Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

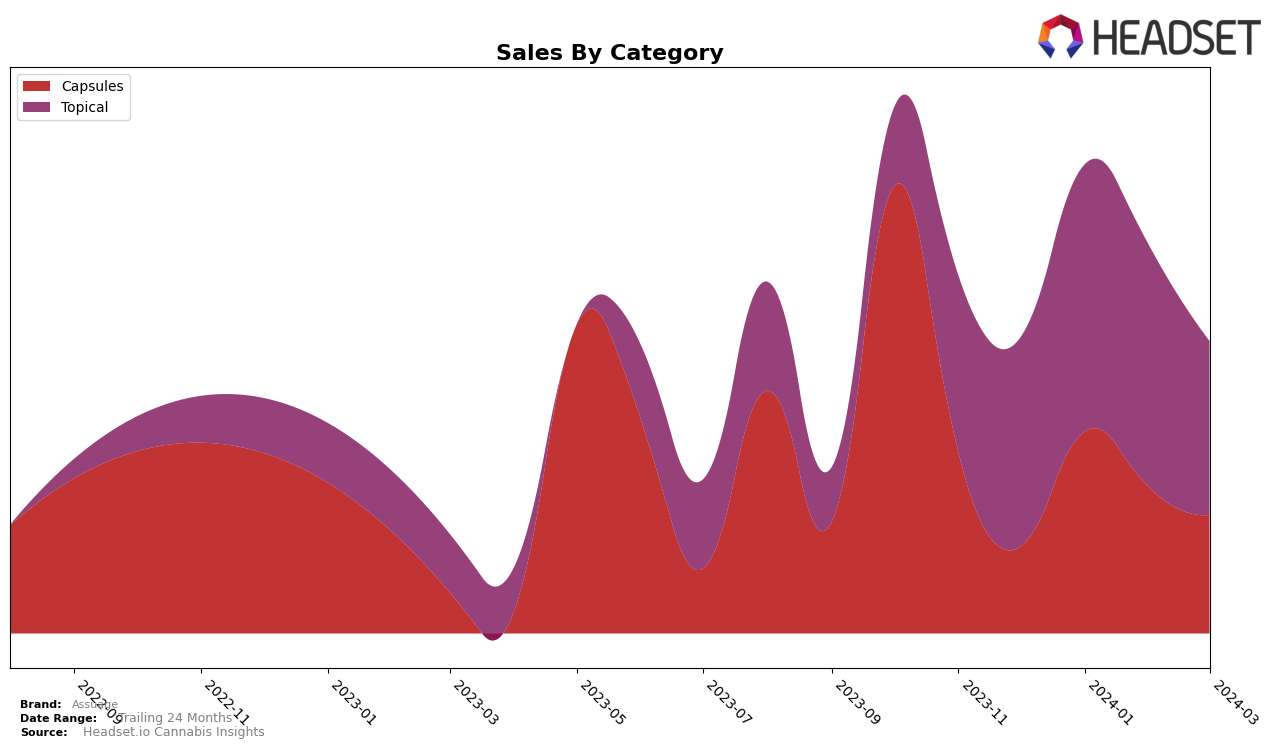

In the competitive landscape of British Columbia, Assuage has shown a commendable performance in the Capsules category, maintaining a presence in the top 15 brands from December 2023 to March 2024. The brand experienced a slight improvement in ranking from December 2023 (15th) to February 2024 (12th), indicating a growing consumer preference. However, it saw a minor dip to 14th place in March 2024. This fluctuation in rankings, alongside a notable peak in sales in January 2024 (1317 units), suggests a dynamic market position. In the Topical category within the same province, Assuage consistently ranked within the top 15, demonstrating steady consumer trust and market penetration. The sales in this category also reflect a stable demand, with a slight increase observed in February 2024 before a modest decrease in March 2024.

Turning our attention to Ontario, Assuage's performance in the Topical category tells a story of significant improvement and challenges. Starting at 24th in December 2023, the brand made an impressive leap to 17th in January 2024, showcasing a strong start to the year with an increase in sales (1226 units). This upward trajectory continued, albeit more modestly, to 16th in February 2024. However, March 2024 saw a reversal in fortunes, with Assuage slipping to 19th. This decline in ranking, coupled with a decrease in sales for March, highlights the competitive nature of Ontario's market and the need for brands to continuously engage and innovate to maintain or improve their market standing.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in British Columbia, Assuage has shown a fluctuating performance in terms of rank and sales over the recent months. Initially ranked 15th in December 2023, Assuage climbed to 13th in January 2024, peaked at 12th in February 2024, but then slightly dropped to 14th by March 2024. This trajectory indicates a volatile market position, with sales peaking in January at a level significantly higher than its initial figures, before experiencing a gradual decline. Competitors such as Solei, which consistently ranked above Assuage, saw a more stable rank with a notable increase in sales from February to March. In contrast, Indiva - US, despite a higher rank, faced a sharp decline in sales in February, only to slightly recover in March. Notably, Tweed entered the rankings in January and has been climbing, suggesting a growing presence. The entry and exit of brands like Daily Special, which was ranked in December but absent thereafter, highlight the dynamic nature of the market. Assuage's performance, amidst these shifts, suggests challenges in maintaining a consistent upward trajectory in a competitive and fluctuating market environment.

Notable Products

In March 2024, Assuage saw its CBD Cooling Gel (500mg CBD) from the Topical category maintain its position as the top-selling product for the fourth consecutive month, despite a drop in sales to 29 units. The CBD Extra Strength Suppositories 4-Pack (100mg CBD) in the Capsules category made a notable entry at the second rank with sales figures reaching 12 units. The CBD/THC 3:1 Suppositories 8-Pack (240mg CBD, 80mg THC) also from the Capsules category held steady at the second position from previous months but dropped to third in March. Meanwhile, the CBD:THC 1:1 Cooling Cream (250mg CBD, 250mg THC, 50g) from the Topical category improved its ranking, moving up to the second spot from its consistent third-place finish in prior months. These shifts indicate a dynamic change in consumer preferences within Assuage's product lineup, highlighting the growing interest in diverse cannabis formulations.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.