Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

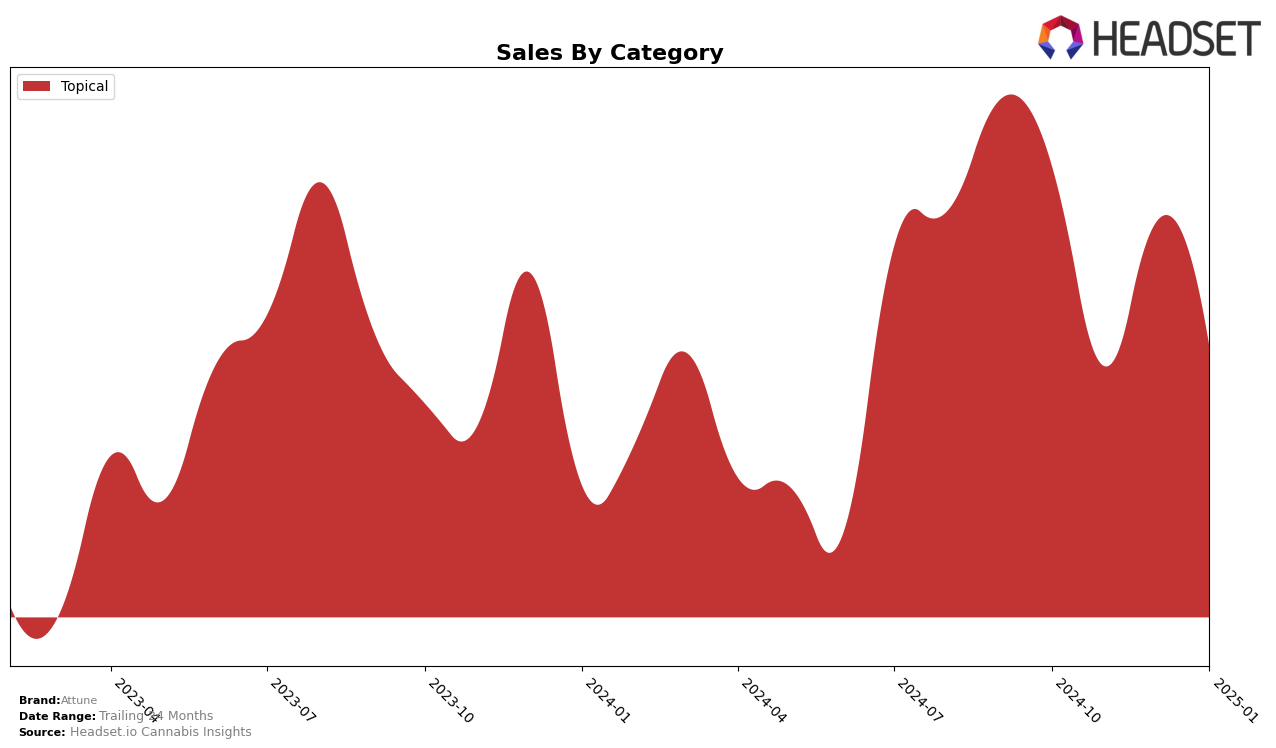

Attune has demonstrated a strong presence in the Topical category within the state of Massachusetts. Over the span from October 2024 to January 2025, Attune maintained a steady performance, starting with a rank of 2nd in October and ending with a rank of 3rd in January. This slight fluctuation in rankings indicates a competitive market environment, yet Attune's ability to remain within the top 5 brands consistently suggests a robust market position. Despite a dip in sales from October to November, where sales fell from $34,390 to $23,486, Attune managed to recover in December with an increase to $31,326, reflecting resilience and effective market strategies.

While Attune's performance in Massachusetts is noteworthy, it is crucial to consider its presence in other states and categories to gain a comprehensive understanding of its market dynamics. The data does not indicate Attune's presence in the top 30 brands in other states or categories during this period, which could suggest either a strategic focus on the Massachusetts market or challenges in scaling across other regions. This absence from the top ranks in other areas might be seen as a limitation or a potential area for growth, depending on the brand's strategic objectives. Understanding these dynamics can provide insights into Attune's market strategies and future opportunities for expansion.

Competitive Landscape

In the Massachusetts Topical category, Attune experienced notable fluctuations in its ranking over the observed months, indicating a dynamic competitive landscape. Starting at rank 2 in October 2024, Attune slipped to rank 4 in November and December, before slightly recovering to rank 3 in January 2025. This movement suggests a competitive pressure primarily from brands like Chill Medicated, which climbed from rank 7 in October to consistently hold rank 2 by January, and Nordic Goddess, maintaining a strong presence in the top ranks. Meanwhile, Treeworks dominated the category, consistently holding the top spot throughout the period. The sales figures reflect these rankings, with Attune's sales peaking in October but showing a downward trend by January, contrasting with the upward sales trajectory of Chill Medicated. This competitive analysis highlights the importance for Attune to strategize effectively to regain and maintain a higher rank amidst strong competitors in the Massachusetts market.

Notable Products

In January 2025, Attune's top-performing product was the CBD/THC 1:1 Muscle Freeze Lotion (75mg CBD, 75mg THC) in the Topical category, maintaining its first-place ranking from previous months, with sales figures reaching 662 units. The Muscle Freeze Lotion (100mg THC, 30ml) also held steady in the second position, despite a decrease in sales from December. The CBD/THC 1:1 Hydrating Soothing Lotion (40mg CBD, 40mg THC) remained in third place, showing a slight increase in sales compared to the previous month. Notably, the CBD/THC 1:1 Muscle Freeze (69mg CBD, 66mg THC) dropped out of the top rankings, having been fourth in December. Overall, the top products have shown consistency in their rankings, with minor fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.