Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

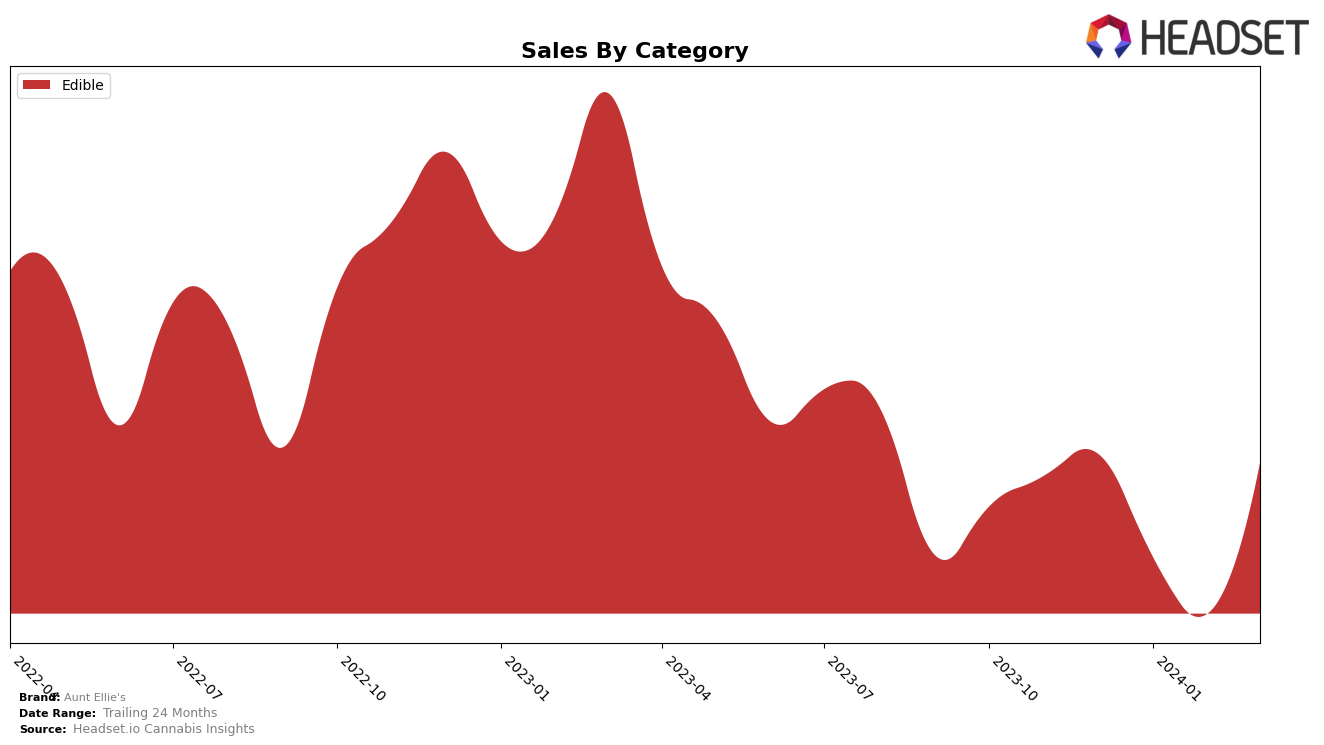

In the Arizona market, Aunt Ellie's has shown a fluctuating performance within the Edible category over the recent months. Starting from December 2023, the brand ranked 29th, which indicates a solid presence within the top 30 brands for that category. However, the subsequent months saw a slight decline, with rankings of 32nd in January 2024 and 33rd in February 2024, suggesting a minor struggle in maintaining its market position. Interestingly, March 2024 witnessed a slight recovery, bringing Aunt Ellie's back to the 30th rank. This movement is reflective of the brand's resilience and ability to regain its footing in a competitive category. The sales data, peaking at $43,670 in December 2023 before dipping and then slightly recovering in March 2024, mirrors this ranking trend, highlighting the brand's fluctuating market performance in Arizona.

The detailed ranking movement of Aunt Ellie's across these months suggests a competitive challenge within the Edible category in the Arizona market. The initial position within the top 30 brands is commendable; however, the drop out of the top 30 in January and February 2024 could be viewed as a setback. The ability to climb back into the 30th rank by March 2024, however, indicates a potential stabilization or an effective response to the market dynamics. Such trends are crucial for stakeholders to monitor as they reflect the brand's market performance and consumer preferences shift. While the exact sales figures for January to March 2024 were not disclosed, the directional movement in sales aligns with the brand's ranking changes, offering a glimpse into Aunt Ellie's performance trajectory in a highly competitive category.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Aunt Ellie's has experienced fluctuating ranks and sales over the recent months, indicating a dynamic position among its competitors. Notably, Aunt Ellie's saw a rank improvement from 33rd in February 2024 to 30th in March 2024, alongside a significant sales increase in the same period, suggesting a positive reception to possibly new or improved products or marketing strategies. Competitors like Sofa King Tasty and Pucks have shown varying performance, with Sofa King Tasty experiencing a decline in both rank and sales, while Pucks fluctuated in rank but maintained a relatively stable sales figure. Tipsy Turtle and Jams also displayed rank and sales movements, with Tipsy Turtle improving its rank and sales, contrasting with Jams' declining trend. These insights underscore the competitive nature of the Arizona edible cannabis market, where brand positioning and sales are highly volatile, directly impacting Aunt Ellie's market strategy and performance.

Notable Products

In March 2024, Aunt Ellie's top-selling product remained the Indica Classic Brownie (100mg) within the Edible category, maintaining its number one rank from previous months with impressive sales of 1334 units. Following closely, the Sativa Classic Brownie (100mg) also kept its second rank consistently, showcasing significant consumer preference. The Indica Daily Dose Brownie (25mg) saw a slight fluctuation in its ranking over the months but secured the third position in March, indicating a stable demand for lower dosage options. The Sativa Brownie (75mg) held onto the fourth spot, demonstrating a consistent choice among consumers for varied THC content. Notably, the Oatmeal Cherry Walnut Cookie (100mg THC) made its debut in the rankings at fifth place, suggesting a growing interest in diverse edible forms.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.