Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

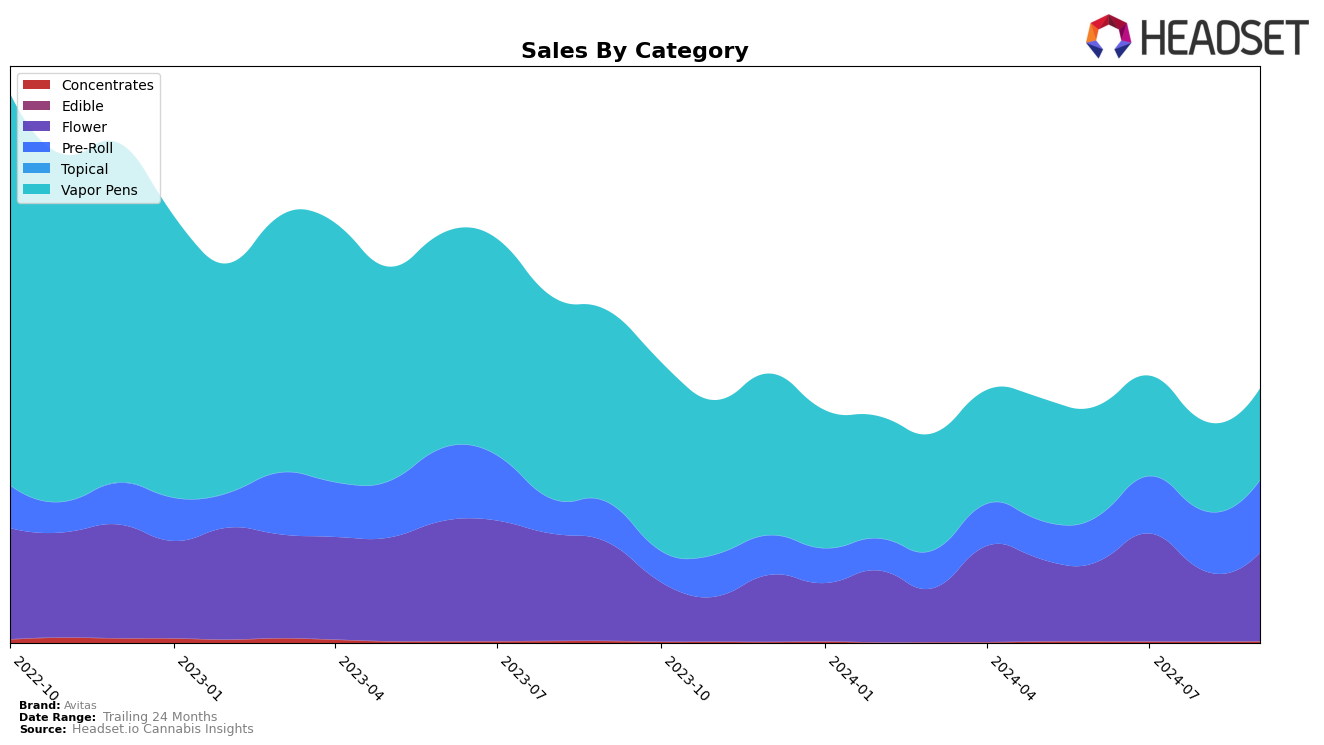

Avitas has shown varied performance across different categories and states. In Oregon, the brand's presence in the Flower category has been quite dynamic. Avitas moved into the top 30 in July 2024, achieving a rank of 27, but fell out of the top 30 in both June and August before recovering slightly in September. This fluctuation indicates a competitive market landscape and potential challenges in maintaining a consistent market position. Meanwhile, in the Pre-Roll category, Avitas has demonstrated a positive trend, improving its rank from 37 in June to 25 by September, suggesting a strengthening foothold in this segment. The Vapor Pens category in Oregon also saw Avitas hovering around the 30s, with minor ups and downs, but consistently maintaining a presence within the top 40. These movements highlight the brand's resilience and adaptability in the face of market fluctuations.

In Washington, Avitas's performance tells a different story. The brand did not feature in the top 30 for Pre-Rolls until September, where it made an entry at rank 97, indicating a new or renewed focus in this category. The Vapor Pens category, however, has been more challenging for Avitas in Washington. The brand's ranking has steadily declined from 50 in June to 66 by August and September, suggesting increased competition or a shift in consumer preferences. This downward trend in Vapor Pens contrasts with the more stable performance in Oregon, pointing to potential strategic adjustments needed to regain competitive advantage in Washington. Overall, Avitas's performance across these states and categories reflects both the opportunities and challenges inherent in the cannabis market.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Avitas has experienced fluctuating rankings over the past few months, with notable changes in its market position. In June 2024, Avitas was not in the top 20, but it climbed to 27th place in July, only to drop again to 50th in August and then recover slightly to 38th in September. This volatility indicates a challenging market environment, with competitors like Meraki Gardens consistently outperforming Avitas, maintaining a strong presence in the top ranks, albeit with a dip to 33rd in September. Meanwhile, Oregrown showed a steady improvement, reaching 32nd place by September, suggesting a competitive threat to Avitas. Additionally, SugarTop Buddery also demonstrated a strong performance, although it faced a decline similar to Avitas in September. These dynamics highlight the need for Avitas to strategize effectively to stabilize its position and capitalize on growth opportunities in the Oregon flower market.

Notable Products

In September 2024, the top-performing product from Avitas was Banana Cakes Pre-Roll 10-Pack (5g), which secured the number one rank with sales of 2303 units. Silver Spoon Pre-Roll 10-Pack (5g) climbed to the second position from fourth in August, showing a strong sales increase to 2266 units. GMO Cookies Pre-Roll 10-Pack (5g) maintained a steady performance by reaching the third rank. Limonada (Bulk) entered the top five, securing the fourth position, while GMO Cookies (Bulk) held its fifth-place rank consistently from August. The rankings indicate a notable shift in consumer preference towards pre-roll products, particularly those in multi-pack formats.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.