Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

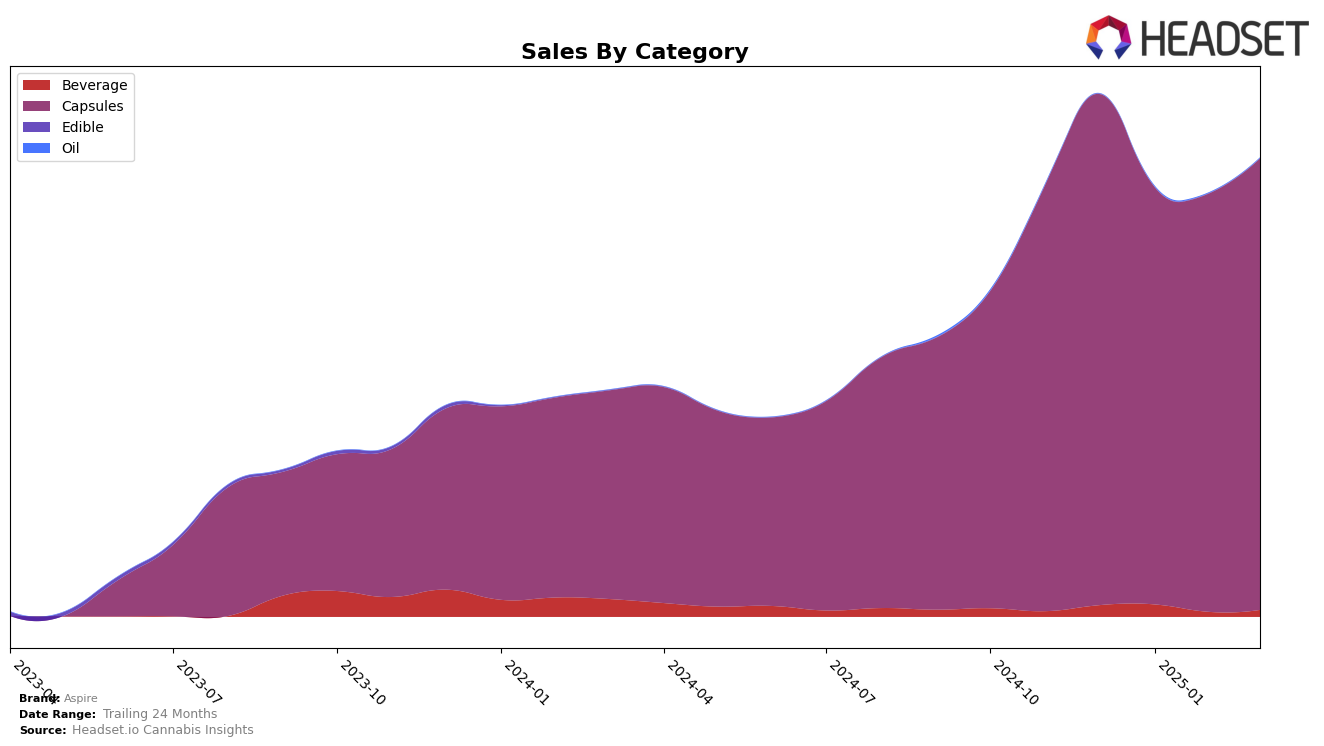

In Ontario, Aspire has demonstrated notable performance in the Capsules category. The brand has consistently maintained the top position from January through March 2025, showcasing its strong market presence and consumer preference. This stability at the number one spot reflects a robust demand for Aspire's capsule offerings, even as sales figures saw a slight dip in January before rebounding in March. On the other hand, Aspire's performance in the Beverage category has been less consistent. While the brand managed to break into the top 30 in December 2024 at rank 33 and climbed to rank 27 in January 2025, it failed to maintain this momentum in the following months, indicating potential challenges in sustaining growth in this particular category.

While Aspire's success in Ontario's Capsules category is commendable, the absence of a ranking in the Beverage category beyond January 2025 suggests areas for improvement or a shift in strategy might be necessary. This discrepancy in category performance could point to varying consumer preferences or competitive pressures that Aspire faces in the Beverage market. It's crucial for the brand to analyze these trends to understand the underlying factors contributing to their market performance. By focusing on maintaining their lead in Capsules and addressing challenges in Beverages, Aspire could potentially enhance their overall market position in Ontario.

Competitive Landscape

In the competitive landscape of the Capsules category in Ontario, Aspire has demonstrated a strong performance, consistently holding the top rank from January to March 2025. This marks a significant improvement from December 2024, where Aspire was ranked second. The brand's ability to maintain the number one position for three consecutive months highlights its growing dominance in the market. Notably, Aspire surpassed Redecan, which held the top spot in December 2024 but dropped to second place in the following months. Meanwhile, Tweed remained steady in third place throughout this period. This shift in rankings suggests that Aspire's strategies, possibly in product innovation or customer engagement, have effectively resonated with consumers, leading to increased sales and market share. As Aspire continues to lead, it will be crucial for competitors to analyze and adapt to Aspire's successful tactics to regain or improve their positions in the market.

Notable Products

In March 2025, Aspire's top-performing product remained the SPARK THC Moonrocks Tablets 15-Pack (150mg) in the Capsules category, maintaining its number one rank from previous months, despite a decrease in sales to 6,402 units. The Spark THC Moonrocks Capsules 50-Pack (500mg) secured the second position consistently, showing a slight increase in sales from February. The Spark THC Moonrocks Live Rosin Reserve Capsules 30-Pack (300mg) held steady in third place, with a modest rise in sales compared to the previous month. The Spark THC Moonshot (100mg THC, 90ml) continued to rank fourth, reflecting stable performance in the Beverage category. Lastly, the CBD 100 Halo Capsules 30-Pack (3000mg CBD) maintained its fifth position, indicating consistent demand despite being the lowest in sales volume.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.