Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

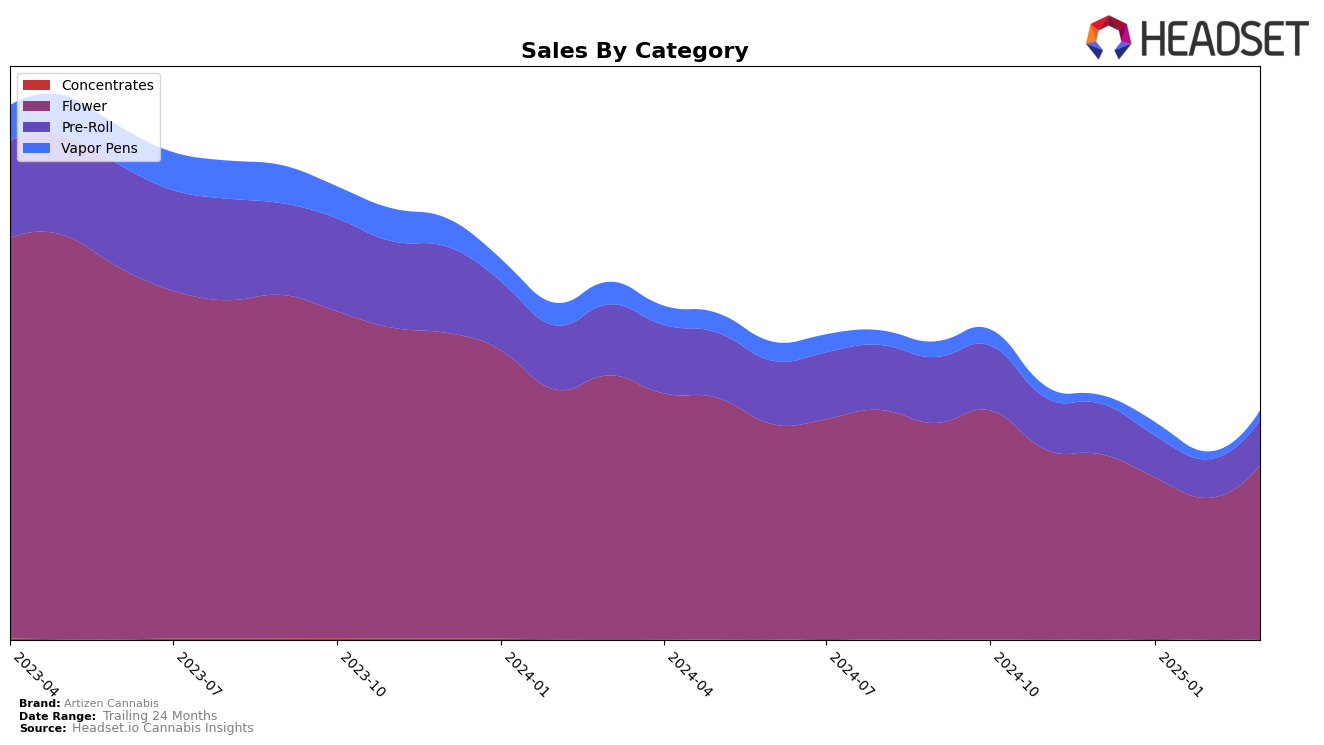

Artizen Cannabis has shown notable performance in the Washington market, particularly in the Flower category. Throughout the period from December 2024 to March 2025, Artizen maintained a strong presence, consistently ranking within the top five brands. Despite a slight dip in February where they ranked fifth, they recovered to third place by March 2025, indicating a resilient market strategy. This consistent high ranking reflects their strong foothold in the Flower category, even as sales figures experienced some fluctuations. Interestingly, Artizen's sales in the Flower category peaked in December 2024, suggesting a possible seasonal trend or successful marketing campaign during that period.

In contrast, Artizen's performance in the Pre-Roll and Vapor Pens categories in Washington was less prominent. In Pre-Rolls, Artizen hovered around the 21st to 24th rank, indicating a stable yet middle-tier position in the market. Their ranking in Vapor Pens was even lower, consistently outside the top 30, which might highlight a potential area for improvement or a strategic decision to focus less on this category. The slight improvement in Vapor Pens ranking from 98th in December to 88th in March could suggest emerging efforts to gain traction in this segment. However, the absence of top 30 rankings in both categories underscores the competitive nature of these markets and the challenges Artizen faces in expanding its dominance beyond Flower products.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Artizen Cannabis has shown a dynamic performance from December 2024 to March 2025. Despite a dip in sales from December to February, Artizen Cannabis managed to climb back to the 3rd position in March 2025, showcasing resilience and effective market strategies. Throughout this period, Phat Panda consistently dominated the market, maintaining the top rank with significantly higher sales figures. Meanwhile, Legends held a steady 2nd position, indicating strong brand loyalty and market presence. Lifted Cannabis Co and Redbird (formerly The Virginia Company) also presented notable competition, with Lifted Cannabis Co experiencing a slight decline in rank by March 2025, while Redbird improved its standing, moving up to the 4th position. These shifts highlight the competitive pressures Artizen Cannabis faces, emphasizing the importance of strategic positioning and customer engagement to enhance its market share.

Notable Products

In March 2025, the top-performing product from Artizen Cannabis was Dutchberry (3.5g), reclaiming its number one rank with a significant sales figure of 5132. Dutchberry Pre-Roll 2-Pack (1g) followed closely, dropping to the second position from its previous first place in January and February. Blue Dream Pre-Roll 2-Pack (1g) maintained a steady third rank, showing consistent popularity. Blue Dream (3.5g) held its fourth position for two consecutive months, after debuting in February. Jack Herer Pre-Roll 2-Pack (1g) remained in fifth place, indicating stable but modest demand compared to the other top products.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.