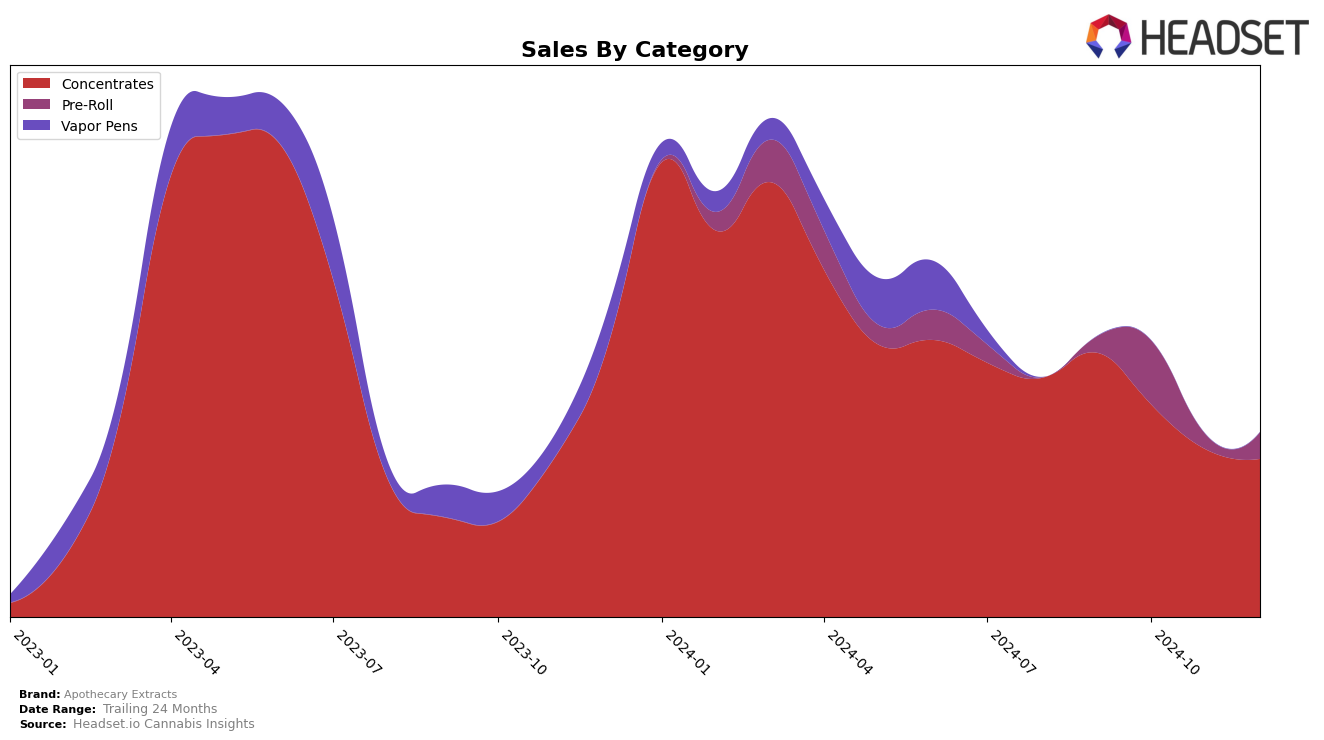

In the Colorado market, Apothecary Extracts has shown a fluctuating performance in the Concentrates category. Starting from a rank of 29 in September 2024, the brand experienced a decline, slipping out of the top 30 in October and November, before making a slight recovery to rank 30 in December. This movement indicates a challenging period for the brand, with sales decreasing from $87,167 in September to $52,367 by December. The downward trend in sales and rankings suggests that Apothecary Extracts might be facing stiff competition or changing market dynamics in this category.

On the other hand, Apothecary Extracts' performance in the Pre-Roll category in Colorado was not as strong, as it did not make it into the top 30 rankings for the months tracked. The absence from the top rankings could imply that the brand is either a smaller player in this category or that it is focusing its efforts more on other segments. This lack of presence in the top tier could be seen as a potential area for growth or a strategic reevaluation for the brand moving forward. Understanding these dynamics can offer insights into the brand's strategic positioning and potential areas for improvement or investment.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Apothecary Extracts has experienced notable fluctuations in its rank from September to December 2024. Starting at 29th place in September, the brand saw a dip to 35th in November before recovering slightly to 30th in December. This trend indicates a challenging period for Apothecary Extracts, likely influenced by declining sales over these months. In contrast, competitors like Rare Dankness and 14er Gardens have shown more dynamic movements, with Rare Dankness peaking at 21st in September and 14er Gardens reaching 17th in November. Meanwhile, Craft / Craft 710 and Green Treets have maintained a steady climb, with Craft / Craft 710 moving from 47th to 32nd and Green Treets from 40th to 31st over the same period. These shifts suggest that while Apothecary Extracts faces challenges, there is a dynamic market environment where other brands are capitalizing on opportunities to improve their standings, potentially at the expense of Apothecary Extracts.

Notable Products

In December 2024, Blue Diesel Wax (1g) emerged as the top-selling product for Apothecary Extracts, holding the number one rank with notable sales of 1368 units. Lunar Palace Wax (1g) followed closely in second place, showing a significant rise from its fifth position in November. Papaya Mintz Infused Pre-Roll (1g) secured the third position after being the top product in October, indicating a decline in its ranking over the months. Pineapple Ripper Batter (1g) made its debut on the list at fourth place, while White Fire OG Batter (1g) rounded out the top five. Overall, the Concentrates category dominated the top positions, reflecting a shift in consumer preference from Pre-Rolls to Concentrates in recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.